Top-Level Takeaways

-

Staring down a triple-digit loan-to-share ratio, Day Air Credit Union has been on the lookout for new sources of liquidity.

-

It introduced its Best in the Miami Valley Certificate, which touts a rate north of 3%, in August 2018.

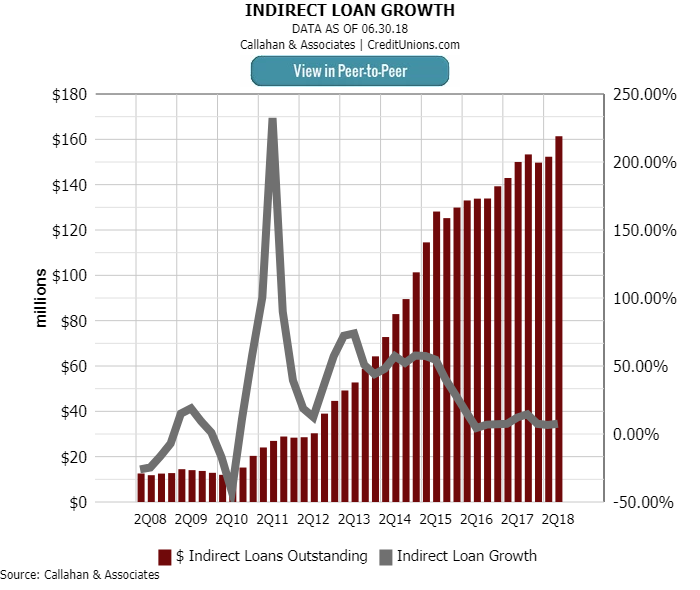

In the third quarter of 2015, the loan-to-share ratio at Day Air Credit Union ($391.3M, Kettering, OH) reached 104%. The credit union’s fast-growing indirect loan operation had helped position the Ohio cooperative at No. 133 out of more than 5,600 institutions in the nation.

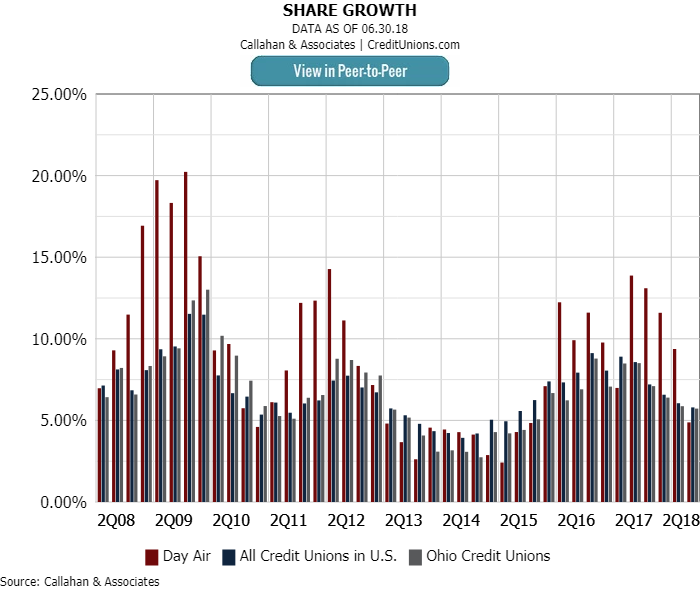

Nearly three years later, Day Air’s ratio has moved closer to national average 92.3% for Day Air versus 82.9% for the nation primarily due to slowing indirect loan growth and higher than average share growth.

Still, the credit union’s appetite for deposits remains. That’s partly why Day Air introduced a high-rate, high-balance CD on Aug. 1 of this year. It’s Best in the Miami Valley Certificate pays 2.75% APY on a three-year certificate and 3.05% on a five-year with a minimum deposit of $10,000.

Here, Joe Eckley, Day Air’s director of marketing, discusses the promotion, how the credit union markets rates, the stickiness of the product, and more.

Why did Day Air introduce this certificate?

Joe Eckley: Credit unions are well loaned out because the industry has such great rates. For Day Air in particular, we needed to bring in some deposits. We offer several standard deposit products, but we studied our CD rates and saw an opportunity to make them even better.

