The mortgage origination market has never had a more successful quarter. According to data from the Mortgage Bankers Association, lenders granted $928.0 billion in new mortgages nationwide between April and June, almost $200 billion more than the previousquarterly record set in the second quarter of 2006. Federal Reserve rate cuts were instrumental to this boom, as Americans rushed to take advantage of record-low interest rates. Of note, refinances accounted for an estimated 62.5% of second quartermortgages, and credit unions historically have thrived in refi-heavy environments.

Key Points

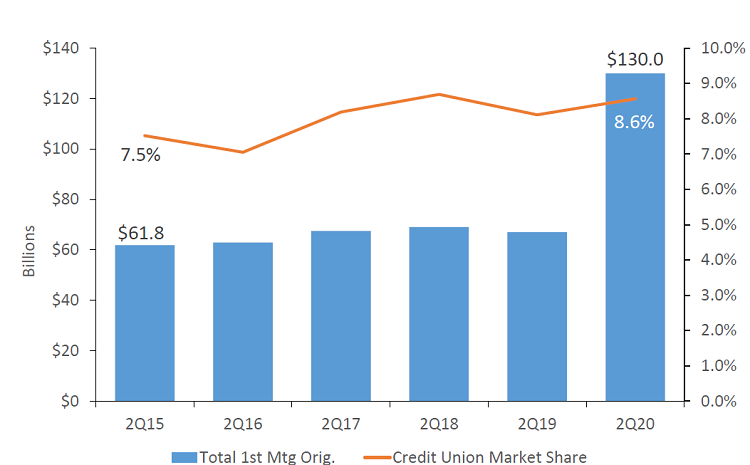

- Credit unions originated $130.0 billion in first mortgages year-to-date, the most in any six-month period on record.

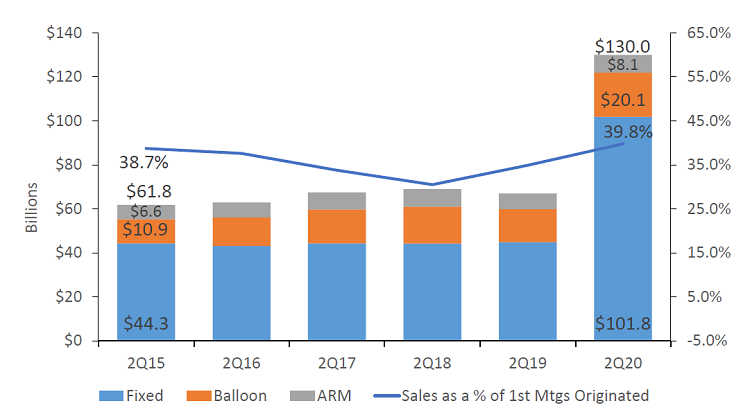

- Fixed-rate mortgages comprised 78.4% of total mortgages originated this year, up 11.4 percentage points from 2019. Balloon/hybrid loans made up 15.5%, and adjustable-rate mortgages accountedfor the remaining 6.2%.

- On the balance sheet, first mortgages outstanding increased 12.8% annually and surpassed $500 billion. Mortgages represented 43.6% of the loan portfolio for credit unions nationwide, the highest on record.

- Total mortgage sales to secondary markets increased 121.1% annually to $51.7 billion. This total makes up 39.8% of mortgages originated year-to-date.

1ST MORTGAGE ORIGINATIONS & MARKET SHARE

FOR U.S. CREDIT UNIONS | DATA AS OF 06.30.20

Callahan & Associates | CreditUnions.com

A refinance-heavy market pushed credit union first mortgage market share to a near all-time high of 8.6%.

MORTGAGE ORIGINATIONS BY TYPE AND SALES TO SECONDARY MARKETS

FOR U.S. CREDIT UNIONS | DATA AS OF 06.30.20

Callahan & Associates | CreditUnions.com

Year-to-date mortgage originations almost doubled from the first six months of 2019. The percent of originations sold to Fannie Mae and Freddie Mac also increased as credit union displayed less interest in holding these lower-yieldingloans.

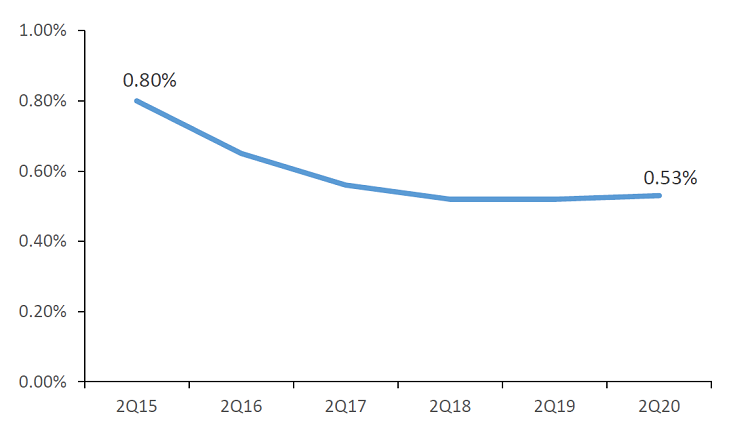

1ST MORTGAGE DELINQUENCY

FOR U.S. CREDIT UNIONS | DATA AS OF 06.30.20

Callahan & Associates | CreditUnions.com

First mortgage delinquency increased 1 basis point from last year.

The Bottom Line

Near-zero interest rates and federal aid together created a surge in demand for home financing, pushing mortgage growth to surpass all expectations in the second quarter. Purchases performed well, but refinances were the driving force as many people lookedto save money on their existing homes. Naturally, refinances have helped keep delinquency rates low, but credit unions should still closely monitor repayment rates if unemployment remains high.

Request A Mortgage Market Intelligence Scorecard

Request a custom Mortgage Lending Intelligence Scorecard, made just for your credit union. Using Home Mortgage Disclosure (HMDA) data we’ll include the peer group (of your choice) and show key local and industry metrics such as funding

This article appeared originally in Credit Union Strategy & Performance.