Macro Economic Trends

GDP Growth Slows; Rate Cuts Possible

Top-Level Takeaways

-

Annual growth in real GDP slowed to 2.0%; down 1.0% from the first quarter.

-

The Federal Reserve increased interest rates four times in 2018 but held rates steady in the first two quarters of 2019 and issued a 25-basis point reduction at the end of July.

-

At 1.6%, inflation in the second quarter fell short of the long-term target of 2.0%.

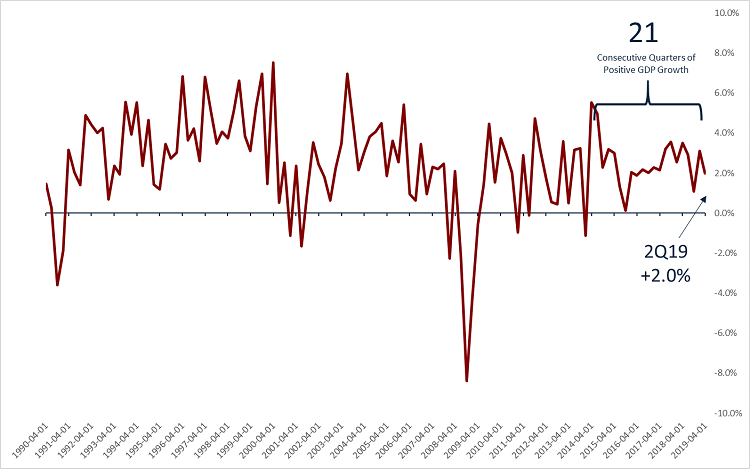

The second quarter of 2019 marked the 21st consecutive quarter the U.S. economy has expanded continuing the county’s longest period of economic expansion on record.

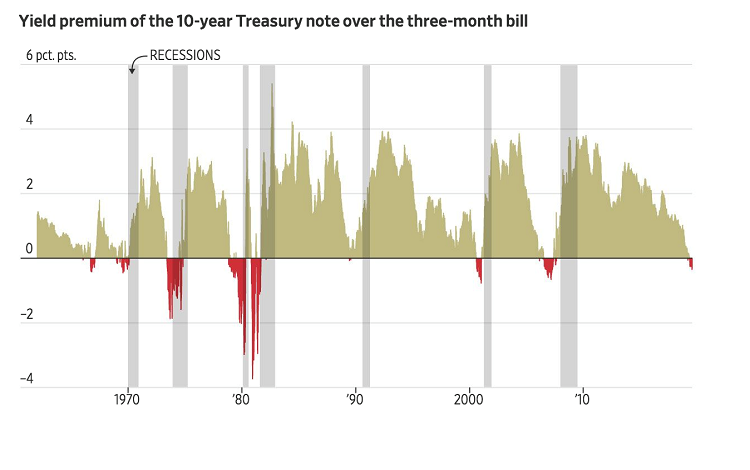

GDP, which grew at a strong clip of 3.1% in the first quarter of 2019, expanded at a more modest rate of 2.0% in the second quarter. However, this was still slightly higher than the 1.9% economists projected. U.S.-China trade talks, the Federal Reserve, and the global economy all contributed to the slowdown between the first and second quarters. Collectively, they sent the bond market soaring as bond yields declined and the yield curve inverted between the 10-year Treasury and the 3-month Treasury, making long-term debt significantly cheaper than short-term debt.

The Fed’s monetary policy in the first half of 2019 looked vastly different from that of 2018, when the Fed issued four rate hikes. It held rates steady through the first two quarters of 2019, leaving many to anticipate rate cuts for the remainder of the year. This shift in market sentiment came as talk of a trade war between the United States and China intensified and the stock market slumped. On July 31, the Fed issued what chairman Jerome Powell referred to as a mid-cycle adjustment and reduced the central bank’s benchmark interest rate by 25 basis points to a target range of 2.0% to 2.25%. This was the first rate cut in 11 years, which occurred during the financial crisis of 2007-2008.

