Top-Level Takeaways

-

The data and lending teams at Oregon Community Credit Union combined forces to create a new way to rate risk and price loans.

-

Auto loan production immediately jumped after introducing new rates, and loan production has been strong since.

Over the past few years, senior managers at Oregon Community Credit Union ($1.7B, Eugene, OR) realized it was time to challenge some long-standing assumptions about auto lending.

The credit union was feeling pressure on its margins and capturing less indirect auto loan market share in its competitive market.

ContentMiddleAd

Something had to change, and lending vice president Ethan Nelson knew where to start.

We hadn’t fundamentally changed the structure of our auto rate sheet in years, so we knew it was time to test some of our assumptions,says the 19-year veteran at OCCU who’s been the lending VP for the past four.

Testing Old Assumptions

To test those assumptions, the credit union undertook a multi-department project that combined the art of relationship lending with the science of data analytics to create a new rate sheet and a new understanding of risk and reward.

When it comes to risk, it turns out one of OCCU’s longstanding assumptions holds water. The project found that FICO scores are a good predictor of risk. One assumption that didn’t pan out is that loan length also is a good predictor.

How Do You Compare?

Check out Oregon Community Credit Union’s performance profile. Then build your own peer group and browse performance reports for more insightful comparisons

Search & Analyze

Not by itself it isn’t,says Casey Foltz, OCCU’s business intelligence manager. A 72-month loan is not riskier than a 60-month loan just because of the loan length.

Thanks to the project, OCCU can also now quantify risk according to member loyalty, giving the credit union the ability to reward loyal members with better rates.

The Results From New Rates

The project began in late 2016, and OCCU put new rates into place in May 2017. The effects were swift. The credit union posted record months in auto loan volumes and high credit scores that June and July.

Nelson attributes some of that to market conditions but says the production surge was beyond expectations.

It was high-quality paper at what we think are fair rates,he says.

Adds Foltz, We ended up with the opportunity to reprice loans according to risk.

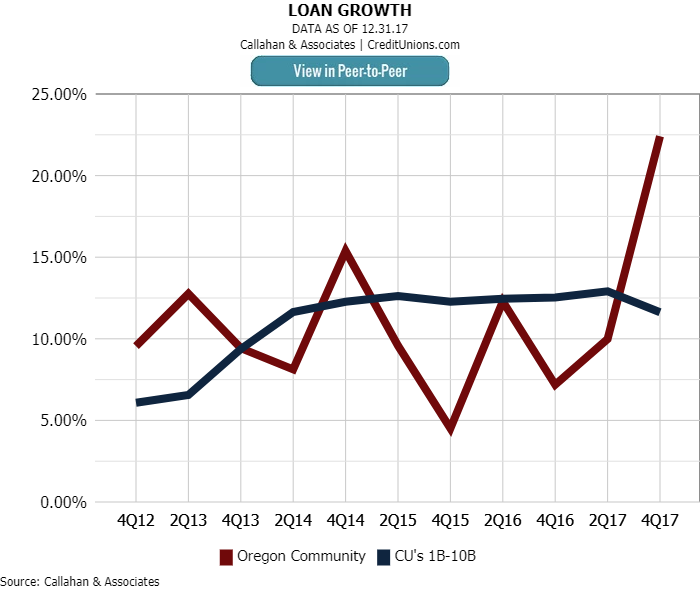

Updating an old rate sheet with new data techniques helped OCCU post year-end loan growth of 22.4%, sharply higher than the 11.6% average for credit unions $1 billion to $10 billion in assets and the 11.6% average for Oregon credit unions. Sharp auto loan growth, particularly indirect, has driven OCCU’s overall lending to new heights.

Auto lending at OCC surged after the credit union restructured its rate sheet in May 2017.

More Than Numbers

The lending and business intelligence departments at OCCU joined forces to take on the analytics project. Foltz’s team put together 20 different models that used algorithms and machine learning techniques.

Collaboration + Process

Casey Foltz and Ethan Nelson of Oregon Community Credit Union offer advice on how to dive deep into a data analytics project.

- Strive for collaboration. It wasn’t data science people on one side of the wall throwing a ball over the top to the other side,says Casey Foltz, OCCU’s business intelligence manager. It was all of us getting together.

- Meet regularly. The project team at OCCU met bi-weekly for the better part of a year. It was very iterative,Foltz says. There were a lot of decision points, and we always erred on the side of being conservative to mitigate the risk. And, we followed the advice of the lending staff.

- Don’t rush. Allow time to the let the process flow where it needs to flow, advises Ethan Nelson, vice president of lending.

- Be open-minded. Think through your assumptions, but don’t be afraid when the data changes those assumptions, Nelson says.

They used open statistics software called R, along with Microsoft business intelligence programs and Tableau reporting tools. The lending team contributed supporting documents, testing, and validation, as well as deep institutional knowledge about members and the market.

Now, OCCU pricing incorporates such factors as overhead cost of paying the dealer reserves, probability of default, how much interest the note is likely to generate, and member loyalty.

It all goes into one simple number where we can see where we’re breaking even and where we have room to adjust,Foltz says. We use that science to support lower rates and properly price those with higher risk, so pricing as a whole is more in line with the real risks.

But OCCU’s approach to lending isn’t solely about hard numbers.

We balance that science with what our gut tells us about pricing loans, what our competitors are doing, how our dealers will react, and what we know about each member we deal with,adds chief lender Nelson.

OCCU’s auto loan pricing project was a winner in the Credit Union Analytics Challenge at last year’s CULytics Summit in Redmond, WA. This year’s summit is March 13-15.

In addition to gut checks, the use of machine learning techniques enhances OCCU’s ability to refine its rate sheet and lending criteria as time and data accrues.

We now model our pricing structures to better understand the results from changes we made and predict what future adjustments we’ll need down the road,Nelson says.

The credit union is no longer working harder for a shrinking number of loans, and it’s no longer subsidizing risker loans at the expense of more credit-worthy members.

We can write more loans to more people of higher risk,Foltz says. That is a real community service.

And the membership as a whole even those without a loan is getting something out of OCCU’s enhanced analytics.

Now, we can put more money toward investing in branches, digital channels, and other value propositions,Foltz says. We view that as returning real value to members.

Some of the modeling underway at OCCU also strongly suggests that a long-term relationship with OCCU specifically and credit unions generally tend to dramatically improve a member’s overall credit.

There are exceptions, but overall that’s pretty clearly happening,Foltz says. If we can price a loan in a way that’s fair to all our members, that higher-risk member will be in better financial shape two or three years down the line.