Small business is a growing business for Community First Credit Union of Florida ($1.3B, Jacksonville, FL), helped along by its partnership with a hometown college.

Community First got into member business lending approximately 10 years ago, about the same time it opened a branch and deployed ATMs on the campus of the University of North Florida. About five years ago, Community First ramped up business services with efforts that included building an informal referral relationship with the school’s Florida Small Business Development Center (SBDC).

Now, in addition to serving the more than 17,000 students and staff at UNF, the credit union sends budding business people to the center for workshops, roundtables, and training that includes everything from creating business plans to blogging and social media.

|

| Susan Verbeck, SVP, Community First Credit Union of Florida |

In return, the SBDC sends potential small business borrowers to the credit union.

It was evident as we discussed with members the idea of small business ownership and borrowing that many wanted low- or no-cost training, guidance, and best practices on growing their businesses and becoming better entrepreneurs, says Susan Verbeck, senior vice president of lending at the 109,156-member Community First. The SBDC at UNF has the knowledgeable, trusted experts that make it the perfect place for such guidance.

And because the center understands the credit union’s philosophy toward supporting the community, it frequently refers small business owners ready to take the next step in growing their business to Community First’s business lending department. It’s a symbiotic relationship, although the credit union doesn’t keep track of how many referrals have gone each way.

We have no formal agreement with the center, Verbeck says. But have a built a relationship based on mutual respect.

CU QUICK FACTS

COMMUNITY FIRST CREDIT UNION OF FLORIDA

data as of 03.31.15

- HQ: Jacksonville, FL

- ASSETS: $1.3B

- MEMBERS: 109,156

- BRANCHES: 17

- 12-MO SHARE GROWTH: 1.34%

- 12-MO LOAN GROWTH: 10.04%

- ROA: 1.18%ASSETS: $2.5B

Other relationships have been built, too. For example, the credit union sponsored a six-week training program at the center, funded by a ScaleUP grant from the Small Business Administration. Community First’s role was to supply the refreshments.

This provided us access to 38 small business owners ready to take the next step in their business ownership careers, Verbeck says Our business lending officers attended each session, and we’ve been in contact with all the graduates and have generated at least five new business members.

You Might Also Enjoy

- Credit Union Performance Benchmarking

- More Than A Name

- Educational Partnerships Build Loyalt

- A Strategy To Test The Need For In-House Counsel

- Instantaneous Shock Analysis Provides Misleading IRR Results For Credit Unions

A Growing Business

The SBDC connection is helping the credit union add to its roster of more than 4,000 business memberships across northeast Florida that includes large manufacturers, lawn care businesses, accounting and medical offices, and startup beauty shops.

The credit union is following a strategy it developed two years ago after it identified member business services as a strategic focus and started targeting businesses up to $5 million in sales.

We created a roadmap for both deposit services and lending products that would take us to a new level of brand awareness and success with business owners, Verbeck says. We believe we are right on target with our accomplishments

That strategy includes expanded non-lending services, including three different attractive and cost-effective business checking accounts tailored for small, medium, and larger enterprises, Verbeck says. They’re joined by mobile banking and deposits, credit card processing, and payroll services.

Verbeck says a majority of the business memberships are deposit only, but the credit union is working to change that.

As we deepen relationships with business owners, we explore their loan needs and provide working capital lines of credit, business credit cards with rewards, equipment and auto loans, and financing for office condos, buildings, and warehouses, the lending SVP says.

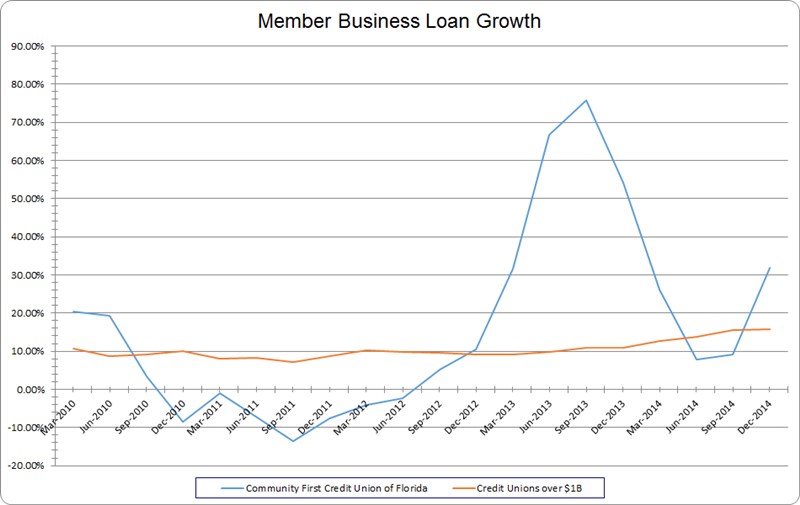

Business member deposits have grown as a result, including 40% in the past year alone, Verbeck says. Meanwhile, Community First posted MBL growth of 31.87% in 2014 and an even higher 54.16% in 2013 placing it in the top quintile in its asset-based peer group.

Business loans were 3.97% of the credit union’s loan portfolio at year’s end, compared with 6.4% for the average billion-dollar credit union in the Callahan database.

MEMBER BUSINESS LOAN GROAN

Data as of March 31, 2015

Callahan & Associates | www.creditunions.com

Source: Peer-to-Peer Analytics by Callahan & Associates

Community First’s existing member business loan portfolio is small in relation to our asset size $30 million of our $774 million in total loans, Verbeck says. But over the next three to five years, we intend to grow that to roughly $75 million as we focus on the business loan opportunities in our market.

There is indeed room in the books for more lending. Community First’s loan-to-share ratio was 70.51% in fourth quarter 2014 compared to 79.47% for the average billion-dollar credit union. It’s also well capitalized at 10.48% compared to its peer average of 7.39%. Its ROA at the end of 2014 was 1.34% compared to 0.96% for its peer group.

How Do You Compare?

Check out Community First’s performance profile.

The Double Bottom Line

Although the numbers are good, performance isn’t exclusively what the credit union’s business focus is all about. It’s also about doing good while doing well, the double bottom line.

There’s no shortage of inpiduals desiring to own their own business and be their own boss, Verbeck says. Many of them, though, need to get started quickly but don’t know how.

For those folks, the credit union immediately refers them the SBDC so they can learn what they need to start their own business. According to Verbeck, the credit union has received positive feedback even when that referral doesn’t ultimately lead to more business for the credit union.

The SBDC connection is helping to add to a roster of more than 4,000 business memberships across northeast Florida, ranging from large manufacturers to lawn care businesses, accounting and medical offices, and startup beauty shops.

Occasionally, there’ll be the member who learns there’s more to starting a business than he thought, Verbeck says. His expectations of going to the center for a jump-start are dashed by the reality of how much goes into this.

Providing that learning moment speaks to the credit union’s core mission and original purpose.

Community First’s commitment to the community we serve is built on providing financial solutions, Verbeck says. This includes financial education to both consumers and businesses. This credit union was founded to serve educational employees. Our support for the community’s financial education today is as important as it was then.