According to the latest Investment Trends Review published by TRUST for Credit Unions, total credit union investment portfolios remained relatively steady as of Dec. 31, 2015, in terms of total balances and portfolio composition.

Balances Increase Slightly

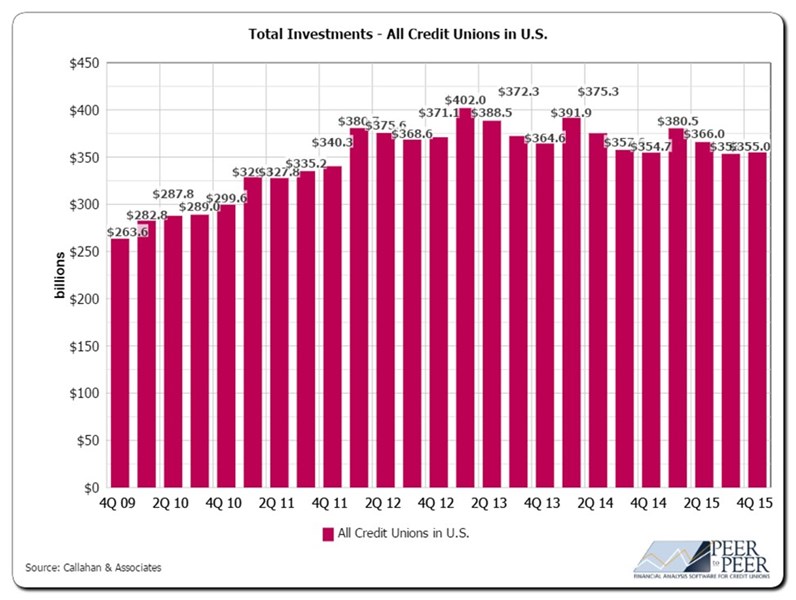

Credit unions held $350 billion in investments at year’s end, a slight increase from the third quarter of 2015. As the chart below shows, total investments were relatively unchanged reflecting the recent pattern in the third and fourth quarters. Total credit union assets remained steady at an all-time high of $1.2 trillion. Very few new investments were made as most institutions awaited the Fed’s decision to finally raise short-term rates at its December meeting.

Educational Resources Available For Investment Managers

With industry investments remaining at higher levels and yields on those investments at record lows, many credit unions are searching for flexible alternatives that can enhance yield without tying funds up long-term.

TRUST offers an educational guide to provide information on an often overlooked alternative, institutional mutual funds. Interested credit unions can download a complimentary copy to learn more about:

- The permissibility of mutual funds for credit unions

- Questions to ask when choosing a provider

- Potential benefits this alternative can provide

- How target duration portfolios may fit into your investment strategy

Download your complimentary copy of the Credit Union Guide to Mutual Fund Investing now.

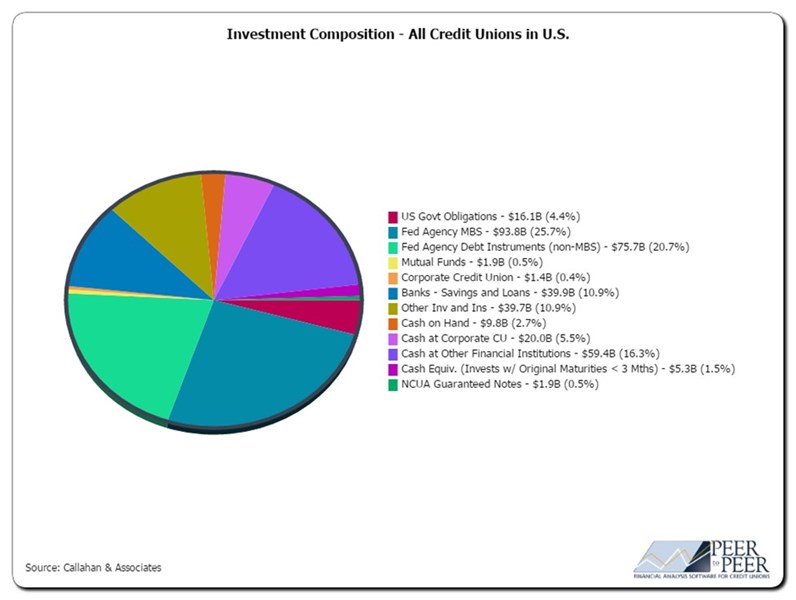

Investment Composition Shows Increase in U.S. Treasuries

The net $2 billion increase in investments for the quarter was primarily in U.S. Treasuries, which increased to 4.4% of total credit union investments. This increase could be attributed to year-end window dressing buying of safe, short-maturity liquid assets or potential TIPS buying on future inflation hopes. Federal Agency Debt Instrument and Fed Agency MBS balances were lower due to calls being exercised and MBS prepayments. Agency debt and MBS continue to be the preferred investments representing 46% of the investment pie. With the spreads over comparable treasuries at very tight levels, these securities aren’t as attractive given the uncertainty of principal repayments.

Download More Q4 2015 Data, Request Customized Review

Interested in more information about the overall industry’s average yield on investments, new weighted average life data and derivatives usage? Download your complimentary copy of the full Q4 Investment Trends Review from www.trustcu.com today or contact us at TCUGroup@callahan.com to learn more about the customized investment reviews we can provide for your credit union.

About TRUST

TRUST helps credit unions succeed in serving their members by providing a professionally managed family of mutual funds exclusive to credit unions as well as the information and analysis they need to support investment decisions. Created by some of the leading credit unions with oversight by a board of trustees, TRUST’s mutual fund options allow credit unions to meet their short duration needs, are professionally managed, and are based on the cooperative values of credit unions.

Visit www.trustcu.com or call us at 800-237-5678 to learn more.

The Trust for Credit Unions (TCU) is a family of institutional mutual funds offered exclusively to credit unions. Callahan Financial Services is a wholly owned subsidiary of Callahan Associates and is the distributor of the TCU mutual funds. Goldman Sachs Asset Management is the advisor of the TCU mutual funds. To obtain a prospectus which contains detailed fund information including investment policies, risk considerations, charges and expenses, call Callahan Financial Services, Inc. at 800-CFS-5678. Please read the prospectus carefully before investing or sending money. Units of the Trust portfolios are not endorsed by, insured by, obligations of, or otherwise supported by the U.S. government, the NCUSIF, the NCUA or any other governmental agency. An investment in the portfolios involves risk including possible loss of principal.