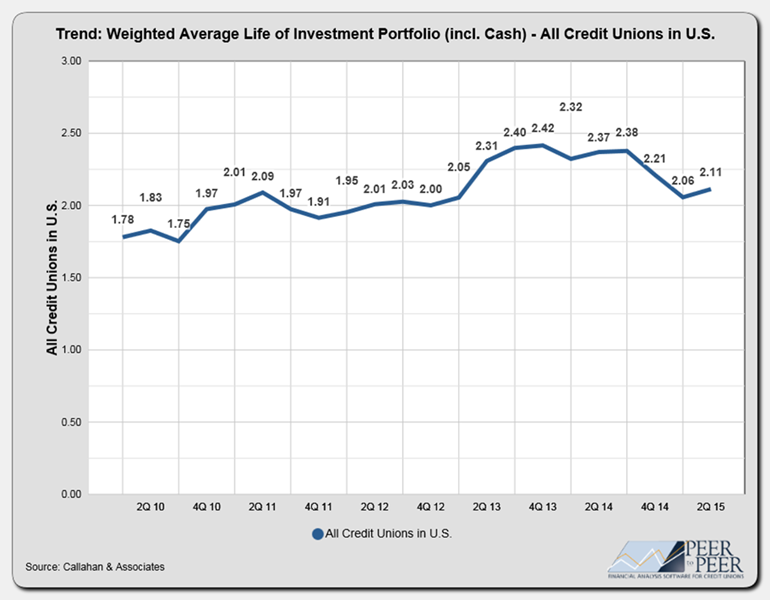

According to the latest Investment Trends Review published by TRUST for Credit Unions, the average life of all credit union investments rose from 2.06 years in the 1st quarter to 2.11 years in the 2nd quarter of 2015. With interest rates unchanged during the period, the slight extension is attributable to lower cash balances.

NOTE: The Average Life Profile is part of a new packet available within Callahan’s Peer-to-Peer Analytics solution. It can be found under the Hot Topics section within the ALM-Interest Rate Risk Packet. This graph and other metrics contained in the packet can provide additional historical information when managing your ALM and IRR.

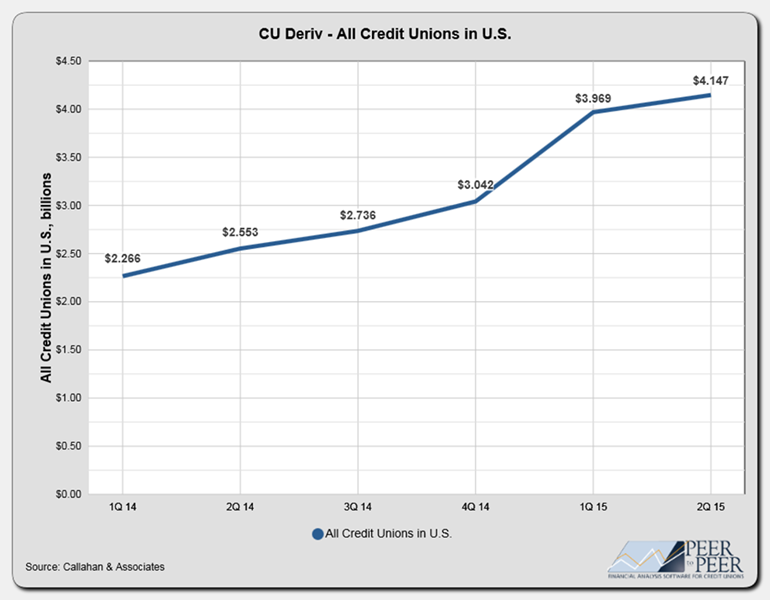

Slow, Steady Growth In Derivatives Usage

We can now also track derivatives usage in Peer-to-Peer. Notional amounts have grown from $2.2 billion to more than $4 billion. Three new credit unions implemented programs in the 2nd quarter, bringing the total to 33 credit unions with derivatives on their books. The derivatives that have been utilized are primarily fixed-to-floating rate swaps to hedge against higher interest rates and swaps used to hedge mortgage exposure on the credit union balance sheet.

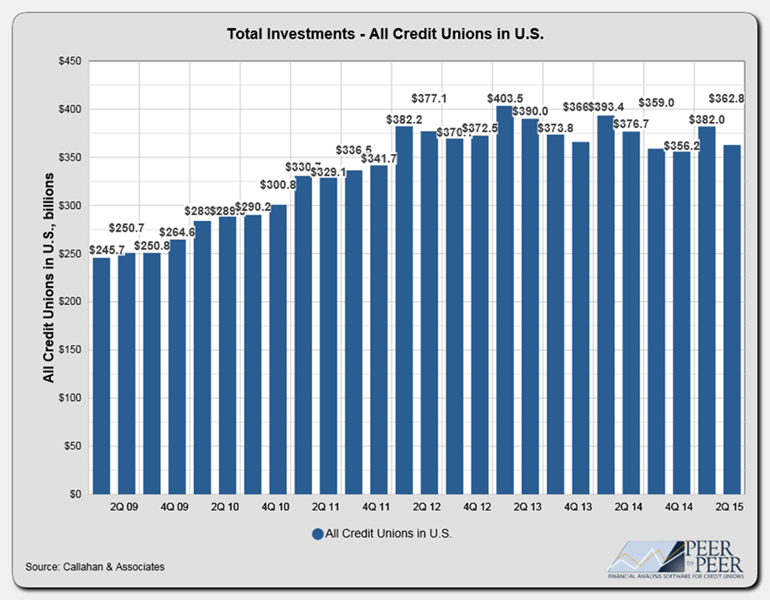

Total Credit Union Investments

Balances decrease as credit unions continue to fund loan growth.

As of June 30, 2015, credit unions held more than $370 billion in investments. As the chart below shows, total investments decreased $19 billion from the previous quarter’s total of $382 billion. Meanwhile, total assets of credit unions remain at an all-time high of $1.17 trillion. The industry’s loan-to-share ratio increased, rising from 73% in the 1Q2015 to 75% in 2Q2015, accounting for the decline in investments.

More Investment Trends Customized Investment Reviews

Interested in more information about the overall industry’s average yield on investments, portfolio composition, and investment maturity? Download your complimentary copyof the full Q2 2015 Investment Trends Reviewfrom www.trustcu.comtoday or contact us at TCUGroup@callahan.comto learn more about the customized investment reviews we can provide for your credit union.

About TRUST

TRUST helps credit unions succeed in serving their members by providing a professionally managed family of mutual funds exclusive to credit unions as well as the information and analysis they need to support investment decisions. Created by some of the leading credit unions with oversight by a board of trustees, TRUST’s mutual fund options allow credit unions to meet their short duration needs, are professionally managed, and are based on the cooperative values of credit unions.

Visit www.trustcu.comor call us at 800-237-5678 to learn more.

The Trust for Credit Unions (TCU) is a family of institutional mutual funds offered exclusively to credit unions. Callahan Financial Services is a wholly-owned subsidiary of Callahan Associate and is the distributor of the TCU mutual funds. Goldman Sachs Asset Management is the advisor of the TCU mutual funds. To obtain a prospectus which contains detailed fund information including investment policies, risk considerations, charges and expenses, call Callahan Financial Services, Inc. at 800-CFS-5678. Please read the prospectus carefully before investing or sending money. Units of the Trust portfolios are not endorsed by, insured by, obligations of, or otherwise supported by the U.S. Government, the NCUSIF, the NCUA or any other governmental agency. An investment in the portfolios involves risk including possible loss of principal.