For several years, Michigan-based Lake Trust Credit Union($1.6B, Brighton, MI) distributed a quarterly internal service survey to evaluate how well it was delivering on its brand promise.Today, however, Lake Trust Credit Union favors an environment that organically creates high levels of service both internal and external from team members across the credit union, and it uses its own GUIDE model to do that.

The GUIDE model is something that is personal to Lake Trust, says Brandalynn Winchester-Middlebrook, vice president of culture and engagement for Lake Trust. We firmly believe it defines how we provide value to our members.

GUIDE provides a framework, but the credit union encourages staff members to implement each of the model’s core values, outlined here, in their own way.

Greet (proactively and with style).

Understand members needs.

Inspire possibilities.

Deliver solutions.

Express genuine appreciation.

A New Organization, A New Way Of Serving Members

Lake Trust Credit Union is the result of a 2010 merger between NuUnion and Detroit Edison. Although the merger was a pairing of two equals that each had a lot to offer the other, the organizations operated differently and had diverse approaches to memberservice.

CU QUICK FACTS

lake trust credit union Data as of 06.30.15

- HQ: Brighton, MI

- ASSETS: $1.6B

- MEMBERS: 167,354

- BRANCHES: 20

- 12-MO SHARE GROWTH: 0.81%

- 12-MO LOAN GROWTH: 4.14%

- ROA: 0.28%

Lake Trust was a new organization,Winchester-Middlebrook says.We wanted to start doing things the Lake Trust way. The brand promise and GUIDE model were concrete ways to do that.

The credit union launched GUIDE in 2013 and has since presented two training sessions to break down GUIDE’s steps and discuss the overall service experience the credit union wants to create from both internal and external perspectives.

GUIDE includes key elements of the service experience and communicates core values, but it is not a script.

We believe in people being themselves, and this model allows them to do that, Winchester-Middlebrook says. There is no pick up the phone and say this.’ Everyone is different, and that diversity is what makes us strongertogether.

Good-Bye Formal Surveys

Member service is important, but the credit union doesn’t believe service starts or stops there. Support functions, which it dubs off-stage roles, are just as critical to serving members as those who serve members directly each day.

We’re all expected to treat one another in a way that aligns with the service we want to provide our members.

We’re all expected to treat one another in a way that aligns with the service we want to provide our members, Winchester-Middlebrook says. It starts at home.

After several years of using quarterly internal service surveys to help the credit union assess how well each department was delivering on the brand promise experience, the credit union decided it was time to retire those more formal tools.

We used the surveys as tools to learn from, which was important in the beginning to align the organization and ensure we were all on the same page, Winchester-Middlebrook says. Now that the GUIDE model has taken hold, we believe wecan encourage each team to reach out and seek that feedback in a way that’s relevant for them.

Lake Trust’s new open-environment headquarters building which has no walled-in offices underscores this idea of organic feedback.

There is not a single office in this entire building, Winchester-Middlebrook shares.

Instead of traditional office space, staff members work within low-walled cubicles equipped with stand or sit desks. The building has a variety of meeting spaces and places to get away to focus on a project, but even these areas are mostly enclosed withglass. The cafeteria, which serves food throughout the day, provides a communal gathering place for team members from across the business units, and even the central hub of the new building a large, open staircase encouragesserendipitous encounters and creates opportunities for quick chats as people pass one another.

A limited number of solid walls within the headquarters of

Lake Trust Credit Union encourages interaction and transparency.

Cross-Functional Hubs

Through data collection and a yearlong planning process, the credit union gained a clearer understanding of what collaborative networks or relationships already existed among business units and what relationships it needed to develop. The credit unionworked with an external consultant to formulate employee teams that could help members more effectively if they were in closer proximity to one other.

Few teams or business units now sit fully together, Winchester-Middlebrook says. We sit based upon who we need to work with to make the biggest impact on our members.

For example, support functions sit near one another for easy access and IT and ERM project managers are integrated with culture and engagement, an HR role. The call center, however, is one example of a business unit that has remained together

Recognition Is Key

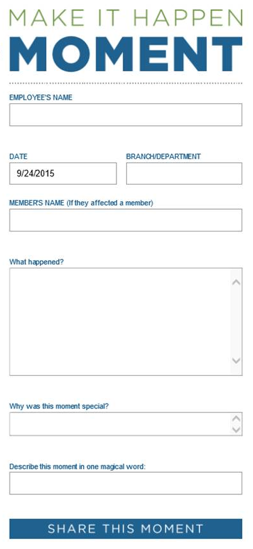

The credit union is still adjusting to its new digs and open environment, but its team members have already started using an online tool to celebrate their internal service successes. Employees use an intranet form to share Make it Happen Momentsand talk about what made that moment special.

An online form helps employees at Lake Trust

Credit Union celebrate one another’s successes.

We want to celebrate when a team member impacts another individual positively, Winchester-Middlebrook says. By encouraging one other, we are re-affirming the GUIDE model. Some of the small moments might not look like a hugesuccess to the average person, but we deliver on our brand promise by impacting one member at a time.

You Might Also Enjoy

- How To Own Internal Service

- 12 Ways To Improve Employee Service

- How To Increase The Satisfaction Between IT and CU