In 2014, Commonwealth Credit Union ($1.2B, Frankfort, KY) was looking for a way to differentiate itself as a financial institution and establish a closer bond with members. To that end, the credit union launched a new marketing campaign “Hey Karen” which ran from its inception in summer 2014 to the end of that year.

Two years later, the credit union converted to a community charter to cover 24 counties across Kentucky.

The credit union is headquartered in Frankfort, the state’s 13th-largest city, and the new charter allows Commonwealth to serve Kentucky’s two largest cities, Lexington and Louisville. Those cities are also home to the Bluegrass State’s two largest universities, which help make the large markets especially competitive.

“We knew it would be a challenge to differentiate ourselves and build name recognition in those markets” says Karen Harbin, the credit union’s president and CEO. “We knew we had to brand ourselves.”

To plan for this new future, the credit union turned to the past while adding a new wrinkle.

Answers From The Boss

For the credit union the “Hey Karen” campaign helps it enter its new markets with a personal look and feel for members. Additionally, it serves to make Harbin a relatable figure with financial authority, says the CEO (disclosure: Karen Harbin is the mother of Madison Harbin, Ambassador, CUBrand Monitor, at Callahan Associates).

How does it work? Using social media or a form on the HeyKaren page, members and non-members alike can ask their banking questions using the hashtag (#HeyKaren), and Harbin would personally respond.

The credit union promoted the campaign across television, billboards, social media, and email. Market response was immediate and significant.

Starting in the summer of 2014, Harbin says she received more than 100 questions per day; more than 10,000 overall through the end of that year.

“I saw and responded to every question” she says, “Although I did have experts in the credit union help me frame each answer.”

Inquiries ran the gamut from general questions about the credit union to operational queries such as how to open an account, take out a loan, or use online services. Many questions were also requests for more information. In those instances, a subject matter expert at the credit union contacted the individual to further the relationship.

The “Hey Karen” campaign made us more relatable and more of a household name, Harbin says.

Banking Best Friends

Post charter change, the credit union again saw the need to humanize banking for members, while also promoting a spirit of engagement and empowerment among both members and employees.

To that end, in summer 2017, the credit union launched “Meet Your BFF” a campaign that gives front-line staffers an authentic way to express their support of the credit union. For “Meet Your BFF” Commonwealth interviewed peer- and manager-nominated branch employees across its footprint to learn how they are bettering lives in their communities. Then, the credit union posted the recorded interviews on its website.

Today, the credit union has six banking BFF interviews, which add a personal touch to the sometimes-cold world of financial services. New team member interviews will be introduced across 2018, as well.

Employees share their personal contributions to their communities, including what they do to give back and their charitable activities, says Patty Smith, the credit union’s chief marketing officer. They also share personal information about themselves, so when people come into the branches they already feel like “Hey, I know you!”

It’s not often you see a CEO who says, Ask me anything you want to know about our organization.

A Personal Commitment To Service

At the end of the day “Hey Karen” which the credit union says is making a comeback later in 2018, with no end date and “Meet Your BFF” are both marketing campaigns, and Smith, as well as the whole credit union, wants to know whether they have moved the needle with members.

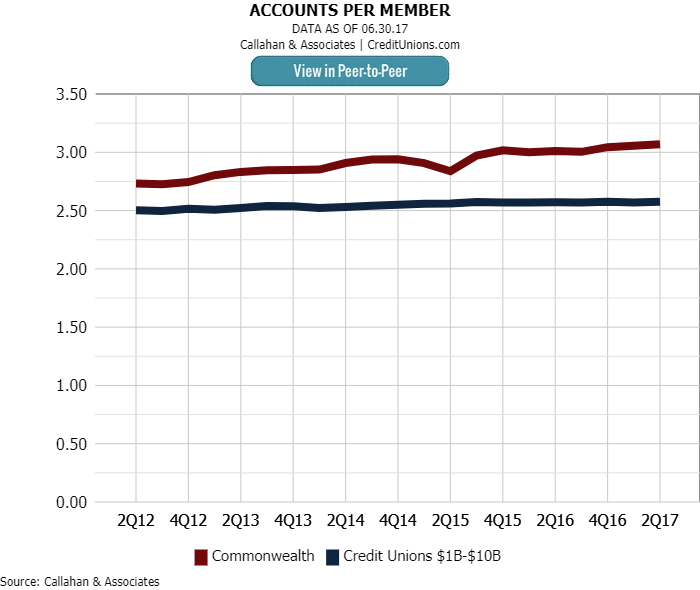

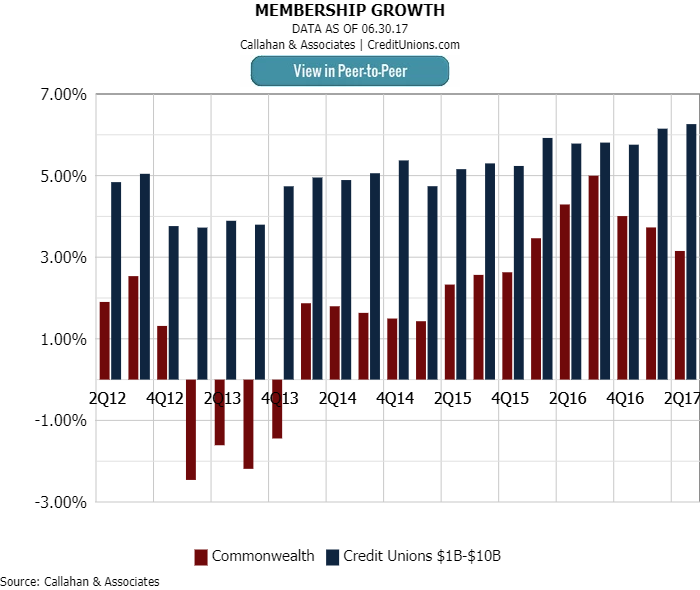

To identify a return on investment, the credit union looks to its membership growth rate as well as its products per member. Since 2014, membership growth has trended up, though it lags the rate of peers with assets $1 billion to $10 billion, according to data from Callahan Associates.

Yet, even as the credit union improves its in-person experience, Smith knows the member experience also requires greater investment in technology, meaning the introduction of ITMs and other new chat features.

Overall, the credit union wants to show members that its commitment to service is strong, and that banking with the credit union is a friendly, personable, relatable, and transparent experience.

“It’s not often you see a CEO who says ‘Ask me anything you want to know about our organization,'” Smith says. “You can tell that she is going to put her feet up on her desk, roll up her sleeves, and take the commitment to service personally.”