GDP

Government and consumer underpinned the second quarter’s 2.0% increase in real GDP, whereas business fixed investment declined and inventory growth slowed. Personal consumption expenditures, which accounted for 68.0% of total GDP, increased $138 billion from the first quarter to the second and reached $13.2 trillion as of June 30, 2019.

Durable goods expenditures, which is a component of personal consumption, increased $52.0 billion from the first quarter to the second. By comparison, it increased $1.0 billion from the fourth quarter of 2018 to the first quarter of 2019. The second quarter jump was driven primarily by food for off-premise purchases which increased $12 billion and clothing and footwear which increased $13 billion.

U.S. GDP GROWTH RATE

DATA AS OF 06.30.19

Callahan & Associates | CreditUnions.com

Source: Federal Reserve Bank of St. Louis

Inflation

The Federal Reserve’s preferred measure of inflation core personal consumption expenditures, or Core PCE excludes the more volatile sectors of food and energy to more accurately express the value of the dollar and measure price changes for household goods and services. Quarter-over-quarter, the annual change in core PCE increased from 1.5% annual growth in the first quarter of 2019 to 1.6% annual growth in the second quarter. That’s lower than the target inflation rate of 2.0%.

One way to gauge the health of the U.S. economy is to compare the difference between shorter and longer-term interest rates on the yield curve.

Employment

The U.S. economy added 224,000 jobs in June, the largest gain since January. And at 3.7%, the unemployment rate at midyear was only slightly lower than the 50-year-low mark of 3.5%.

There are three ways to look at employment: The labor force participation rate, the employment rate, and the traditional unemployment rate. The labor force participation rate measures the ratio of Americans available for work as a percentage of the total population. The unemployment rate is the ratio of Americans without a job who are counted in the labor force as a percentage of the total labor force, while the employment rate is the percentage of the labor force that is employed.

UNEMPLOYMENT VS. EMPLOYMENT VS. LABOR FORCE PARTICIPATION RATES

DATA AS OF 06.01.19

Callahan & Associates | CreditUnions.com

Source: Federal Reserve Bank of St. Louis

Record low unemployment doesn’t necessarily correlate to record employment, however. In fact, record low unemployment can tell a misleading story.

The employment rate for the U.S. population ages 15 to 64 was 71.2% as of June 30 3.4 percentage points above the 67.8% reported in June 2009 but still below the highs reported in 1999 and 2006. The United States is near historical lows in terms of the number of civilians searching for jobs, but at 62.8%, the labor force participation rate in June 2019, which reflects economic engagement, was 4.5 percentage points lower than the 67.3% reported in May 2000. When discouraged workers stop looking for work, the participation rate drops. As a result, the unemployment rate also decreases because it doesn’t include workers who have given up.

June wage growth outpaced inflation 3.1% versus 1.6%, respectively meaning the average employed American is enjoying more purchasing power. The employment-cost index, a measure of wages and benefits, increased 2.7% annually as compensation growth outpaced inflation. Total compensation for private industry workers increased 3.7% from the year prior. Amid rising wages, personal income increased $244.2 billion in the second quarter of 2019.

Interest Rates

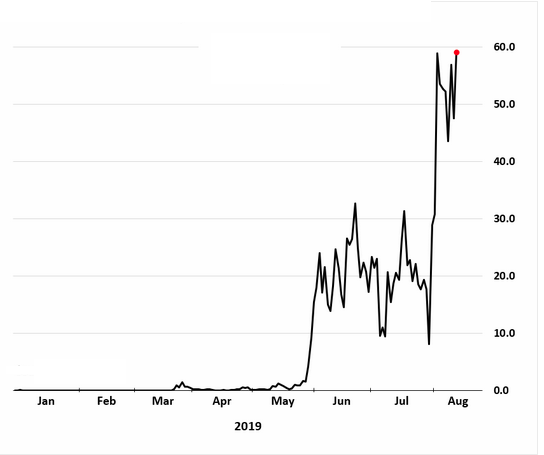

Adjusting the federal funds rate is a key monetary policy tool for the Federal Reserve. After four increases to the benchmark interest rate in 2018, the Fed maintained its target range of 2.25%-2.50% through the second quarter of 2019. Shortly after the close of the quarter, the Fed announced at its July meeting that it was cutting the target range by 25 basis points to 2.00%-2.25%.

