From a macro perspective, the auto industry is facing a headwind. Vehicle sales in the United States have come in behind 2016 every month so far this year

On a positive note, credit union auto lending performance remains strong. Annual growth of 16.3% in the new auto segment underpinned a 13.6% year-over-year increase in total auto balances, which hit $321.4 billion as of mid-year. This marks the 16th consecutive quarter of annual double-digit auto portfolio growth.

The rate of growth, however, is a mixed bag. Annual growth in the total auto portfolio decelerated by 50 basis points versus last year. A more pronounced slowdown was evident in the used auto portfolio. There, annual growth decelerated 1.3 percentage points. Conversely, new auto loan growth accelerated 80 basis points over second quarter 2016. ContentMiddleAd

Auto loans accounted for 34.8% of the total loan portfolio at credit unions as of mid-year. Behind first mortgages, autos represented the second-largest segment of lending. Year-over-year, these loans increased their share of the portfolio by 80 basis points and narrowed the gap on first mortgages to 5.9 percentage points in the second quarter.

The indirect lending portfolio expanded 20.2% year-over-year, remaining a reliable source of growth. By comparison, direct loans grew 5.9% annually. Indirect loans as a percentage of total auto loans reached 56.7% in the second quarter, up 3.1 percentage points year-over-year.

Auto loan penetration expanded 1.06 percentage points annually to top 20.0%, showing that credit unions are increasingly extending auto credit. As more members turn to credit unions to finance their vehicles, however, maintaining sound asset quality is imperative for sustainable growth. The industry’s auto loan delinquency increased 1 basis point annually; auto loan net charge-offs increased 7 basis points year-over-year.

The credit union share of the auto finance market nationally increased 1.4 percentage points annually and hit 18.9% in the second quarter of 2017. Despite softening sales in the auto market, credit unions are not skipping a beat when it comes to meeting the vehicle financing needs of members.

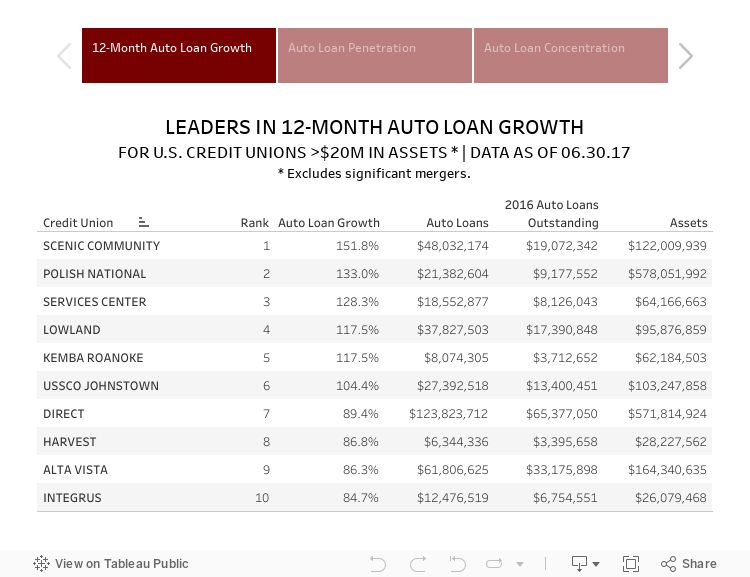

Click through the tabs below to see the top 10 credit unions in each leader table.

var divElement=document.getElementById(‘viz1513708382809’); var vizElement=divElement.getElementsByTagName(‘object’)[0]; vizElement.style.width=’750px’; vizElement.style.height=’577px’; var scriptElement=document.createElement(‘script’); scriptElement.src=’https://public.tableau.com/javascripts/api/viz_v1.js’; vizElement.parentNode.insertBefore(scriptElement, vizElement);

var divElement=document.getElementById(‘viz1513708382809’); var vizElement=divElement.getElementsByTagName(‘object’)[0]; vizElement.style.width=’750px’; vizElement.style.height=’577px’; var scriptElement=document.createElement(‘script’); scriptElement.src=’https://public.tableau.com/javascripts/api/viz_v1.js’; vizElement.parentNode.insertBefore(scriptElement, vizElement);

See the rest of these tables and explore dozens more along with hundreds of pages of credit union performance data in the 2018 Callahan Credit Union Directory. It’s the gold standard for reliable insight. Read the digital download today.

CASE STUDY

Helping High-Risk Members Secure Reliable Transportation

Southern Chautauqua FCU | Lakewood, NY | Assets: $70.4M | Members: 14,958

Azalea City Credit Union | Mobile, AL | Assets: $26.6M | Members: 3,445

Azalea City Credit Union and Southern Chautauqua Federal Credit Union don’t share much geography, but they lend from the same playbook.

Both work extensively with the types of borrowers who often turn to pay-here lots or payday lenders; they both charge higher-than-market rates for loans; and they both end up with more bad loans than most credit unions their size.

It is what it is, says Ola Anise, president and CEO of three-branch Azalea City. So, do we accomplish our mission of people helping people, or do we only help people with a Beacon score of 640 or higher? If that’s the case, we might as well be a bank.

The loan rates at these two credit unions reflect the higher risk they take on. Azalea City’s average interest rate was 8.44% on used cars at mid-year. For Southern Chautauqua, it was 17.99%. The national average for all credit unions was 4.83%.

Consequently, overall yield on loans was 8.1% for Azalea City and 7.43% for Southern Chautauqua, compared with 4.51% for all credit unions nationally.

But higher rates haven’t scared off borrowers. Azalea City posted year-over-growth of 35.8% in its auto portfolio, and Southern Chautauqua posted 19.3% growth. Credit unions nationally posted growth of 14.0% as of June 30, 2017. Neither credit union participates in indirect lending.

Both are also well loaned out, with second quarter loanto-share ratios of 86.1% for Southern Chautauqua and 85.8% for Azalea City. The national average was 79.6% and 58.6% for credit unions with less than $100 million in assets.

Not surprisingly, delinquencies and charge-off ratios are higher than average at these two credit unions. The national average in the second quarter was 0.75% and 0.56%, respectively. At Azalea City, it was 3.08% and 1.59%. At Southern Chautauqua it was 1.75% and 1.46%.

But that’s OK, says John Felton, president and CEO of Southern Chautauqua.

If 650 people now have transportation and can keep their jobs, so I take back 65 cars. Felton says. Look at what we helped a lot of people achieve.

Read The Whole Story

How Do You Compare?

NCUA and FDIC data is right at your fingertips. Build displays, filter data, track performance, and more with Callahan’s Peer-to-Peer analytics. More insightful performance comparisons start here.