More than a few basketball fans at Mountain America Credit Union ($14.0B, Sandy, UT) were watching the release of the 2022 NCAABasketball Tournament brackets — and it had nothing to do with office pools. Two players with hometown favorite BYU, guard Shaylee Gonzales with the women’s team and guard Alex Barcellow with the men’s team, are part of Mountain America’s first name, image, and likeness (NIL) sponsorship deals.

BYU’s women’s team received a 6th seed in the March Madness tournament but was eliminated by Villanova in a close game on March 19. The men’s team was on the bubble but didn’t make the cut. Nothing about the results, however, disappointed Sharon Cook, senior vice president and chief marketing officer at Mountain America.

“It’s a lot of fun to work with these athletes because they’re so energetic and full of passion for what they’re doing,” Cook says. “It’s great to join with them, watch them grow, and celebrate their successes with them.”

In June 2021, the National College Athletics Association (NCAA) adopted an interim rule that allows players and their agents to enter into NIL deals with outside sponsors, opening the door for college athletes, like professional players, to earn money from endorsements. A few big brands such as Gatorade, Dr. Pepper, Mercedes Benz, and World Wrestling Entertainment (WWE) have entered the arena. So have a few credit unions.

Sports analysts say NIL contracts hit $100 million in 2021 and are expected to reach $1 billion annually in five years. That’s a lot of money exchanging hands, but many of the initial sponsors have had to feel their way through the new landscape.

The NCAA prohibits “pay for play” deals with universities; however, it left regulation of sponsorships up to the states. So far, 28 states have adopted regulations to govern sponsorships of athletes enrolled within their state. In the remaining states, NIL deals are allowed by the NCAA as long as colleges establish guidelines.

Here, marketing teams at three of the credit unions that were among the first to enter the NIL market offer insight on making deals with college players.

1. NIL deals are not as expensive as you think.

Sponsorships with large universities can cost big bucks. In 2018, Public Service Credit Union signed a 15-year, $37.7 million deal for naming rights to the new Colorado State stadium. Last year, Gesa Credit Union secured the naming rights to Washington State’s football field in a 10-year, $11 million deal.

Although a few NCAA players have signed multimillion-dollar NIL deals, most sponsorships are $500 to $1,500. Typically, these deals cost less because sponsors don’t have to license the university logo.

CU QUICK FACTS

Michigan State University FCU

DATA AS OF 12.30.21

HQ: East Lansing, MI

ASSETS: $6.7B

MEMBERS: 321,315

BRANCHES: 20

12-MO SHARE GROWTH: 19.0%

12-MO LOAN GROWTH: 12.8%

ROA: 1.37%

For example, Michigan State University Federal Credit Union ($6.7B, East Lansing, MI) sponsored all eligible players on its namesake Michigan State University women’s basketball team for the 2021-2022 season and track athlete Nala Barlow for the 2022 season. Each athlete receives $500 per month in compensation for in-person appearances at events, marketing, promotions, and social media posts. MSUFCU may also feature student-athletes in print ads, billboards, videos, television commercials, and on other platforms.

“Our contracts with all 12 women student-athletes are similar in value to one TV/radio campaign,” says Deidre Davis, chief marketing officer at MSUFCU.” But the value with this campaign is that it will run for several months and is more targeted to our target audiences.”

The structure of sponsorships can differ. Some offer a flat rate with monthly payments for an ongoing contract or a one-time payment for a one-off deal. Others are structured on a dollar amount per follower for a player’s social media account, up to a cap. And others are a combination of methods.

“They’re all over the place,” MACU’s Cook says. “It’s difficult because it’s so new. There’s no given guideline. It’s really just a matter of looking at it and saying, ‘Is this OK for the value we think we can bring to our members, and does that match what the player might want?'”

Cook says Mountain America considered several deals, some brought to the credit union by the players, and decided on three sponsorships in 2022: BYU’s Barcello and Gonzales, and Dixie State women’s soccer midfielder Savannah Stauffer, a nativeof Springville, UT.

Cook also says to be prepared to negotiate with sports agents as well as players’ parents. One of the key qualities the credit union looks for in the athletes it sponsors is that the students give back to the community and “operate in a specific way.”

“We’ve had some success with some players, and we’ve let of a couple of deals go,” she says. “You know when it clicks and it’s going to work for both of you. Then it’s like any other sporting sponsorship. You negotiate back and forth and see how it fits.”

“MSUFCU and their leaders are pioneers in recognizing women’s athletics,” says Moira Joiner, one of 12 MSU basketball players with NIL sponsorships.”We are glad to be a part of their vision for our collective future.”