In addition to changing the benchmark rate, the Fed announced a change to another form of monetary policy, quantitative easing (QE). Following the 2007-2008 recession, the Fed conducted three rounds of treasury and mortgage-backed securities purchases, which increased its balance sheet to more than $4.5 trillion. Satisfied with the health of the economy, the Fed began to wind down QE and reduce its balance sheet in 2017, with a reduction end goal of September 2019. At the July FOMC meeting, committee members voted to suspend the reduction as of Aug. 1 instead of at the end of September. Labelling it a mid-cycle adjustment, chairman Jerome Powell said this is not the beginning of a rate-cutting cycle; however, despite these reassurances, the market is pricing in a 60% probability of three or more additional rate cuts throughout the remainder of 2019.

MARKET PROBABILITY OF FUTURE RATE CUTS

DATA AS OF 08.14.19

Callahan & Associates | CreditUnions.com

Source: Bloomberg

Tempered global growth, low inflation, and ongoing U.S.- China trade negotiations contributed to a decline in bond yields over the second quarter. As investors anticipated a more dovish Fed, the slope of the Treasury yield curve or, the difference between interest rates on long-term and short-term debt inverted.

One way to gauge the health of the U.S. economy is to compare the difference between shorter and longer-term interest rates on the yield curve, says Sam Taft, associate vice president of analytics and business development at Callahan & Associates. There are a couple of insightful measures of the yield curve. The first is the difference between the yield on the 3-month Treasury bill and the yield on the 10-year Treasury note, which has been inverted for most of the quarter. The second is the gap between the 10-year and 2-year notes. Some economists prefer to use the gap between the 10-year and 2-year, as the 2-year yield reflects expectations for Fed policy for a period beyond the next meeting or two.

The 2-year Treasury yield remained below that of the 10-year throughout the second quarter of 2019. However, the gap inverted for the first time since 2007 shortly after the end of the quarter. This inversion has preceded every recession for the past 50 years and is widely considered an indicator of a potential recession in the next 12 to 18 months.

A HISTORY OF YIELD CURVE INVERSIONS

DATA AS OF 08.11.19

Callahan & Associates | CreditUnions.com

Source: The Wall Street Journal

Mortgage Market

According to the National Association of Realtors (NAR), existing home sales in the United States fell 2.2% year-over-year to 5.27 million as of June 30, 2019. Market headwinds, specifically supply constraints related to affordable housing, were further compounded in the first half of the year by uncertainty and fluctuations in mortgage rates.

The median existing home price increased for the 88th straight month. It was up 4.3% in June to an all-time high of $285,700. According to Lawrence Yun, NAR chief economist, the imbalance persists for mid-to-lower priced homes with solid demand and insufficient supply, which is consequently pushing up home prices.

At the October 2018 FOMC meeting, Powell stated that rates were a long way from neutral. The Fed chair kicked off 2019 with a statement that low inflation would allow the Fed to be patient in its decision to continue raising rates.

The tone at the June 2019 meeting was even more dovish. Meeting minutes revealed uncertainties around the economic outlook had increased. As the Fed signaled it would cut rates to sustain the expansion, mortgage rates for a 30-year fixed, 15-year fixed, and 5-year adjustable fell in the second quarter of 2019 from the year prior. The average rate for fixed-rate products recorded the largest decline it was down 77 basis points to 3.80%. The average rate for the 15-year fixed dropped 80 basis points to 3.24%. The average rate for the 5-year adjustable-rate mortgage dropped 34 basis points to 3.48%.

It will be imperative to monitor how the Fed conducts monetary policy through the remainder of 2019.

