Top-Level Takeaways

- Business deposits fuel credit union share growth.

- Cannabis banking emerges as niche opportunity.

- Personal relationships remain key to success.

For Greenwood Credit Union ($868.6M, Warwick, RI), business banking isn’t a new venture – it’s been part of their DNA since the beginning.

“We’ve been doing this for so long that nobody knows exactly when we started,” says Fred Reinhardt, who’s helmed the Ocean State cooperative since 2016. “We’re a little over 75 years in existence and may have been offering business accounts from day one, but at least for 50 years.”

This longstanding commitment to serving businesses is paying off for credit unions like Greenwood and Metro Credit Union ($3.4B, Chelsea, MA). Both institutions are outpacing industry averages for share growth, with business deposits playing a significant role.

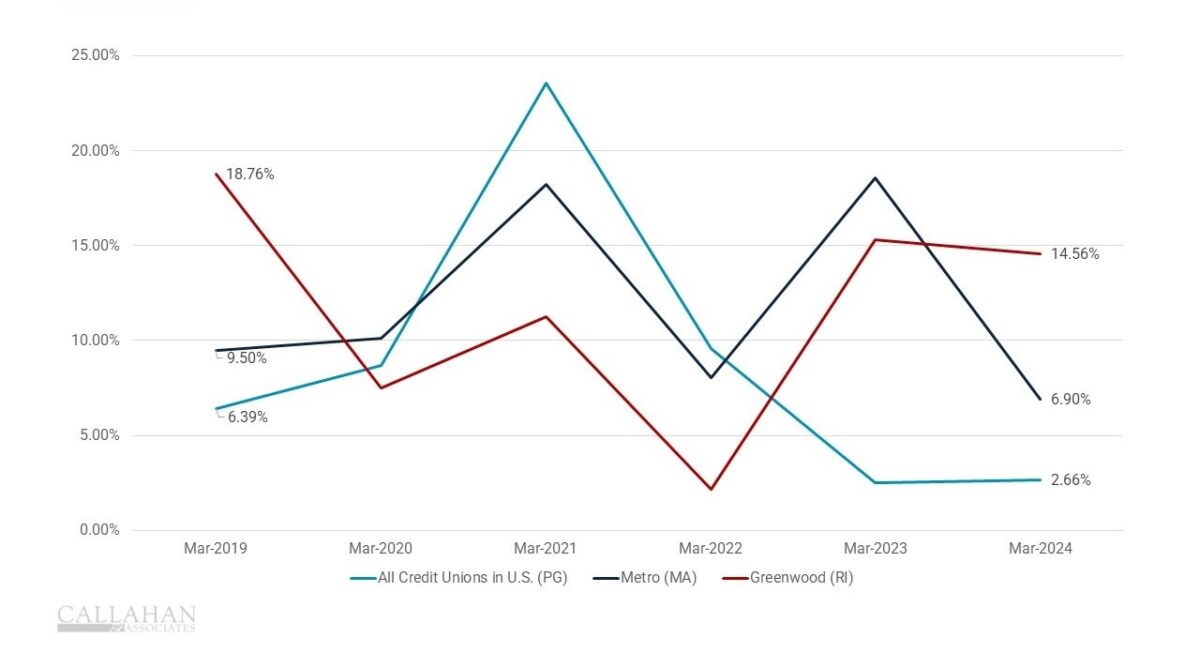

YEAR-OVER-YEAR DEPOSIT GROWTH

FOR U.S. CREDIT UNIONS

© Callahan & Associates | CreditUnions.com

Call report data shows Greenwood’s overall deposits increased by 14.56% year-over-year at the end of the first quarter, while Metro posted 6.9% overall share growth. These figures stand out against the industrywide figure of 2.66% growth in insured shares and deposits for the first quarter.

President and CEO Robert Cashman sees the growth in deposits and business services of late as the result of a flight to safety in uncertain times.

“When some regional banks experienced runs and financial stress, we saw significant deposit growth,” he says. “It wasn’t just temporary — this has become sticky money as members have seen our strength and experienced good service.”