2. Vet, vet, vet the players … and vet some more.

Like any type of sponsorship tied to an individual, there’s a little risk and a lot of luck involved in the outcome. Who’s to know if a highly ranked high school standout won’t be a bench warmer in college? A single injury, or a poor decision off the field or court, can wipe out a promising player’s career. On the other hand, a relatively unknown player can rise to the ranks of MVP or Heisman Trophy winner, with a long career ahead in the pros.

CU QUICK FACTS

ADDITION FINANCIAL CREDIT UNION

DATA AS OF 13.31.21

HQ: Lake Mary, FL

ASSETS: $2.6B

MEMBERS: 162,265

BRANCHES: 25

12-MO SHARE GROWTH: 13.7%

12-MO LOAN GROWTH: 22.8%

ROA: 1.03%

During the 2021 football season, Addition Financial ($2.6B, Lake Mary, FL) partnered with University of Central Florida quarterback and hometown hero Dillon Gabriel for social media and in-person appearances promoting the credit union’s Aspire college checking accounts and UCF Knights affinity debit cards. Outside of UCF football, Gabriel launched his own company, DGTheBrand, and was able to speak to the importance of financial literacy not only as a student but also as a business owner in his Addition Financial appearances.

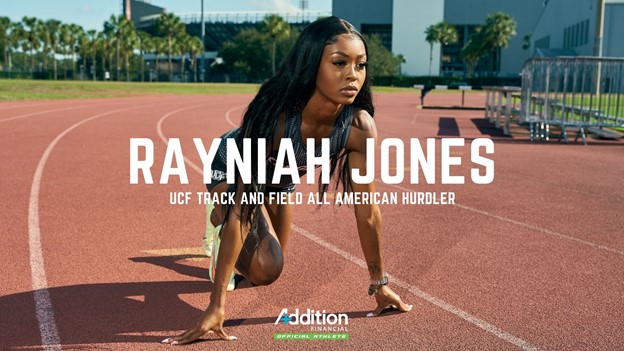

However, a long-term relationship wasn’t meant to be. Gabriel broke his left clavicle in September during the final play of a game against Louisville, ending his season early. He announced plans to transfer to the University of Oklahoma in December. A month later, Addition Financial launched a second NIL partnership with Rayniah Jones, a hurdler for the UCF track and field team who qualified for the U.S. Olympic Team Trials in 2021

The deal with Jones includes social media posts, in-person appearances, digital and outdoor advertising, television commercials, and podcast interviews.

“NIL programs are an incredible way to drive brand awareness and align your organization with a spokesperson that your audience trusts and roots for,” says Katie Thomason, vice president of community engagement and partnerships at Addition Financial. “When setting up an NIL program for your credit union, make sure you do your research. What other brands has your prospective athlete partnered with? How does this athlete represent himself or herself on social media? What is this athlete’s reputation offline?”

Thomason advises that online sports marketplaces can help credit unions research athletes in their market and understand what they might be seeking in an NIL partnership.

“Get to know the athletes you’ll be working with,” Thomason adds. “Each athlete has a different personality and range of interests. By focusing on building those relationships, you can create a more authentic brand partnership and help them play to their strengths when creating content.”

3. It’s all about social media influence.

NIL contracts might be new, but social media marketing is not. One of the key metrics sponsors are looking for is the number of followers athletes bring to the relationship over Instagram, Facebook, Twitter, TikTok, and more. Credit unions can then base contracts on influencer marketing industry standards. But it’s not just about social media numbers, it’s about engagement with those followers, Thomason says.

Quarterback Dillon Gabriel has 32,000 followers on Instagram. In addition to posting about his work with Addition Financial, Gabriel’s stories included the “swipe up” feature to link directly to his landing page on the Addition Financial website.

And now that Instagram incorporates a link button on stories for all users, not just those with 10,000 or more followers, that opens up opportunities for track star Rayniah Jones, who has 7,000 Instagram followers. According to Thomason, those followers are actively engaged with her content.

“Our first social media post to announce the partnership with Rayniah received more than 21,000 impressions on Instagram, and comments have been overwhelmingly positive,” Thomason says.” As a credit union based in Central Florida, we understand firsthand how much the UCF brand resonates in our community. These partnerships allow us to engage with UCF fans we might not normally reach and have given us the opportunity to increase our impact among college students.”

