Top-Level Takeaways

- TruStone has embraced AI for internal purposes rather than member-facing functionalities.

- Faster, more accurate access to information has improved processes and sped up member service.

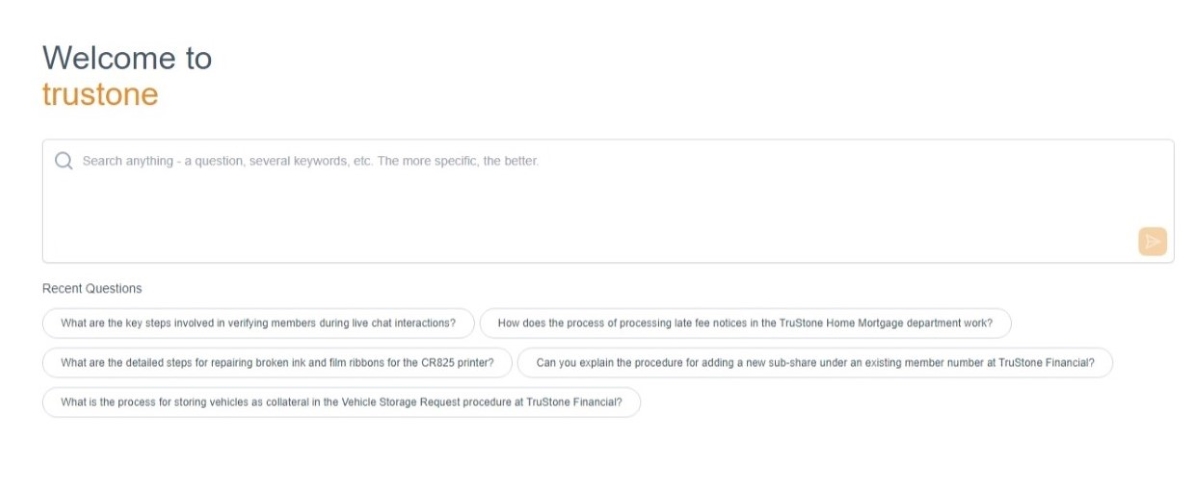

Although there are credit unions still feeling out their approach to artificial intelligence, TruStone Financial Credit Union ($5.0B, Plymouth, MN) is going full speed ahead. The cooperative just launched TruAssist, its new AI-powered knowledge base.

Credit unions were already exploring AI and machine learning before ChatGPT exploded onto the scene last year, but most of those tools have been embedded in member-facing chat support and lending software. But ChatGPT (along with other generative AI solutions) and the competing large-language models (LLMs) that are now so rapidly appearing have created the opportunity to push the envelope at a pace and scale heretofore unimaginable.

“TruAssist is our first large-scale deployment of generative AI, and it’s become a guiding principle here,” says Gary Jeter, TruStone’s chief technology officer. The credit union’s leaders saw ChatGPT’s potential when it hit the market, he adds, and they’re now seeing that potential turn into impact.

The platform is the Twin Cities cooperative’s first large-scale generative AI deployment, and all team members now use it for accessing policies and procedures, HR benefits, and the employee directory and handbook. While not member-facing, it’s also empowering new levels of efficient member service.

Speeding Up And Smoothing Out

TruAssist has smoothed communication across back-office and front-line teams while identifying gaps in the knowledge base and automating the information-updating process that support teams need to keep current. Documents that previously took up to two minutes to retrieve now take as little as 10 seconds, and in-branch wait times that previously took as long as 15 minutes have been reduced to less than three minutes, since staff are no longer waiting for instructions or information.

“Accessing the right information has become effortless. We no longer need to jump through hoops,” says Lisamarie Meyer, SVP and director of the cooperative’s Minnesota branches. That leaves more time for managers to coach and mentor, she adds, since they’re no longer answering procedural questions, and new hires can get up to speed more quickly.

First The Policy, Then A Phased Rollout

After some research and experimentation, TruStone launched its generative AI policy in April 2023. It provides guidelines and allows select team members to use a limited number of gen AI platforms, including ChatGPT, Bard, and Perplexity. Select team members also have access to paid versions of ChatGPT 4.0.

TruAssist underwent a four-phase introduction, culminating with an enterprise-wide rollout.

- Proof of value: 12 initial team members gained access in November 2023.

- Proof of concept: More than 80 team members in nine Minnesota branches gained access the following month.

- Pilot: Starting in January 2024, all retail branches and TruStone Home Mortgage offices in Minnesota and Wisconsin had access.

- Full deployment: All employees, including in operations, the member service center, and back-office departments such as finance, IT, compliance, and BSA/fraud, had access beginning in February 2024.