NATIONAL MORTGAGE RATES

DATA AS OF 06.30.19

Callahan & Associates | CreditUnions.com

Source: Freddie Mac

Read the full analysis or skip to the section you want to read by clicking on the links below.

INDUSTRY AT-A-GLANCE BALANCE SHEET: ASSETS LOAN BALANCES ASSET QUALITY INVESTMENTS BALANCE SHEET: LIABILITIES INCOME STATEMENT

Nationally, mortgage balances represent the largest component of household debt. Mortgage balances increased $162 billion to $9.4 trillion in the second quarter of 2019, surpassing the high of $9.3 trillion recorded in September 2008. According to the Federal Reserve Bank of New York, total household debt rose for the 20th consecutive quarter. It increased $192 billion to reach $13.9 trillion. This is $1.2 trillion higher, in nominal terms, than the prior peak of $12.7 trillion in the third quarter of 2008.

Although household debt is at a record high, household indebtedness remains far below 2008 levels. A primary measure of household indebtedness is the ratio of household debt service payments as a percentage of disposable personal income. Data for total household debt service payments is yet to be released for the second quarter; however, the ratio was 9.91% as of March 31, 2019. That’s 3.13 percentage points lower than the 13.04% recorded at the same time in 2008.

The second quarter of 2019 officially marked the longest expansionary period in U.S. history. Despite volatility in both market prices and the political landscape, the United States economy picked up momentum with rising wages, low unemployment, and strong consumer spending.

Although the economy is growing, the inverted yield curve and low inflation point to a more cautious economic outlook, says Jay Johnson, chief collaboration officer at Callahan & Associates. It will be imperative to monitor how the Fed conducts monetary policy through the remainder of 2019.

Credit Union Trends

Industry-At-A-Glance

Top-Level Takeaways

-

Membership increased 3.7% year-over-year to 119.7 million as of June 30.

-

Assets increased 6.4% annually to top $1.5 trillion.

-

Earnings pushed up ROA 6 basis points year-over-year to 0.96%.

The credit union business model which is purpose-driven and focused on the financial well-being of members is not like that of other financial institutions. That’s readily apparent during strategic planning season, when cooperatives discuss new methods to differentiate their products and services and enhance the member experience.

For example, this year, many credit unions are discussing how a deliberate, calculated expansion of credit risk could better serve members. They’re also considering how their local roots and member interactions can help them recognize product and service needs of members, thereby positioning the credit union for long-term success.

These are important considerations to keep in mind while analyzing the industry’s midyear financials.

Industry Performance

The number of credit unions in the country dropped from 5,596 in the second quarter of 2018 to 5,425 in the second quarter of 2019. There were 3,335 federally chartered credit unions and 2,090 state-chartered credit unions at midyear.

It is important to note, however, that credit union consolidation is slowing. The year-over-year difference in the number of institutions averaged 259 in the first half of the decade and 236 in the second half. Additionally, the percentage of the industry lost to a merger or liquidation has been less than 4.0% for the past three years.

