As credit unions evolve to serve more members in more ways, many are realizing that structure can be a strategic advantage or a silent constraint. Every line on an org chart connects people. In turn, those connections shape how credit unions build member experience, engagement, and loyalty, all of which are essential elements of institutional growth.

When it comes to growth, few teams carry more weight than marketing. The way credit unions organize their marketing function — who it reports to, how it collaborates, and what it’s tasked to achieve — can determine how effectively the entire organization connects with members and expands its reach.

A Stronger Foundation Enables Stronger Service

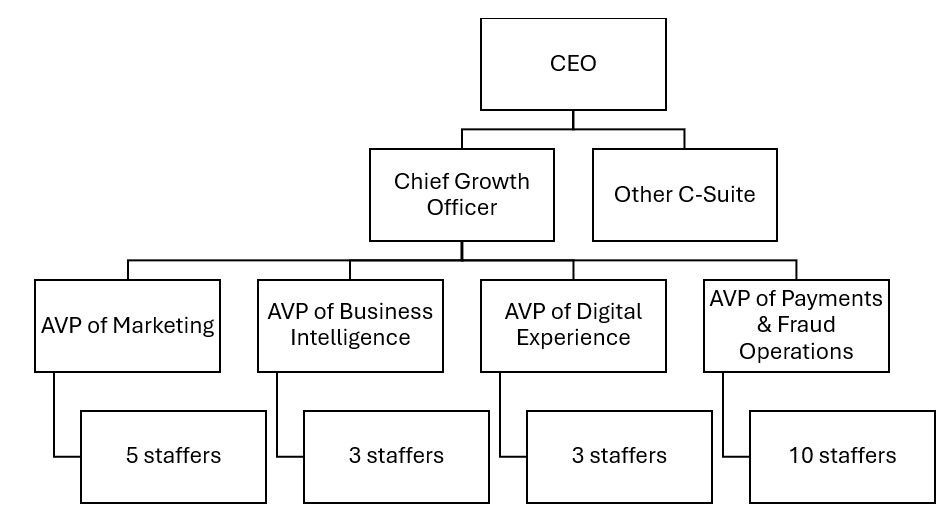

At 3Rivers Federal Credit Union ($2.7B, Fort Wayne, IN), marketing functions as a growth and revenue center supported by marketing, business intelligence, and digital experience. All roles of this three-legged stool fall under chief growth officer Gautam Borooah, who joined the credit union in early 2025.

“To get to that next level, we have to be an organization that drives profitable revenue and growth,” Borooah says. “This trifecta of marketing working in tandem with analytics and digital experience is essential to that.”

The team works across the organization to identify areas in need of support, then considers if there is enough ROI to develop profitable campaigns to support growth. When the right opportunities arise, the three functions come together to develop campaign plans, which include details surrounding timelines, milestones, dispersing leads, facilitating dialogue across the organization, and more.

“We’re always looking for ways to support our organizational goals,” says Simone LeClear, assistant vice president of marketing. “It’s great when business intelligence comes in and says, ‘We see an opportunity here.’”

All Eyes On ROI

3Rivers’ business intelligence unit is made up of five team members who ensure the team has the right data to guide investment decisions. That’s all part of a broader push to make the credit union a more metrics-driven organization.

“It’s important to foster revenue so we can do the things that credit unions do,” says Chad Gramling, assistant vice president of business intelligence. “If we’re not well-capitalized, we’re limited in what we can do and how we can contribute to our communities.”

The credit union’s emphasis on ROI is crucial, he adds, because it’s members’ money being invested. Careful planning and cross-departmental collaboration helps to justify when the credit union spends money — and when it doesn’t. According to the BI executive, the team has delved into projects only to realize they didn’t make sense and had to abandon them.

“That calculation makes those decisions a little bit easier,” Gramling says. “It takes out some of the emotion and makes it more rational.”

A Winning Digital Experience

The digital experience team ties together the messaging from the marketing team with the analytics from business intelligence. Pairing those efforts helps illustrate the performance of individual initiatives as well as provides better insight into different member journeys.

“Hopefully that gets us to whatever end goal we’re trying to achieve, whether it’s a campaign or just informing our members about day-to-day stuff,” says Tim Boggs, assistant vice president of digital experience.

The actions of each unit impacts the efforts of the others, and Boggs and his team often serve as the connective tissue.

“Some of the digital platforms I oversee provide data to Chad’s team to put the big picture together and create these campaigns,” Boggs says. “It all comes full circle.”

What’s Next?

3Rivers’ marketing model is continually evolving to meet the credit union’s growth needs.

