Top-Level Takeaways

- Credit unions experienced increased share growth in early 2024, particularly through higher-rate CDs, which helped them reduce borrowing despite rising deposit costs.

- Langley FCU shifted its focus from overall deposit growth to helping more members achieve modest savings.

- It introduced a high-yield savings account and is using behavioral economics and digital nudges to encourage systematic saving among members.

In an era where financial stability often feels as fleeting as a trending hashtag, Americans are finding refuge in an increasingly popular place: credit unions. But while many financial cooperatives are focused on attracting deposits with high-rate certificates, Langley Federal Credit Union ($5.4B, Newport News, VA) is taking a different tack.

Share growth at credit unions nationwide picked up slightly in the beginning of 2024 as members flocked to higher-rate CDs. Although growth in certificates far outpaced the rest of the share portfolio — 43.0% year-over-year versus -9.8% for money market accounts and -9.4% for regular shares and deposits — balances in all share categories increased in the first quarter.

That growth gave credit unions enough wiggle room to reduce borrowing, which is traditionally a more expensive way to raise liquidity. However, after several years of relatively stable deposit costs, these, too, are on the rise.

“Much of our deposit growth — as is the case across the industry — has been through CDs,” says Curtis Baker, senior vice president and chief lending officer at Langley FCU. “You’re really just buying the money. You throw out good CD rates, and you try to win the market. It’s very expensive.”

But that’s not the only problem. Buying money also presents a philosophical quandary for institutions whose mission is to serve members of modest means. That’s because those high CD rates tend to attract more affluent depositors putting larger balances onto the books.

That didn’t sit right with Langley. So, at the end of 2023, the Virginia cooperative challenged itself to think more broadly about its deposit strategy.

“We made significant changes to our strategic goals for 2024,” Baker says. “The first was to focus less on overall deposit growth and more on helping many more members achieve a modest amount of savings.”

New Challenges Require New Ways Of Thinking. After a mid-decade push to rightsize its balance sheet, a Virginia cooperative understands how to pivot when times get tough. Read more in “In An Uncertain Economy, Langley FCU Rewrites Its Playbook Again,” available today on the Callhan client portal.

A High Yield For Low Savers

A look at its membership revealed roughly 100,000 members — or slightly more than one-quarter — held more than $400 in savings. Put another way, nearly 75% of its membership would have trouble covering an emergency expense of a few hundred dollars.

CU QUICK FACTS

LANGLEY FCU

HQ: Newport News, VA

ASSETS: $5.4B

MEMBERS: 377,175

BRANCHES: 22

EMPLOYEES: 696

NET WORTH RATIO: 8.74%

ROA: 0.50%

The credit union knew it could do a better job helping the average member build a safety net.

In late 2023, Langley FCU introduced a high-yield savings account with a 5% APY that maxes out at $10,000.

“It’s the best yielding product we have,” Baker says. “Our goal is to get as many people as we can to that product, but it’s not for those who are going to put in $100,000, $200,00, or $1 million. We’re extending our best rate to a more modest amount of savings.”

That 5% rate is on par with CD offers from other financial institutions that require an initial deposit of $500 or more. At Langley FCU, high-yield savings requires no minimum balance; it does, however, require enrollment in e-statements.

As it’s a reverse-tier product, balances higher than $10,000 receive 0.05% APY. The same rate applies if withdrawals exceed one per month. Notably, savers can only open the account digitally — no branch visits or phone calls — and accounts are capped at one per member.

Penny By Penny, Dollar By Dollar

Langley’s high-rate savings account encourages members to systematically save a little scratch every month. That’s an essential component of this product because these account holders haven’t built a savings habit and might not have much to set aside at the end of the day.

“It’s going to take some time to get to $400 or more because we serve a working poor demographic,” Baker says.

To that end, the credit union is looking to behavioral economics for strategies to nudge members to save through digital banking and other means. It is testing such strategies via a monthly email to members that includes multiple “nudging insights” to open a high-yield savings account, set up a recurring/automated savings plan in digital banking, set corresponding savings goals, join the credit’s savings challenge, or take advantage of Langley FCU’s step-up savings plan.

Savvy Spending

Langley FCU’s cashback club allows members to purchase digital gift cards to brands they already use as well as exclusive brands available only through the rewards program.

The credit union also provides members with their credit score every month and alerts them via email when there’s a change. This reminds them to keep logging in to check their score and keep track of their products and transactions.

“We want to encourage our members to use our digital channels, especially for transactions,” Baker says. “Members should be engaged with their balances and their products and services.”