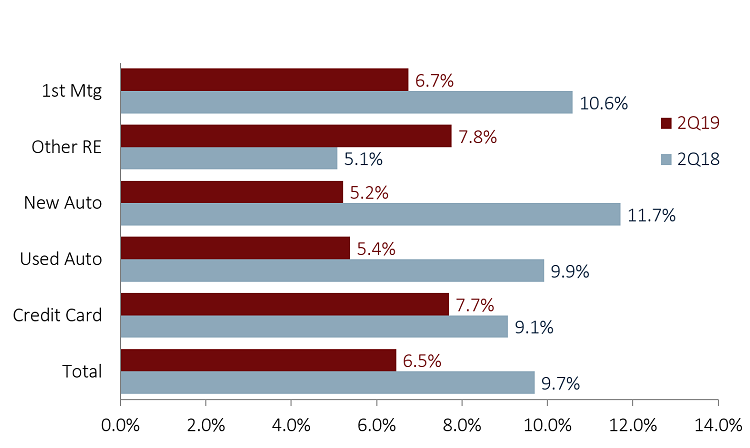

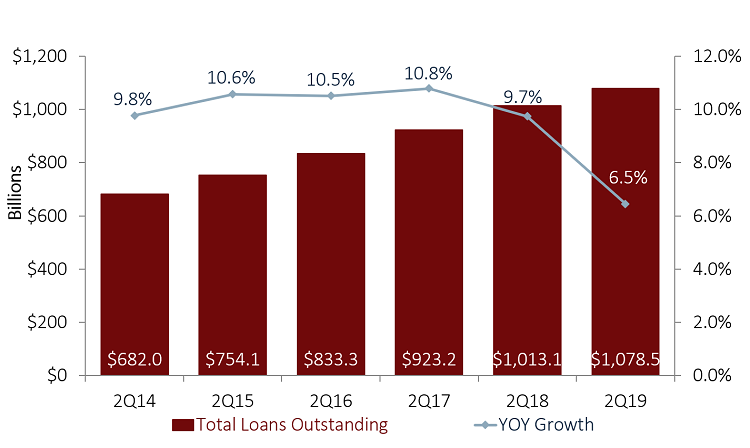

Despite the drop in the number of credit unions, the industry’s assets at midyear topped $1.5 trillion. That’s an increase of 6.4% from the previous June. Loan growth slowed 3.2 percentage points year-over-year, from 9.7% as of June 30, 2018, to 6.5% at midyear 2019. Deposits, on the other hand, increased $73.0 billion, or 6.0%, year-over-year. That’s an acceleration of 57 basis points.

Credit unions also reported impressive gains in investment growth, which rose 4.5% year-over-year. In June 2018 investments had fallen 4.0% from the year prior as credit unions had been allowing investments to run off to fund loan demand; as such, this portion of the balance sheet had been contracting.

Elsewhere, capital growth surpassed double-digits it nearly doubled from 6.4% in 2018 to 11.3% in 2019 while membership growth held steady at 3.7%. The movement served more than 119.7 million members as of June 30, 2019.

INDUSTRY GROWTH OVERVIEW

FOR U.S. CREDIT UNIONS | DATA AS OF 06.30.19

Callahan & Associates | CreditUnions.com

Strong earnings over the past year fueled double-digit capital growth in the second quarter.

Midyear results show that members continue to respond to credit union value, says Jay Johnson, chief collaboration officer at Callahan & Associates. Lending activity increased, and credit unions rewarded savers with higher rates. These results, combined with recent interest rate movements, indicate the industry is well-positioned to help members even more in the second half of 2019.

Members

Credit union membership has grown 20.7% or, 20.5 million members since the second quarter of 2014. In the past year alone, 4.3 million members opened a new account. That’s an increase of 3.7% from June 30, 2018.

Whereas the U.S. population has grown less than 1.0% for the past five years, membership growth at credit unions has stayed above 3.5% since the fourth quarter of 2015. As of June 30, 2019, total credit union membership surpassed 119.7 million.

MEMBERSHIP AND ANNUAL GROWTH

FOR U.S. CREDIT UNIONS | DATA AS OF 06.30.19

a href=”https://www.callahan.com/” target=”_blank”>Callahan & Associates | CreditUnions.com

Annual credit union membership growth fell to 3.7% by midyear 2019. The movement added 4.3 million new members in the past year.

Market Share And Member Impact

Credit unions aren’t just adding members; they’re engaging members, too.

The percentage of members that hold a credit union credit card 17.6% as June 30, 2019 has increased 1.4 percentage points in the past five years. Real estate penetration, which includes an estimated number of loans sold but servicedby credit unions, has increased 10 basis points in the past five years. It was 5.7% at midyear. Share draft penetration, an indicator that a credit union is a member’s primary financial institution, has increased 5.0 percentage points inthe past five years. It was 58.4% at midyear. Finally, auto loans, too, have gained in popularity. In 2014, 17.0% of members held a credit union auto loan. That number was 21.3% as of June 30, 2019.

