One Wyoming credit union’s dedication to its community is changing its city’s — and possibly state’s — nonprofit landscape.

In October, Blue Federal Credit Union ($2.1B, Cheyenne, WY) and the Blue Foundation opened the Boost Center by Blue, a one-stop-shop family resource center for anyone in the community. The idea was to create a centralized location that offers help for everything from housing and transportation to food insecurity and financial services.

“The Blue Foundation gives back to a lot of nonprofits directly through grants, but we said, ‘How can we do more? How can we truly create an impact in our communities?’” says Kim Alexander, Blue FCU’s chief strategy and growth officer.

Blueprint 2030 And The Vitality Index

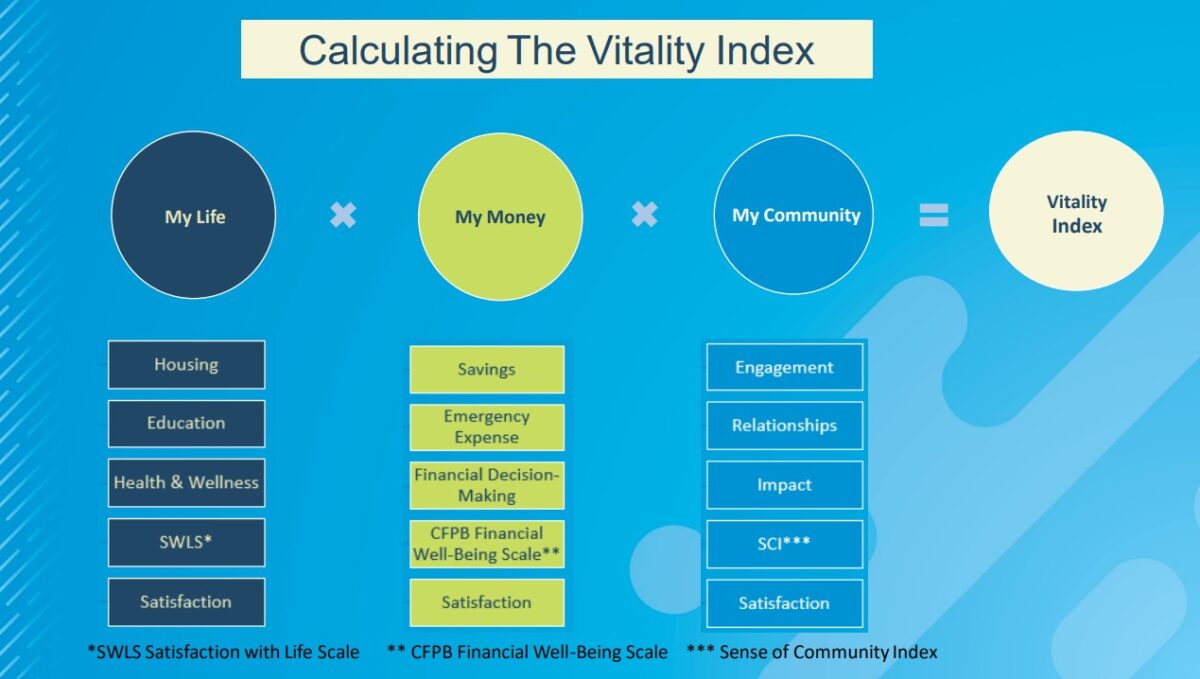

The origins of the Boost Center trace back to Blue FCU’s 10-year strategic framework, dubbed Blueprint 2030. In 2020, the executive team decided the credit union needed to look beyond traditional KPIs and created the Vitality Index as a new way to understand its market. Now, every two years, the organization collects data that examines members’ and non-members’ attitudes toward their life, their money, and their community.

As part of that process, members of the credit union’s strategy team conduct interviews with local organizations to ask about pain points. Alexander says although this requires a heavy boots-on-the-ground investment, this collaboration has led to valuable discoveries.

“The Boost Center just kind of came up during a meeting we were having in Fort Collins with the team,” the EVP explains.

