The Federal Reserve kept interest rates at record lows throughout the second quarter, and the economic uncertainty wrought by COVID-19 supported record inflows at financial institutions as stimulus checks flooded the market and consumers sought the safetyof deposit accounts. Consequently, credit union investment portfolios reported strong growth in shorter maturity and cash allocations, with many opting to keep these excess funds in overnight accounts. Notably, total assets at the Federal Reserveincreased 85.7% year-over-year to $7.1 trillion as of June 30, 2020.

Key Points

- Total Investments (including cash balances) at U.S. credit unions increased 38.2% year-over-year to $533.8 billion as of June 30. This was a direct result of surging deposit inflows and relatively slower loan growth.

- Cash and cash equivalents increased 78.4% year-over-year to $216.8 billion. Cash at the Federal Reserve increased at the fastest rate of any cash product, up 90.4% annually to $134.4 billion as of the second quarter 2020.

- With the Federal Reserve leaving rates low and credit unions keeping much of their investments in cash, average investment yields fell 89 basis points annually to 1.53%. Correspondingly, investment income for the industry fell 21.0% from June 30,2019.

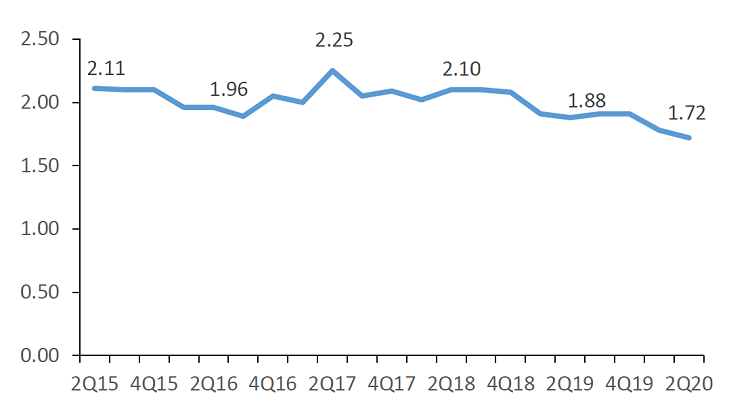

- The weighted average life of the credit union investment portfolio shortened to 1.72 years as of the second quarter of 2020, down from 1.88 years on year ago.

TREASURY YIELD CURVE RATES

FOR U.S. CREDIT UNIONS | DATA AS OF 06.30.20

Callahan & Associates | CreditUnions.com

Fed policy is contributing to the normalization of the slope of the yield curve in 2020.

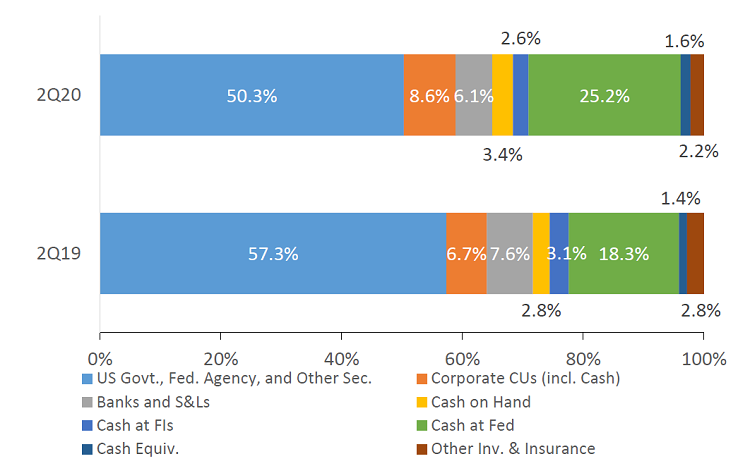

INVESTMENT COMPOSITION

FOR U.S. CREDIT UNIONS | DATA AS OF 06.30.20

Callahan & Associates | CreditUnions.com

Cash and cash equivalents increased 78.4% over the past year as credit unions prioritized liquidity.

WEIGHTED AVERAGE LIFE OF INVESTMENT PORTFOLIO

FOR U.S. CREDIT UNIONS | DATA AS OF 06.30.20

Callahan & Associates | CreditUnions.com

The average life of credit union investments shortened 0.16 years as credit unions kept a larger proportion of cash in their investment portfolio.

The Bottom Line

In the fallout from COVID-19, consumer spending slowed and the federal government offered relief programs. Such actions have led to credit unions reporting the largest increase in share inflows on record. The majority of this liquidity was allocated toovernight cash accounts, which are paying a fraction of what they returned just one year ago and are forcing credit unions across the country to navigate pressures to margins and earnings models. Looking ahead, institutions will need to focus on deployingexcess balances into investment options aligned with their risk tolerances and deposit decay assumptions to help offset some of this lost revenue.

This article appeared originally in Credit Union Strategy & Performance.