Core team members worked to actively engage with retail managers throughout the launch process in order to raise awareness and help manage expectations. The broader staff communications also included CTO coffee sessions and videos that promoted what was coming.

Prompts For Success And Learning Together

In the wake of going live across the organization, TruAssist users now enter hundreds of prompts each day, and Meyer says “how to open a safe deposit box” is a good example of the types of queries used and how the platform has improved operations.

“Opening safe deposit boxes happens infrequently, so many team members need to relearn the process,” she says. “In the past, employees had to search on the intranet for the procedure. That prompt now instantly provides the 14 steps needed.”

CU QUICK FACTS

TruStone Financial Credit Union

HQ: Plymouth, MN

ASSETS: $5.0B

MEMBERS: 214,200

BRANCHES: 24

12-MO SHARE GROWTH: 3.79%

12-MO LOAN GROWTH4.03%

NET WORTH: 10.55%

ROA: 1.07%

Writing effective prompts has been the biggest challenge so far. “Google searching has created the habit of using search and key words, and now we need to expand on our thought process by being more specific with our questions,” Jeter says.

The more specific the prompt, the better the answer. To facilitate that, staffers are provided web-based training and other aids to learn how to create more-effective prompts.

Men, women, and machines also are learning together. “Some leaders and team members originally expected 100% accuracy in the responses,” says Mayka Thao, SVP for global planning and delivery, who serves as project manager. “We conducted focus groups with pilot users to better educate and to address their pain points to enhance the tool.”

Results of that process now include a “thumbs down” indicator for wrong answers that alerts operations staff to address that response, the document it draws from, or both. Users can also double check responses against the documents themselves, but that’s expected to continue declining as TruAssist evolves and end users become more comfortable and confident with it.

“Accuracy in the TruAssist platform has significantly increased, which has built trust from our users, as well as boosted their comfort level in using the platform,” Jeter says.

The platform was developed in collaboration with Senso AI, whose credit union users group has served as a sounding board and source of collaboration. TruAssist is a branded version of Senso’s Agent Fetch. Jeter says his shop is ahead of its peers at this point, but that he welcomes feedback from other credit unions that have deployed generative AI at scale.

You, Too, Can Improve With AI. TruStone uses AI to help employees swiftly access company policies, HR benefits, and more. Learn more about how the credit union is reaching unprecedented levels of efficiency in this webinar exclusively for Callahan clients. Watch today.

The Human Element

To address concerns about AI overreach, Jeter says the human element remains at the heart of the TruAssist project.

“Generative AI is an extremely useful copilot,” the TruAssist CTO says. “Long-hand division is rarely done. We all use calculators. At the most basic level, generative AI is a very, very, very sophisticated word calculator. Despite having ‘intelligence’ in the name, it is not intelligent like a human being,” he says.

The humans at TruStone are actively providing feedback that allows TruAssist managers to pinpoint issues and fine-tune the platform internally and with their vendor.

This ensures that it remains intuitive, user-friendly, and aligned with human preferences and behaviors by considering factors such as user interface design, interaction flows, and accessibility. “We’re confident that these efforts will improve human activities, interactions, and decision-making processes in utilizing AI systems,” Jeter says.

A Collaborative Journey

TruStone is just beginning its gen AI journey. Jeter sees a “truly intelligent chatbot” in the future, along with a growing ability to analyze member recordings, chats, and other interactions to better understand trends, issues, and how to better address member needs.

“It’s endless. We’re learning as we’re going,” the TruStone CTO says. “This really is an exciting time to be in technology and finance.”

3 Do’s And 2 Don’ts

TruStone CTO Gary Jeter provides these best practices from his credit union’s use so far of generative AI to improve internal operations.

Don’t:

Don’t wait to get started. “The speed of innovation is exponential, and we’re in the steep portion of the curve,” Jeter says. “The longer you wait, the harder it will be to jump on.”

Don’t assume team members know a lot about gen AI. “Recognize there are concerns about job replacement, and that there’s a lot of misunderstanding out there.”

Do:

Get all parts of the credit union involved. “(Branches SVP) Lisamarie Meyer’s leadership and experience was critical to our success. She brought a critical level of ‘street cred’ and positivity,” Jeter says. “Mayka Thao’s amazing organizational skills and leadership also was critical to our success.”

Roll out in phases. “TruAssist needed to learn our policies and we needed to learn how to optimize TruAssist. A big bang launch would have been disastrous.”

Don’t wait for policies to be up to date and accurate. “TruAssist worked brilliantly at identifying outdated policies.”