In 2024, while brainstorming what a resource center might look like, the state of Wyoming started offering grants related to family resource centers. At the same time, Laura Fowler was preparing for her retirement from the local school district after 38 years in education. As one of Blue FCU’s nonprofit contacts, she’d been running an ad hoc resource center for students and their families. She’s also the co-creator of the Parent Engagement & Educational Partnerships with Schools program (PEEPS).

Blue FCU’s strategy team knew it had a golden opportunity — provided the right person was in charge.

“We’re all great credit union people and finance people, but we don’t do family resource centers,” Alexander says. “However, we believe we need to serve everybody in our communities and we should be giving back.”

A Gift To The Community

Blue FCU subsequently hired Fowler as executive director of the Blue Foundation. In her role, she leads the Boost Center — a first-of-its-kind facility in Wyoming.

“We want to become the premier center, to model what a family resource center could look like,” Fowler says. “We don’t know how fast we can grow yet because of funding sources, but this center has hit the ground running. There was no soft start.”

The center opened in late October 2024 and within the first month connected 29 people to one or more of its 30 community partners. Fifteen more people received help in the first week of December alone.

“This center has been the gift to Cheyenne that they didn’t know they needed,” Fowler says.

When an individual enters the center, they have a conversation with staff about their situation — what’s going on and what they need.

“It’s not like we interview them, per se,” Fowler says. “It’s more like a ‘getting to know you’ chat.”

During the course of the conversation, a team member takes notes on what services the person might benefit from. Only until a comfort level is established do they move on to next steps. Because all clients are different, there is no one-size-fits-all approach, Fowler says. The goal is to meet that person where they are and continue to work with them once they’ve been matched with the right resources.

“We really want to do financial pathways once we get our folks out of crisis,” Fowler says. “Picture Maslow’s hierarchy, where it’s food and shelter at the bottom. We have to get through that first because when you’re dealing with trauma you can’t even think outside of that scope. But then we want to wrap ourselves around our people so we can follow them throughout their journey.”

Teamwork Makes The Dream Work

One day, Fowler received a phone call from a social worker at the local children’s clinic regarding two young boys whose father had been paralyzed in a car accident. The man had been transferred for care hundreds of miles away, and the boys’ grandparents — in their one-bedroom apartment — were ill equipped to care for the boys.

CU QUICK FACTS

BLUE FCU

HQ: Cheyenne, WY

ASSETS: $2.1B

MEMBERS: 142,339

BRANCHES: 28

EMPLOYEES: 381

NET WORTH: 9.3%

ROA: 0.26%

“We have several programs in Cheyenne for when grandparents become guardians,” Fowler says. “We connected them to the kinship program so they could start working on guardianship papers.”

The resource center also quickly looped in the Salvation Army to help fund gas cards so the boys could visit their dad. It also reached out to another local organization that provides beds for kids in crisis.

“Here’s the crazy thing — we’ve still never met the grandparents,” Fowler adds. “We don’t know the family. We haven’t been able to do an intake. But through phone calls and trusted relationships in the community, we’ve been able to support them.”

Fowler says one of the biggest takeaways from the center’s journey to date is the power of collaboration.

“Our local organizations are starting to talk with one another,” she says. “They’re starting to play in the same sandbox when they weren’t before. Now I feel like we’re on speed dial for several places. We’re getting phone calls from several mental health providers, for example, saying, ‘Hey, our guys are working on mental health, but can you help with housing?’”

Today, Fowler and the Blue Foundation’s community navigator, Audrey Apodaca, sit on five nonprofit boards. The center also holds monthly touchpoints with several of its more than 50 community partners.

Onward And Upward

The early success of the center has Blue’s strategy team ready to shoot for the stars. However, it must collect data in the next six to nine months to gauge how best to grow.

“Once this is up and running and we can secure future funding sources, we would like to expand the Boost Center across the footprint of where Blue FCU serves,” Fowler says.

Right now, 95% or more of the Boost Center’s funding comes from the credit union. A key focus for the first quarter of 2025 will be fundraising and creating a sustainable framework for long-term funding.

“Our ultimate goal is to bring in true funding through the community,” Alexander says. “But we feel like first we have to prove we’re making an impact in our community. It’s a whole new world out there. You’ve got to get out in your community, you’ve got to get to know the people on the ground.”