PENETRATION RATES

FOR U.S. CREDIT UNIONS | DATA AS OF 06.30.19

Callahan & Associates | CreditUnions.com

Credit unions are working to engage, not just add, members. Their efforts are evident in the number of members who are turning to cooperatives for their financial needs.

When it comes to market share, credit union performance remains strong in mortgages, credit cards, and auto. First mortgage market share was 8.1% as of June 30, 2019, which is down slightly from the year prior. Revolving consumer loan balances, mostlycomposed of credit cards, continued to trend upward and reached 6.2% in the second quarter. Auto market share was 18.4% at midyear. This is down 1.4 percentage points from one year ago.

AVERAGE MEMBER RELATIONSHIP

FOR U.S. CREDIT UNIONS | DATA AS OF 06.30.19

Callahan & Associates | CreditUnions.com

Average loan balances per member have increased 23.0% in the past 5 years.

The average member relationship for U.S. credit unions reached $19,180 at midyear. That’s an increase of $443 from the same time last year. Although loan growth is slowing, it remains the driving factor behind gains in the average member relationship.Loan balances per member were up 2.7% year-over-year to $8,461; share balances per member rose at more tempered 2.1% to $10,719.

Balance Sheet: Assets

Top-Level Takeaways

-

Loan originations fell 2.5%, or $6.3 billion, from the first six months of 2018.

-

Total delinquency reached the lowest second quarter level since 2007.

-

Investments grew 4.5% annually to $386.3 billion as of June 30.

Aggregate loan balances at credit unions nationwide reached nearly $1.1 trillion in the second quarter of 2019 as more members turned to credit unions for autos, mortgages, credit cards, and more.

The annual growth in balances, however, was slower than what credit unions reported in the same period last year thanks to a drop in originations during the first three quarters of 2019. Of note, origination data for the second quarter was strongerthan it was in the first quarter as credit unions worked to stabilize the decline.

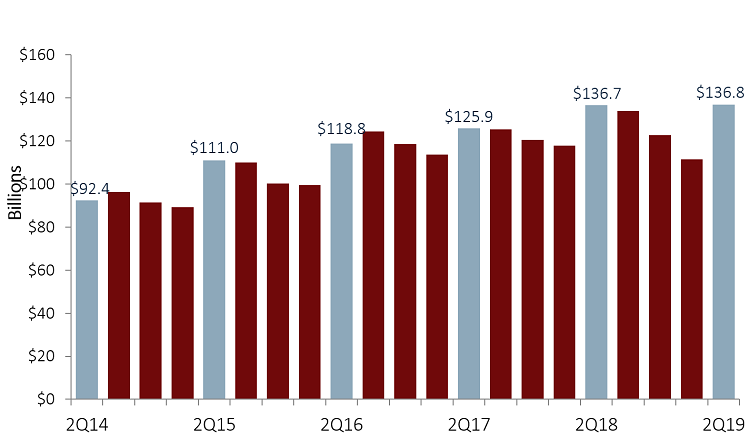

Loan Originations

Loans originated in the second quarter of 2019 were on par with the year before. Credit unions originated $136.8 billion in the second quarter of 2019 versus $136.7 billion in 2018. That’s a difference of $124.7 million. By comparison, the differencein first quarter originations was $6.4 billion $4.7 billion from first mortgage originations alone which has resulted in a more noticeable drop in originations year-to-date. However, second quarter data shows credit union performanceis rebounding.

Loan originations for the first six months of 2019 totaled $248.3 billion, a 2.5% drop from the same time last year. Other real estate originations aside, loan originations fell across the board.

Consumer loan originations, which comprised 61.7% of total originations, declined 2.5%. Member business loans, which at 4.4% comprised the smallest portion of the origination portfolio, also fell. The segment reached $10.9 million in the first sixmonths of 2019.

