Top-Level Takeaways

-

Contactless cards may get adoption push as a way to social distance in plastic.

-

Some credit unions already have them, others are getting in line.

A pandemic of global proportions may be pushing contactless card adoption to new heights, and soon.

The Futurist Group think firm has just issued a report on survey findings that the coronavirus outbreak had sharply increased U.S. consumers’ perceived importance of contactlesspayments.

And that was as of March 3, the report notes, the same day the World Health Organization advised consumers to quit using cashbecause of the ability of paper to carry the deadly virus.

The Futurist Group’s survey of 3,187 structured product reviews on the perceived importance of contactless functionality in evaluating a credit card offer found that 38% of consumers considered it table stakes, a 26.6% jump from beforethe virus hit.

While this is early data, and more time is needed to assess the real and lasting impact on consumer behavior, this is an indication that the tipping point for contactless usage in U.S. may arrive faster than anticipated, the Futurist Group report says.

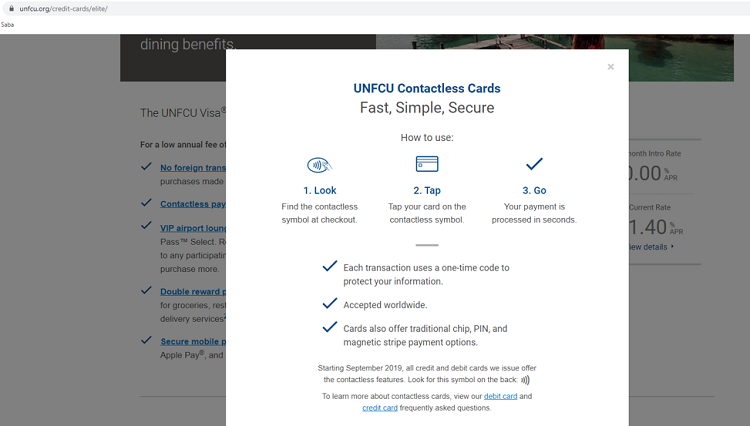

This pop-up page helps explain the features that UNFCU members can expect with their contactless credit and debit cards.

The credit union industry already was ramping up contactless card use before the pandemic took hold. For instance,United Nations Federal Credit Union($6.0B,Long Island City, NY) began offering debit and credit cards with the contactless wave-and-pay chip in September.

Gurinder Singh, Assistant Vice President Of Global Card Solutions, United Nations FCU

The cards are being issued on demand and as current plastic expires. Gurinder Singh, UNFCU’s assistant vice president of global card solutions, says he expects about half of the cooperative’s 200,000 debit and credit cards to be contactlessby year’s end.

That prediction came before the pandemic struck. With a global membership served by only three branches, UNFCU has been going first like this for a while. We were the first financial institution in the U.S. to offer EMV cards.That was in 2010 Singh says.

The nation’s fourth-largest credit union, meanwhile, began offering contactless plastic last June and now has more than 100,000 in members’ hands. We’re issuing contactless credit cards for all new, renewal, replacement and reissued cards, and also upon member request, says Rick Rasmussen, senior manager for product strategy at BECU ($22.2B, Tukwila, WA).

Check out this SECU website landing page that outlines features of contactless cards.

The second-largest cooperative in the country, State Employees’ Credit Union($41.4B, Raleigh, NC) is issuing both debit and credit cards with contactlesschips. They began debit in 2018 and credit last May. Members are getting them when their current plastic expires.

Rick Rasmussen, Senior Manager of Product Strategy, BECU

As of Feb. 1, SECU had distributed about 1 million contactless debit cards and about 136,000 contactless credit cards, about 54.5% and 25%, of the portfolio for each, respectively, and about 10% of its face-to-face activity was contactless.

The volume of contactless activity increases monthly as we have more cards on the street and the merchant terminals are migrated, says Leanne Phelps, SECU’s executive president of card and ATM services.

Contactless cards are quick and easy, taking only a few seconds to complete, making it more convenient for both the cardholder and the merchant, Phelps says. Additionally, the payments industry is moving more and more towards contactlesscards being the norm.

This is where the industry is headed.

This is where the industry is headed, says Cyndie Martini, CEO of Members Access Processing, the Seattle-based card processing CUSO for more than 100 credit unions. She notes that morethan three-fourths of the top 100 Visa merchants by transaction already offer the ability to tap to pay at checkout.

Martini says 10 to 20 of her company’s clients are in the process of going live with contactless cards. PSCU, meanwhile, says about 30 of its 1,500 credit union clients are live on contactless and that many more are on the way.

It’s one of our key initiatives to enable contactless moves for many over our credit unions over the next 18 months, says Jeremiah Lotz, managing vice president of digital experience and payment products of the Florida-based CUSO,which has devoted a landing page to contactless.

We’re currently poised to produce more than 3 million new contactless plastics to support natural and mass reissuance strategies, Lotz says.

Europe already seeing increased contactless payments limits. Read more here.

Leanne Phelps, Executive Vice President of Card and ATM Services, State Employees’ Credit Union

CO-OP Financial Strategies declined to say how many of the California-based CUSO’s more than 3,000 clients have gone contactless or were in the pipeline but does recommend credit unions makethe move.

Unlike the switch to EMV-enabled cards, which was powered by Visa and Mastercard liability shifts, the change to contactless is not mandatory in that sense. But, says CO-OP senior product manager for debit Vickie Walker, we feel the credit unionis losing a competitive advantage if they don’t. Members could go to another issuer to get contactless cards.

The competition also includes mobile payment apps from Apple, Google, and more, adding to any pressure credit union card issuers might feel to add contactless cards to their portfolio. And, for those who already have it, there’s no time like thepresent.

In this moment in time, issuers must increase awareness of the contactless feature on their cards. Targeted marketing efforts must go beyond explaining the functionality and instead educate consumers about all benefits that contactless can offer,The Futurist report says. Responsible communication should prioritize those who are at the highest risk of infection.