The bell cow newspaper around here, the Dayton Daily News, publishes certificate rates for local institutions every Thursday. We knew our certificate rates were far and above the certificate rates at the banks, but when saw we had the best rates in the Miami Valley, we asked ourselves why we weren’t touting that?

Click the tabs below to view graphs.

LOAN-TO-SHARE RATIO

LOAN GROWTH

INDIRECT LOAN GROWTH

SHARE GROWTH

Is your market competitive?

JE: Yes. The only major financial institution that is not here is Wells Fargo. Fifth-Third has a big presence here. PNC is next, followed by U.S. Bank and Chase Bank. Wright-Patt ($4.3B, Beavercreek, OH) is the biggest credit union in our area, but there’s also Universal 1 ($427.9M, Dayton, OH) and River Valley ($344.3M,Miamisburg, OH).

Why compete on rate in such a crowded market?

JE: It goes back to the idea behind the credit union. We’re in business for our member’s financial well-being. To us, that means offering them the best rates possible.

Our goal is to find a way to best serve our members because we’re not in this to make a profit. If we were, we’d have different rates and different product promotions. Instead, we’re in this to give our profits back to our members through better rates and lower fees.

Of course, our MSRs know our members and their families. For a lot of people, that’s great. For others, they care more about rates and fees. That’s our real differentiator against Fifth-Third because that’s where we hit members’ wallets.

When saw we had the best rates in the Miami Valley, we asked ourselves why we weren’t touting that?

How does Day Air’s 3.05% on a five-year certificate compare to what you offered before? How does it compare to competitors?

JE: Before this promotion, we had been running our five-year certificate at 2.6%. We wanted to bump that up and see if we could bring in a little more deposit activity. At my last look, the next highest five-year certificate rate was 2.62%. We’re also running a three-year certificate at 2.75%, which is the highest for that term, as well.

Are there any stipulations?

JE: Nothing beyond the standard stipulations. We wanted to keep it simple. Members need a minimum deposit of $10,000, but they don’t need to complete a certain number of transactions with us or open direct deposit. They just need $10,000 of new money.

Who are you targeting with that $10,000 minimum?

JE: We’re hoping that number brings in our more financially mature target member. With our marketing we targeted mainly Boomers, but also Gen X and above. We’re looking for someone more established in their career with more money to invest. We’re not really going after millennials.

Another reason we set it there was for our back-end. Operationally, we weren’t looking to service deposits at this rate for $500-$1,000. At $10,000, the product is operationally more efficient.

With that amount of money, are people more likely to stay once the term is up?

JE: That’s another side to it. We know some people are going to shop the rates and take their money after five years. But we think people will pay more attention to how we are serving their needs at this high dollar amount. We have the opportunity to show them over the course of three to five years that they should do more of their banking with us.

How is Day Air marketing the promotion?

JE: For starters, we took out a huge ad right below the rate table in the Daily News reiterating our rate. We also took out ads in some of the community newspapers in our area, thinking that readers of those papers are probably the same people who have the means to invest in this certificate.

Then, we did some pushes to current members, primarily through email but also with in-branch signage.

Digitally, we’ve done a lot of targeted social media marketing. We expanded our social media budget to be able to more effectively target our social media videos and ads promoting the certificate. We’ve also upped our search engine marketing budget. People looking for certificates in the Miami Valley should get us in their search results. We also changed our radio advertising on both traditional radio and streaming radio through Pandora.

How long will Day Air run the promotion?

JE: Our plan is to run it through September, at which point we’ll assess how it has progressed. We’ll likely run it for as long as it makes sense. We want to give our members the best rates, and as long as it makes sense for us, we’ll keep this around.

What are your expectations with this promotion?

JE: Our goal is to attract somewhere in the range of $10 million of new deposits. It’s going well, and I think we’ll get there. We’re about halfway through how long we expected to run the promotion and our deposit activity is on pace. Our activity has even started to increase. That will continue as our marketing stays out there. We have to hit them a few times before they hear the message.

This interview has been edited and condensed.