First mortgages, which accounted for 26.9% of originations, fell from $69.0 billion in the first six months of 2018 to $66.9 billion as of June 2019. Still, this year-over-year drop of 3.1% is a marked improvement from the 15.5% drop in originationsthat credit unions reported in the first quarter of 2019.

Mortgage rates in 2019 have fallen in response to a change in the tone of the Federal Reserve, and consumers have taken the opportunity to refinance and purchase homes. In the second quarter alone, mortgage production increased 6.9% from the sameperiod last year, which has helped soften the slowdown recorded in the first half of 2019.

The only area in which credit unions reported an increase in originations was other real estate, which grew $162.8 million year-over-year. These loans are a bright spot in the real estate portfolio. Home prices have appreciated in recent years, andconsumers who are buoyed by a stronger economy and rising confidence have increasingly tapped into that equity.

YTD LOAN ORIGINATIONS

FOR U.S. CREDIT UNIONS | DATA AS OF 06.30.19

Callahan & Associates | CreditUnions.com

Originations for consumer and mortgage loans have dropped, but isolated second quarter performance shows credit unions have stabilized the decline.

QUARTERLY LOAN ORIGINATION CHANGE

FOR U.S. CREDIT UNIONS | DATA AS OF 06.30.19

Callahan & Associates | CreditUnions.com

Loan originations in the second quarter 2019 were on par with 2018.

Loan Portfolio Composition And Balances

Over the past five years, more members have chosen credit unions for their auto financing needs. Vehicle loans made up 34.7% of total loans in the second quarter of 2019 versus 31.5% in 2014. Other real estate posted accelerated outstanding balancegrowth in the second quarter that is consistent with origination activity, but its share of the portfolio has fallen 2.0% since 2014 to 8.5% as of June 30, 2019. Real estate loans in general make up less of the portfolio in 2019 than they didfive years ago their 49.6% share of the portfolio at midyear represented a drop of 2.4 percentage points versus 2014.

LOAN COMPOSITION

FOR U.S. CREDIT UNIONS | DATA AS OF 06.30.19

Callahan & Associates | CreditUnions.com

Real estate loans made up a smaller portion of the loan portfolio at midyear than they did in 2014.

In total, the credit union industry has recorded robust loan growth in the past five years. In the second quarter of 2019, loan balances reached nearly $1.1 trillion that’s an increase of 6.5% from the year prior.

TOTAL LOANS AND ANNUAL GROWTH

FOR U.S. CREDIT UNIONS | DATA AS OF 06.30.19

Callahan & Associates | CreditUnions.com

Second quarter performance broke the record four-year run of double-digit loan growth.

Aggregate first mortgage loan balances increased 6.7% year-over-year to $443.6 billion by midyear 2019. In the second quarter of 2019, first mortgages accounted for 41.1% of the industry’s overall loan portfolio, the largest share of any creditunion loan product.

Credit card loan balances grew 7.7% year-over-year and neared $63.0 billion by June 2019. Credit unions have extended credit at a faster rate than members are using it; as such, unfunded commitments rose 8.8% year-over-year to $140.5 billion, andcredit card utilization was down to 30.4% as of June 30, 2019.

Total auto loans increased $19.0 billion annually, or 5.3%, to reach $374.4 billion as of the second quarter of 2019. New auto loans increased 5.2% annually. At $7.3 billion, these loans accounted for 38.8% of the overall growth in the auto portfolio.Used auto loans grew at a slightly faster rate of 5.4%. They reached $226.5 billion and make up 60.5% of the total auto portfolio.

Rising new car prices, more used vehicles on the market, and off-lease vehicles entering the market have together contributed to increasingly competitive pricing dynamics. Indirect loans continue to play a significant role in the credit union autoportfolio, however. That segment expanded 6.7% year-over-year to close the quarter at $227.1 billion. It comprised 60.7% of the total auto portfolio at midyear.

LOAN GROWTH BY PRODUCT

FOR U.S. CREDIT UNIONS | DATA AS OF 06.30.19

Callahan & Associates | CreditUnions.com