Redstone Federal Credit Union ($4.3B, Huntsville, AL) is combining social media and in-person engagement through a series of webinars on a range of topics.

The big Alabama credit union live tweets seminars while simultaneously hosting members and non-members in person at the Atrium, the public meeting space in its Huntsville headquarters.

Lindsay Laderoute, Digital Content Developer, Redstone Federal Credit Union

In its most recent session on June 16, Lindsay Laderoute, Redstone’s digital content developer, says 37 people physically attended the free webinar Fraud Trends: How To Minimize Your Exposure to Fraud while they and others also engaged through Twitter.

Here, Laderoute shares what Redstone has learned since it began using Twitter for webinars a couple years go.

What is Redstone Federal Credit Union’s overall thinking and strategy for seminars tweeted and non?

Lindsay Laderoute: Redstone believes it is incredibly important to educate our members and potential members. We provide free, educational seminars on an array of topics, including to different groups and organizations. These seminars allow our members and others to connect with our experts in different fields to learn and ask questions about subjects like mortgages, insurance, budgeting, and more.

We decided to live tweet some of our seminars for three reasons: To increase followers for our @RedstoneFCU account and gain overall exposure, to give our seminar attendees notes to reference later, and to educate members and non-members on important topics while raising awareness about our free seminars.

Why did you tweet a fraud seminar? Who presented it?

CU QUICK FACTS

REDSTONE FEDERAL CREDIT UNION

Data as of 03.31.16

- HQ: Huntsville, AL

- ASSETS: $4.3B

- MEMBERS: 383,768

- BRANCHES: 16

- 12-MO SHARE GROWTH: 5.57%

- 12-MO LOAN GROWTH: 7.63%

- ROA: 0.69%

LL: Our Security and Investigations Department created a fraud seminar to share their expertise and experience on different fraud trends. They felt our members needed to stay up to date on what types of fraud they might encounter, since fraud is a timely topic and ever changing.

The seminar was presented by Jonathan Kirby, assistant vice president of security and investigations, and Brian Smith, our manager of security and investigations. The people in that department have 300 years of combined experience themselves, and they also partner with local law enforcement to stay in the know about the type of fraud activity happening within our communities.

Fraud is a broad category. What was the focus of the information?

LL: The seminar included four sections: local fraud examples, social media scams, recent fraud trends, and elder abuse. The presentation also included information about Redstone tools that help our members detect, protect, and minimize the impact of fraud. These include debit card control features inside online banking and mobile banking, as well as text alerts.

The presentation finished with our experts answering questions from seminar attendees, which continued even after the seminar ended with one-on-one conversations between attendees and our experts.

We update our fraud seminar with the latest trends and hold it two to three times a year.

Don’t reinvent the wheel. Redstone Federal Credit Union’s latest fraud seminar included a series of 69 tweets. See the entire package in the Callahan Associates Executive Resource Center.

How long did it last?

LL: The seminar lasted about an hour and a half. We like to keep them to about an hour, but we open up the last segment for questions. Usually the attendees fully use this time by asking questions, making the seminars extend beyond the one-hour mark.

Not every seminar we host is a good fit for live tweeting, so we determine this on a case-by-case basis.

Where can people find it afterward?

LL: We tell our attendees and members who inquire afterward about the seminar to look at our Twitter for the live tweeting segment. We also direct them to the Privacy and Security page on our website.

If we hold a seminar multiple times, we tell them to watch our seminar page for registration to open for the next one. We also have a blog where members can find additional resources on seminar topics and information.

Is the fraud seminar the first time you used the Twitter channel in this way?

LL: We experimented with live tweeting a few seminars in 2014, but at the time it did not gain traction with our Twitter audience. On Feb. 11, 2016, we finally had success with our First-Time Home Buyers seminar. Ever since, we’ve been live tweeting seminars that are relevant to our Twitter demographic and have topics that translate well on social media.

Not every seminar we host is a good fit for live tweeting, so we determine this on a case-by-case basis.

Why did you decide to use Twitter for your fraud seminar?

LL: We thought this would be a great way to educate members and non-members not in attendance on information from our seminars and to increase our Twitter exposure. It also gives our seminar attendees a way to obtain notes for reference after the seminar and allows us to inform them of our social media presence and the useful information shared via these channels.