When some regional banks experienced runs and financial stress, we saw significant deposit growth. It wasn’t just temporary – this has become sticky money as members have seen our strength and experienced good service.

Casting A Wide Net For Commercial Clients

Both credit unions serve a diverse range of business members, reflecting their local economies and fields of membership.

Greenwood, which operates from a single branch, counts nearly 2,000 business members among its core membership of approximately 12,000 local account holders. These businesses range from small storefronts to larger commercial real estate projects. Reinhardt notes the credit union’s largest loan to date is a $9 million construction loan for an 80-unit apartment complex.

Metro’s business banking relationships run a similar gamut.

“We serve anyone from someone doing six units to someone doing 100 units,” Cashman says. “We’re very good at risk management, with internal guidelines to avoid concentrations in one borrower, geographic area, or project type.”

Greenwood has found a niche serving Rhode Island’s legal cannabis industry, with a focus on cultivators who sell their product to legal dispensaries. The credit union currently serves about a half-dozen legal cannabis shops, while some 35 of the state’s 60 licensed growers bank with Greenwood.

This specialized banking has contributed to Greenwood’s deposit growth, although Reinhardt cautions that cannabis account balances can fluctuate significantly based on business cycles and regulatory environments.

Relationships, Community Engagement Are Key

Both credit unions emphasize the importance of experienced staff in managing business relationships.

Metro has built a team of eight to 10 people covering the full spectrum of business banking, from origination to servicing.

“We want people with experience through multiple economic cycles, who can react and read the landscape well,” Cashman says.

Greenwood operates with a lean team of three commercial lenders, plus a chief lending officer who also manages relationships. This efficient structure aligns with its single-branch business model, Reinhardt says.

Despite their credit unions’ different sizes, both CEOs stress the importance of community involvement in cultivating business relationships.

“Part of our commitment is to our local community,” Reinhardt says. “We invest not only financial resources but the time and talent of our staff in various non-profits and local towns. You make connections, build relationships, and it absolutely helps attract more business.”

Cashman agrees.

“Being ingrained in the community is really important,” he says. “People have felt comfortable coming to us because they know we’re here for the community.”

Although maintaining a focus on personal relationships remains a key priority, both credit unions have also invested heavily in technology to serve their business members effectively. That includes everything from upgrading online banking platforms to give commercial clients a better user experience to recognizing the need for flexible modern payment options.

“People have pop-up ventures here and there, like at farmers markets,” Reinhardt says. “They need the hardware to accept card payments in those scenarios.”

Metro has similarly embraced technology while maintaining its commitment to personal service. Despite new digital offerings, “we’re still local,” Cashman emphasizes.

“You can get answers very quickly,” he says. “And it’s not unusual for me to speak directly with commercial borrowers.”

When our commercial lending team makes a loan, we’re soliciting the deposit accounts as part of it.

Making Business Personal: Acorns To Oaks

The high-tech, high-touch approach helps both credit unions expand beyond business services and into personal banking when possible.

“When our commercial lending team makes a loan, we’re soliciting the deposit accounts as part of it,” Reinhardt says.

The pandemic was a good example of seizing such opportunities, when Greenwood stepped up to handle Paycheck Protection Program loans big banks wouldn’t. One quarter of those new commercial clients are still members.

Metro takes a similar approach, viewing each business relationship as an opportunity to expand services.

“The more products and services an organization has with you, the more stickiness and the more ingrained they become,” Cashman explains. “We’ll help them get established, starting off with something small, and helping them grow and build.”

Both Reinhardt and Cashman emphasize that the key to their success in business banking — and in growing those relationships into personal accounts — comes down to communication and presence in the community.

“Banking is a relationship business; it can’t be viewed as just transactions,” Cashman says. “That’s very cold. The relationship piece is what warms it up. We’re set ourselves apart because of strong relationships and caring.”

Nurturing relationships from their earliest stages has proven the recipe for long-term success for the Beantown shop. As Cashman puts it, “One of my mentors used to say, ‘Little acorns grow big trees.'”