Mobile payments, online loan applications, remote deposit capture, and more. The world of financial services is changing, with consumers demanding an array of products and services virtually as well as in the branch.

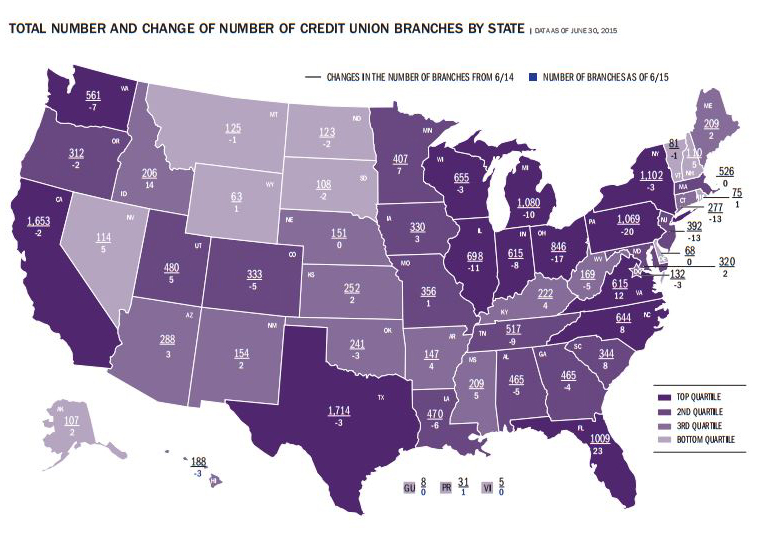

Even as the credit union branch network grows, online delivery channels are giving members 24/7 access to their finances. Yet, differing resources and member preferences mean not all credit unions are interested in implementing the same delivery channels and online transaction capabilities.

Source: 2016 Credit Union Directory by Callahan Associates

Click image to view larger size.

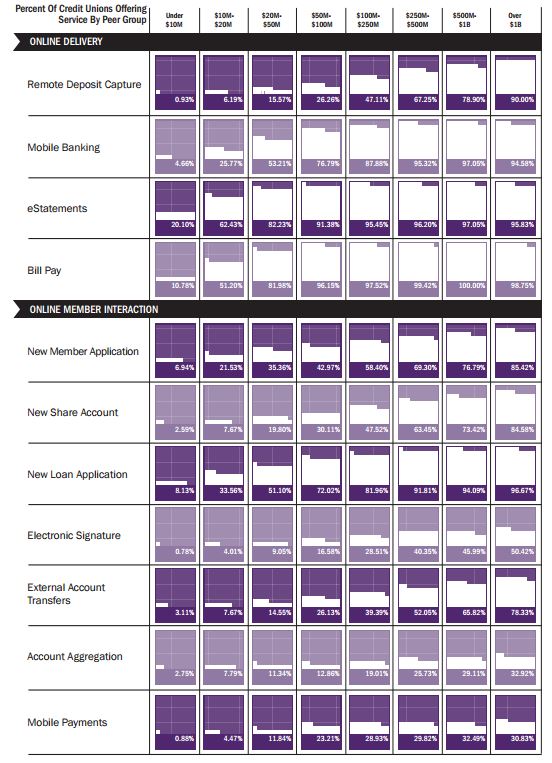

For example, fewer than 1% of credit unions with less than $10 million in assets offer remote deposit capture; for credit unions with more than $1 billion in assets, that number rises to 90%.

Similarly, whereas 20.1% of credit unions with less than $10 million in assets offer e-statements, 95.83% of credit unions larger than $1 billion in assets do.

DELIVERY CHANNEL DEPLOYMENT

ONLINE TRANSACTION CAPABILITIES

For all U.S. credit unions | Data as of 06.30.15

Callahan Associates |

Source: 2016 Credit Union Directory by Callahan Associates

Click image to view larger size.

This graph, from Callahan’s 2016 Credit Union Directory, helps credit unions ascertain where they fall in terms of online delivery and services in regard to their asset-based peer group. And the following strategies from four credit unions highlight different channels and capabilities cooperatives across the country have made available to members.

Mobile App Drives Short-Term Lending At WSECU

Washington State Employees Credit Union($2.4B, Olympia, WA) began offering two short-term loans QCash and QCash Plus in 2004. It added online applications in 2009 and launched mobile applications for Apple and Android devices in May 2014. Currently, approximately 40% of applications come in through the web, 33% through mobile, and 17% via phone. The rest of the applications come through branch walk-ins. Some 5% of the credit union’s nearly 228,000 members use the loans. Read more on CreditUnions.com.

How Do You Compare?

Make sense of deposit data for individual branches, institutions, and entire markets. With BranchAnalyzer, the ability to make smart tweaks to your branching strategy is just a click away.

Smile For Selfie Pay

When MasterCard wanted to pilot facial recognition authentication for smartphone payments,First Tech Federal Credit Union($8.6B, Mountain View, CA) was a natural fit. After all, its 400,000-plus members hail from SEGs such as HP, Microsoft, Intel, CISCO, Amazon, Intuit, Google, and Twitter.

The participants were all volunteers, and the credit union asked them to make as many transactions as they were comfortable making usually five or six a day using their Android and iPhone devices, says First Tech’s director of cards and payments, Brian Ziff-Levine.

earn more about the benefits of selfie pay on CreditUnions.com.

The Eyes Have It At Arizona Federal Credit Union

Arizona Federal Credit Union($1.4B, Phoenix, AZ) is at the leading edge of mobile technology. The billion-dollar institution allows members to deposit checks from their smartphones, make payments through their iPhone or Apple Watch, and even control their credit union debit or credit card in near real time. And now, members can ditch their clunky, complicated passwords in favor of touch and eyeprint identification.

In this QA on CreditUnions.com, Eric Givens, senior director of digital banking for Arizona Federal, discusses the credit union’s digital banking department, how to streamline the mobile experience, technical education for membership, and of course eyeprint ID.

Explore maps, leader tables, and hundreds of pages of credit union performance data in Callahan’s Credit Union Directory. It’s the gold standard for reliable insight. Download your digital copy today.

Leaders Credit Union Takes The Lead In Digital Innovation

Leaders Credit Union($270.8M, Jackson, TN) has more than 35,000 members it serves through a six-branch network. The credit union, which is headquartered approximately 70 miles east of Memphis, TN, has a mix of demographics you’d expect to find in any Mid-South America town. Despite the many ways in which it is a typical credit union, however, it is also aggressively expanding its digital services. The credit union has self-made mobile lending apps, responsive websites, and robust online alerts functions and promotional messaging prompts. In this CreditUnions.com article,the credit union shares how it balances member demand, product development, and marketing needs to deliver high-tech solutions.

You Might Also Enjoy

- A Strategy To Manage Cash And Serve Members

- Brick-And-Mortar Trends By The Numbers

- How PenFed Improved Its Branch Experience

- How 4 Credit Unions Beat The Branch Doldrums