Suncoast Credit Union ($18.4B, Tampa, FL) was a large credit union even before it obtained CDFI status in 2016, but the designation has enabled the Sunshine State cooperative to make an even bigger impact on the communities it serves. Specifically, Suncoast has won three separate grants that have facilitated the launch of programs and products commonly focused on micro lending, affordable housing, and serving the Hispanic market.

“The CDFI designation provided access to resources for us to do even more good nationwide,” says Melva McKay-Bass, Suncoast’s chief community development officer.

Micro Products With Major Impact

Suncoast offers startup businesses micro loans in amounts ranging from $500 to $50,000. For businesses that have generally been open for less than a year, that kind of funding provides crucial working capital. What’s more, the credit union’s micro lending program also includes an education component that provides resources entrepreneurs need to start, manage, and grow their businesses.

Suncoast launched the micro loan program in 2018 and in 2024 alone the credit union has made more than 500 loans with combined balances exceeding $14 million.

To encourage saving by making it more seamless, Suncoast offers the Smart Start certificate, makes it easier for members to save. Typically, certificates require a $500 introductory deposit; however, Smart Start allows members to open an account with only $50 and make ongoing deposits of up to $50 per paycheck. When the accountholder has saved $500 — in less than a year — they can roll it over into a traditional certificate account.

With a focus on affordable housing, Suncoast’s First-Time Homebuyers mortgage provides financing up to 97%, with as little as 1% from the buyer’s own funds when combined with a 2% gift from an immediate family member. There is no PMI requirement, and Suncoast contributes up to $3,000 toward closing costs. Mortgages for first-time buyers at Suncoast currently represent 34% of total mortgages closed year to date.

CDFI status also has enabled Suncoast to lend more deeply to consumers with credit challenges — although McKay-Bass is quick to point out Suncoast bases its lending decisions on far more than just credit scores. Through partnerships with various nonprofit organizations, the credit union works with working poor families, such as those who are part of the ALICE population — defined as Asset Limited, Income Constrained, and Employed — to provide products, services and resources to promote financial wellness and inclusion.

Collaboration Station

Larger shops with an eye toward community development can have an outsized impact on not only their own program recipients but also the broader landscape. Suncoast Credit Union, for example, previously has helped credit unions — particularly smaller ones — achieve CDFI certification, helping to boost the overall number of CDFI-certified credit unions.

“It’s helpful to either collaborate with an organization that understands the process and nuances of the application or to partner with an organization that is a seasoned CDFI and can provide tips and tools to have a successful application,” says Melva McKay-Bass, chief community development officer at Suncoast.

“There is a perception that we’re taking away from the smaller credit unions,” McKay-Bass says. “Nothing could be further from the truth. There are categories as to how the awards are granted, one being the size of the institution, and I don’t think people realize that.”

Partner Up

When a credit union is applying for a grant, especially for the first time, it’s helpful to seek the insight of others. Suncoast Credit Union worked with CU Strategic Planning and other industry groups to ease the certification and reporting processes.

Even as Suncoast helps smaller shops achieve certification, McKay-Bass says she sees more large credit unions seeing the value CDFI designation. For those who haven’t taken that leap yet, she advises remembering the industry’s mission of not for profit, but for service.

“We are here to provide access to those who might not otherwise have it,” she says. “It’s about continuing to spread that value proposition, continuing to look at ways we can level the playing field, and providing ways to increase financial wellness to individuals who live and work in the areas we serve.”

Avenues For Growth. Challenges In Data.

CDFI certification — and the partnerships surrounding it — have led to growth opportunities for Suncoast. Its work with Inclusiv, a trade group serving CDFI credit unions, led to a 2019 certification with Juntos Avanzamos and deeper roots with the area’s Hispanic community, which makes up a substantial part of Suncoast’s membership base.

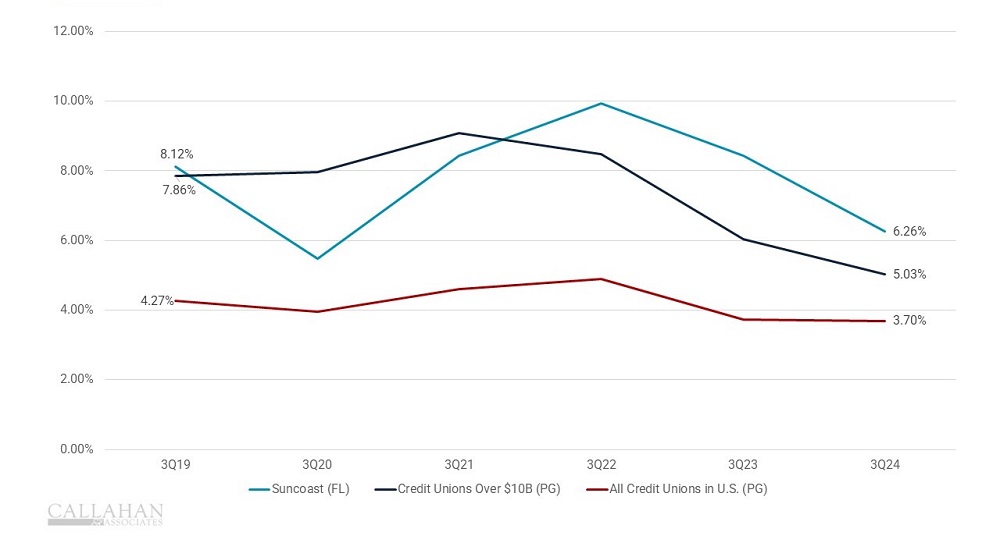

Overall, Suncoast’s CDFI efforts have contributed to membership growth rates well above the national average and on par with or higher than that of credit unions with more than $10 billion in assets.

MEMBERSHIP GROWTH

FOR U.S. CREDIT UNIONS

SOURCE: FirstLook From Callahan & Associates

Yet even after a decade, Suncoast still faces many of the same challenges as smaller, more recently certified CDFI credit unions. For one thing, data analytics — a field many credit unions struggle with — is critical to the endeavor. Accurate data is required to track outcomes and ensure Suncoast is a good steward of the dollars it has been given.

“Having the appropriate analytics and accurate reporting is not only important for the existing grant but also can dictate whether we’re eligible for a follow-up grant,” McKay-Bass says.

At Suncoast, a community development officer is assigned to oversee the credit union’s CDFI efforts , while an internal analytics team monitors performance. Importantly, McKay-Bass says it’s not necessary for a credit union to hire a whole new department to run its CDFI efforts initially, however it depends on the credit union’s bandwidth.

Aligning grant requests with Treasury Department priorities is another ongoing challenge. To identify where they can have the biggest impact, credit unions must understand their own capacities as well as what the Treasury feels is most impactful to the industry and the nation.

All challenges aside, McKay-Bass doesn’t hesitate when asked what she’d do differently if she was starting the process over again.

“I would’ve done it sooner.”

Performance Benchmarking Made Easy For CDFIs. Are you a CDFI struggling to find meaningful comparisons for performance benchmarking? Callahan’s Peer Suite allows users to create a custom peer group of CDFIs in minutes and compare key metrics like membership, loan, and share growth. Let us show you how. We’ll even provide a free performance report for you to keep at the end of the session. Learn more today.