The move to a growth-focused department hasn’t come without changes. For one, the credit union has phased out a vice president of marketing role, and to increase efficiency, staffers who would previously have reported to that role now report to Borooah.

“We wanted to be more nimble and have fewer layers,” he says.

A director of communications and community role is also in the works, with a focus on internal communications.

“As we get ready for that next level of growth, which hopefully propels us to be a $5 billion-asset credit union, we have to be much more deliberate in our communications strategy,” Borooah says.

Think Like A Credit Union, Function Like An Ad Agency

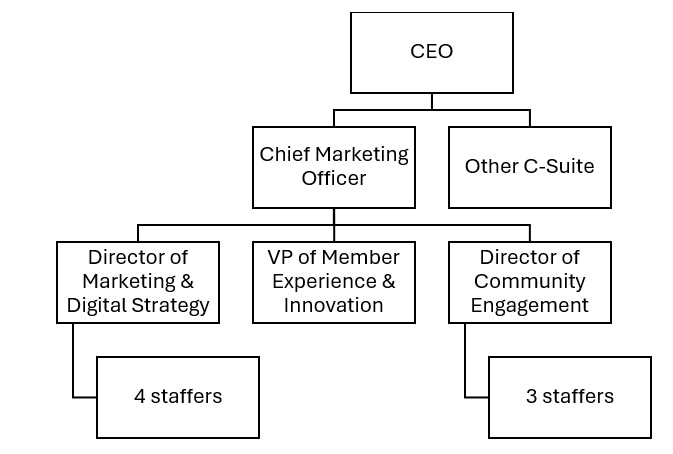

To hear Leigh Anne Bentley tell it, the marketing department at Leaders Credit Union ($1.2B, Jackson, TN) has “exploded” in the past several years. The credit union has its own three-legged stool of sorts, with divisions focused on traditional marketing, community engagement, and innovation and member experience.

When Bentley joined Leaders in 2016, marketing had just three people — two traditional marketers and a community-engagement specialist. Today it houses 11 staffers, including two team members focused on digital marketing, a graphic designer, videographer, and more, plus a four-person community-engagement team.

“We’ve always had this structure; as we’ve grown, we’ve simply added more people to it,” says Bentley, the credit union’s chief marketing officer. “Our core approach hasn’t changed, we’ve just gone much deeper in each area.”

Some of the most significant growth has come from the four-member community-engagement team. Each member of that cohort works on functions like managing SEG relationships, promoting financial wellness, serving on boards, and volunteering for chamber events in the community. The credit union is based in Jackson, TN, but has a branch presence in counties beyond the Jackson metro area, so each team member covers a specific area

Traditional marketing and community engagement each have their own director that oversees small teams, whereas innovation and member experience functions as a team of one. Along with Bentley, community engagement and innovation/member experience all serve on Leaders’ advisory boards, divvied up by geography.

Growing Bigger And Better

The department’s growth has reflected the credit union’s own. When Bentley joined nearly a decade ago, Leaders had assets of approximately $330 million. Today, it holds more than $1.2 billion in assets.

Bentley and another member of the team both have ad agency backgrounds, and the department functions similarly, with a focus on in-house production. The team produces everything in-house, from print to digital to online and TV advertising. It also makes all web updates except those that require coding.

The staff is a mix of those with traditional advertising backgrounds and former branch employees. The videographer was a universal banker before moving into marketing. That employee produces video for not only Leaders and its foundation but also the credit union’s podcast, including breaking it up into smaller reels to run on different social media platforms. Given the resources the credit union was spending on videos, finding an internal film major that wanted to get into marketing proved serendipitous.

“It was a great transition to move her over,” Bentley says. “She proved herself immediately.”

Even In Marketing, Member Experience Matters

To ensure marketing’s priorities reflect broader organizational goals, the team meets twice every month with other departments to discuss analytics, campaigns, sales, and more. Those meetings also provide fodder for the internal newsletter the marketing team distributes each month.

Although each division has its own focus area, Bentley says the entire team works with an eye toward member experience, always asking what’s best for members and striving to keep MX at the forefront. But like in any team, marketing alone does not an experience make.

“I’ve got to give kudos to the front-line staff and the sales staff for the level of member service we have,” the CMO says. “We can market all day long, but it’s the front lines and the people on the phones and in the branch who show what great member experience looks like.”

Streamline Your Marketing Structure. Building the right marketing team doesn’t have to start from scratch. Callahan’s Policy Exchange offers ready-to-use org charts, job descriptions, and templates designed to help credit unions hire efficiently and structure teams for success. Explore hundreds of resources that make planning easier and keep your focus on strategy, not paperwork. Learn more today.