SOCIAL REACH OF MSUFCU’S STUDENT-ATHELETES

DATA FROM MSUFCU

Callahan & Associates | www.creditunions.com

| # | PLATFORM | FOLLOWERS |

|---|---|---|

| 1 | 35,909 | |

| 2 | 7,365 | |

| 3 | TikTok | 1,049 |

| 4 | TOTAL FOR ALL PLATFORMS | 44,323 |

MSUFCU’s student-athletes have a combined reach of more 44,000 followers.

With 10 of the 12 MSU women’s basketball team members and track star Nala Barlow posting regularly on social media, their combined influence reaches more than 44,000 followers. Although MSUFCU doesn’t have analytics from the players’ accounts, it’s definitely seeing an uptick in traffic from player posts.

“We’ve noticed a lot of notifications on our social feeds from the players,” says Davis from MSUFCU. “It’s obvious we are receiving more interaction on our social profiles as a result of the athletes’ posts.”

Engagement with posts on MSUFCU’s social properties is also strong. MSUFCU announcements on the NIL contracts reached more than 16,000 followers, resulting in 700 reactions, likes, and clicks across the credit union’s Facebook and Instagram accounts. More than 1,000 of those Instagram impressions were non-follower accounts.

MSUFCU also sponsored several women’s basketball ticket giveaways on Facebook and Instagram throughout the season.

“Each Facebook post reached approximately 2,800 people on average,” Davis says. “Each Instagram post reached approximately 1,000 people and helped us gain 10 to 20 new followers each time. Instagram is where we have seen the highest increase in engagement. We are tagged much more often on Instagram now that the NIL athletes are posting on our behalf, which is helpful for our algorithm and reach in general.”

4. Align NIL sponsorships with the credit union’s mission.

Student-athletes’ stories offer a natural segue to the credit union mission of financial wellness and education. Even more poignant is that many of these athletes are starting to enter of the business world, and some lucky few are planning ahead for a professional sports future.

“As a proud partner of the UCF Knights, these sponsorship deals allow us to showcase this partnership while demonstrating our commitment to students and financial education,” Addition’s Thomason says. “These student-athletes are able to provide more relatable content to capture the attention of a younger demographic.”

UCF track star Rayniah Jones says it was an important reason for choosing Addition Financial.

“I think it’s important for college students to start learning about managing their finances responsibly,” Jones says. “Through this partnership, I’m most excited to shed light on financial literacy for other students and help them learn these habits from a young age.”

CU QUICK FACTS

MOUNTAIN AMERICA CREDIT UNION

DATA AS OF 12.31.21

HQ: Sandy, UT

ASSETS: $14.0B

MEMBERS: 1,033,661

BRANCHES: 101

12-MO SHARE GROWTH: 17.2%

12-MO LOAN GROWTH: 16.1%

ROA: 1.90%

Both Addition Financial and Mountain America recorded podcasts with their athletes to highlight these messages as part of their ongoing financial education programs.

“You need to think outside the box to determine if there are other places to promote these partnerships and incorporate those into your contract,”Thomason advises.

Mountain America’s Cook also notes that the NIL relationships are a great opportunity to help the athletes themselves learn about managing their finances.

“We have had an opportunity to share different aspects of our business that they’re interested in such as business services, mortgages, and real estate,”Cook says.”We can put them in touch with folks to teach and guide them and introduce them to people that might be helpful in furthering their education.”

5. Make plans well in advance.

College athletes aren’t like typical spokespeople. They have busy class schedules, practice schedules, media appearances, and game days, with little extra time for sponsorship activities. Sponsors would love to schedule appearances at local branches during the season such as during the March Madness tournament but these are the worst possible times for the athletes.

“It puts a lot of strain on many of the athletes, especially during their actual season,” Cook says. “You have to be open and flexible and work around their schedule. You can’t pull them out of their world at those critical times. So, like anything you do in marketing, you come up with a plan and work ahead. Maybe get some interviews done beforehand and air them during the actual game time.”

A big part of sports marketing is reacting quickly to unexpected opportunities. Two of MSUFCU’s most successful social posts were about MSU coach Suzy Merchant hitting a milestone number of wins, which reached 3,500 people, and athlete Nia Clouden being named Big Ten Player of the Week, which reached 2,500 people.

The credit union has been a sponsor of MSU athletics for more than 12 years and became the presenting partner of MSU women’s basketball in 2019 as part of a multiyear athletics sponsorship agreement. NIL contracts were the natural next steps, Davis says.

“The NIL landscape is a brand-new frontier that is ever-changing, but it does demonstrate that the value of influencer marketing is alive and well,” Davis says. “We are continuously learning as new student-athlete partnerships are launched. And as these programs evolve, we hope to continue to collaborate with athletes in meaningful and innovative ways.”