Total vehicle sales across the country slowed in March. According to FRED Economic Data from the Federal Reserve Bank of St. Louis, total auto sales decreased from 17.2 million in February to 11.7 million in March, the lowest monthly total since June 2010. The restrictive economic effects of the COVID-19 pandemic combined with the legal hurdles of franchised dealers selling directly to customers have caused shoppers nationwide to buy cars at a slower rate. Falling consumer sentiment, also, has slowed spending and borrowing for consumer products, despite the Federal Reserve’s attempt to combat this trend with decreased interest rates.

Key Points

- Auto loan balances expanded 2.1% as of the first quarter. This is the slowest first quarter rate reported since 2011. Used auto loan balances grew 3.9% annually, whereas new auto balances decreased 0.7%.

- Nearing $378.0 billion, total auto balances still reached record highs. As of the first quarter, these loans comprised 33.5% of the credit union loan portfolio, down 1.4 percentage points annually./li>

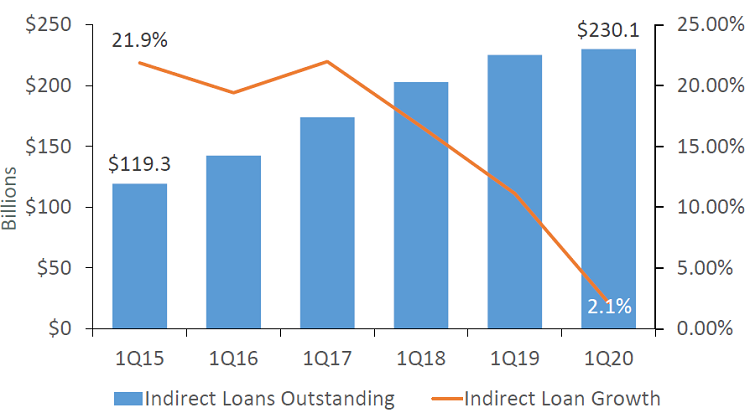

- Indirect loan balances grew 2.1% year-over-year, an annual deceleration of 9.0 percentage points.

- Average auto loan balances at credit unions nationwide were down $205 annually to $14,540 as members purchased used and off-lease vehicles in lieu of new.

- Auto loan penetration increased 3 basis points year-over-year to 21.2%. This is the highest penetration rate of any loan product on the credit union balance sheet.

INDIRECT LENDING

FOR U.S. CREDIT UNIONS | DATA AS OF 03.31.20

Callahan & Associates |CreditUnions.com

After six straight years of double-digit growth, growth in outstanding indirect loan balances was 2.7% as of Dec. 31, 2019. This is the lowest rate since year-end 2011.

NEW VS. USED AUTO BALANCES

FOR U.S. CREDIT UNIONS | DATA AS OF 03.31.20

Callahan & Associates | CreditUnions.com

New auto balances grew at a slower rate than used auto balances in 2019. The last time this occurred was in 2011.

AVERAGE AUTO LOAN BALANCE

FOR U.S. CREDIT UNIONS | DATA AS OF 03.31.20

© Callahan & Associates | CreditUnions.com

As consumer demand shifted toward used and off-lease vehicles, the average auto loan balance declined 1.4% in 2019. This is the first calendar year decline since 2010.

The Bottom Line

Decreased consumer spending and a pronounced pullback from indirect lending programs contributed to slower auto loan growth at credit unions. Through the first three months of the year, credit union auto market share was 18.3%, a 30-basis-point decline from the first quarter of 2019. Still, more than 21% of credit union members hold an auto loan with their institution.

Without official data from the NCUA, Callahan is reporting first quarter data trends from institutions that represent 99.7% of the industry’s assets.

This article appeared originally in Credit Union Strategy & Performance. Read More Today.