How did you market it?

LL: We marketed the seminar on our home page with a rotating tile ad and through the seminar page on our website. We also sent an email invitation to a targeted list of members and prospective members who have previously expressed an interest in fraud or security information.

What kind of activity did it generate from members during the session?

LL: Many attendees were happy to have Twitter available as reference notes, and some attendees began following our Twitter account and interacted with us through likes, retweets, and tweets. There was a lively question-and-answer session at the end of our seminar, and our fraud experts even stayed after the seminar ended to have more detailed discussions with members about their situations and questions.

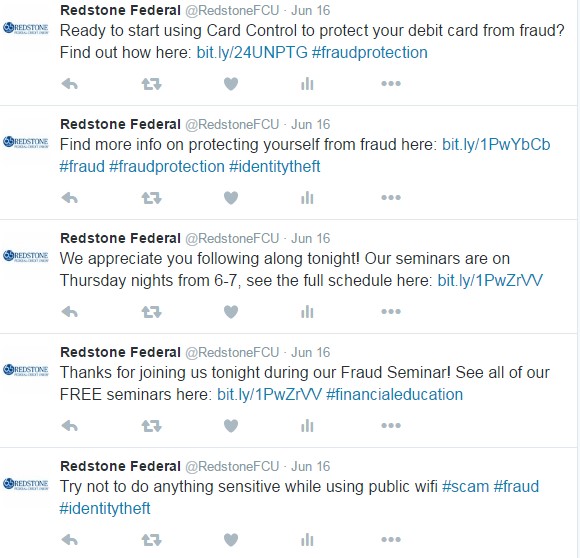

Redstone Federal Credit Union’s security experts created a series of 69 tweets for use in the credit union’s latest fraud webinar.

How did you measure that activity?

LL: We checked our Twitter notifications after the seminar had ended at about 7:30 that night and also the next day for any lingering activity.

What kind of feedback did you get? How did you solicit and receive that feedback?

LL: Seminar attendees were able to write down questions, concerns, feedback, and comments on their registration sheet for door prizes, leading to further conversations and lead capture from those attending. Our Security and Investigations department uses this information to continually improve their presentations.

Listen as Callahan senior vice president Chris Howard discusses how to deal with security breaches and learn best practices that can save a credit union’s reputation in the Callahan Leadership webinar Cybersecurity And Credit Unions.

How do non-members participate?

LL: We see most non-member participation occurring on Twitter in the form of likes, retweets, and tweets, which is one of the main motivations for live tweeting the seminars broadening Redstone’s exposure as a financial thought leader.

How does this fit into your overall social media marketing strategy?

LL: We have multiple goals for our social media marketing. One is to inform members and potential members with financial advice and help them navigate the different situations they experience throughout life.

We also strive to be a thought leader and impact members and non-members alike with helpful, useful, and interesting information regarding the financial aspects of their life events. We are always working toward expanding our exposure and social media presence. Live tweeting our seminars helps us reach this goal and expand our presence.

Redstone FCU live tweeted a seminar called Preparing for a Natural Disaster on Feb. 25, 2016.

4 Tips For Seminar-Tweeting Success

Redstone Federal Credit Union has been refining its techniques for live tweeting webinars for two years. Here, Betsy Pruitt, the credit union’s manager of online marketing, offers tips on how to make the most of tweets.

- Review seminar content beforehand to have a grasp on the content, keywords, and main points.

- Research trending topics on Twitter related to the seminar topic and choose five to seven hashtags to use throughout the seminar.

- Download five to seven photos before the seminar to use sporadically to help break up copy while live tweeting.

- Prepare a short introduction speech to give before the seminar starts to inform attendees about live tweeting, the credit union’s social media presence, and how they can get involved.

Editor’s Note: The original version of this article incorrectly cited online marketing manager Betsy Pruitt as the presenter of this Twitter seminar. This has been corrected to Lindsay Laderoute, the credit union’s digital content developer.

You Might Also Enjoy

- 4 Alternatives To Facebook And Twitter

- Lessons From A YouTube Series

- Looking For Mobile Coupons? There’s An App For That.

- 3 Social Media Tips To Attract Millennials