Of course, sometimes, a gentle nudge just isn’t enough. That’s why the current product encourages setting up a systematic savings effort through automated transfer in digital banking.

“We’re thinking about how we might get more aggressive in forcing our members to confront this issue, which is lack of savings,” Baker says.

Performance And Results

To date, total balances for the 9,500 members who have opened a high-yield savings account exceed $57 million.

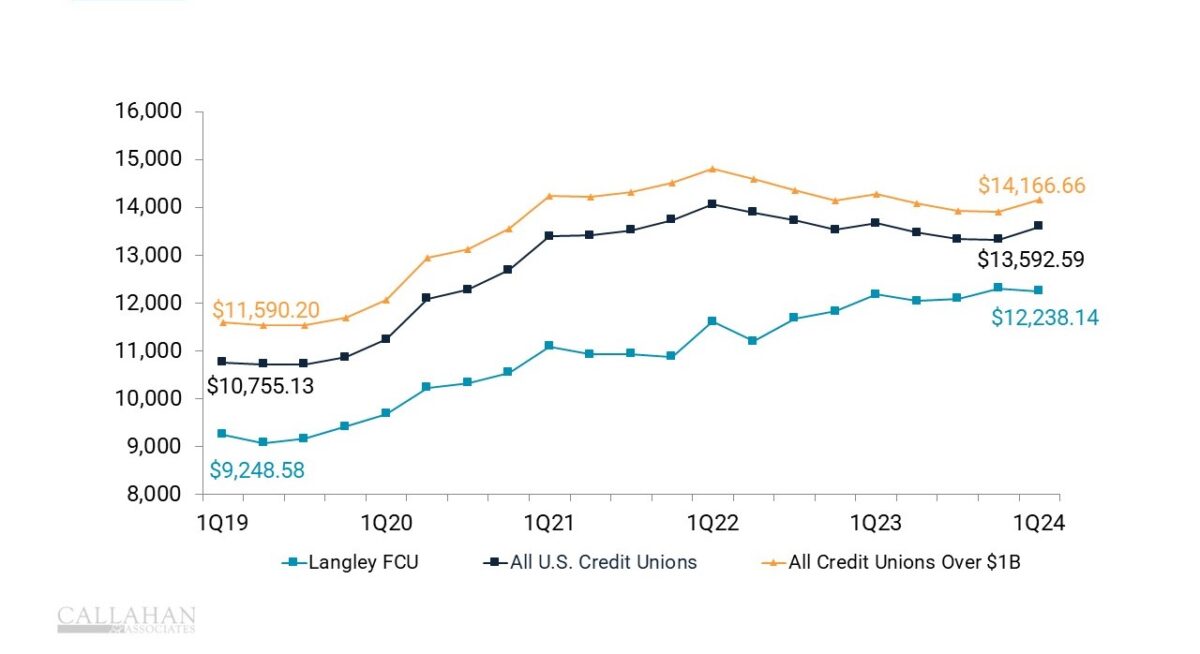

At $12,238, Langley FCU’s average share balance per member as of March 31, 2024, was lower than its peer group of credit unions over $1 billion in assets, according to data from Callahan & Associates. That’s to be expected of a credit union that serves a “working poor” demographic and is why Langley introduced high-yield savings to begin with.

AVERAGE DEPOSIT BALANCE

FOR U.S. CREDIT UNIONS

© Callahan & Associates | CreditUnions.com

“More people can enjoy [high-yield savings],” Baker says. “It democratizes our impact instead of focusing efforts on growing CDs.”

Langley FCU’s high-yield savings account is still in its early stages; however, quarterly performance data suggests the credit union is helping members save more. In the first quarter of 2024, Langley’s 6.3% share growth was much higher than the nationwide average of 2.4%.

SHARE GROWTH

FOR U.S. CREDIT UNIONS

© Callahan & Associates | CreditUnions.com

The credit union is posting this growth while falling slightly below peers on earnings, with just 0.50% in assets. That drop in ROA comes from socking away more in provision expenses; again, not surprising for a credit union that serves a poorer membership. Still, with an efficiency ratio of 74.2%, Langley FCU is bringing in revenue with limited overhead.

Ultimately, the credit union is performing well and Baker is confident Langley FCU’s pivot from total deposit balances to members with more than $400 is going to pay off for both the credit union and its members.

“I wish we did this going into 2020 versus 2024, but I’m glad we did it,” Baker says. “We said we’re going to be faced with buying money in the form of CDs. Let’s not do that. Let’s take this opportunity to make a major change in the way we do business and deliver on our vision more directly.”