At a time when many credit unions are flush with cash, many co-ops and their state leagues are pushing for access to public deposits and an increasing number have been successful. Credit union executives say they are less concerned with having more money in their coffers and are instead eager for other benefits that come with taking municipal deposits.

It really is a member service issue, says Stacy Augustine, senior vice president and general counsel of Northwest Credit Union Association in Washington, which began allowing municipal agencies to keep their money at credit unions on July 1, 2011. It’s always been something we should have been able to do.

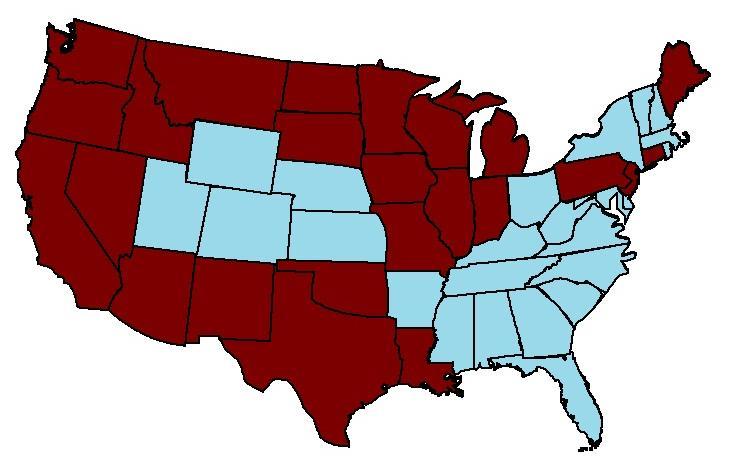

Credit unions are allowed to accept public deposits under NCUA regulations, but many states limit where public entities can deposit public funds. In about half the states, legislatures have kept credit unions off the list of acceptable depositories. Credit union executives say with public deposits they can develop more member services and reach different aspects of the community, including those that already have a relationship with the credit union.

Washington and New Jersey are among the states that have recently amended the state law, and New York has been trying to push similar legislation more than a year at least. But Augustine says it’s a difficult battle for credit unions.

Credit unions in Washington tried pushing the legislation through for several years, but faced a tough political climate, Augustine says.

The first proposed bill in Washington died in 2009 after it got tremendous push back from banks, but the association returned with it in 2010, finally passing that year. As of now, municipalities may only deposit with state-charted credit unions and only up to $100,000, which makes it impractical for larger cities like Seattle to keep their funds with co-ops.

Now, the credit union group is working on increasing the cap on municipal deposits to the full $250,000 that it’s federally insured for and to include all credit unions. So far, two credit unions have been approved to accept municipal deposits in Washington: Gesa Credit Union ($1.1B, Richland, WA) and Numerica Credit Union ($1.1B, Spokane, WA).

In New Jersey, where the law has passed but may not be effective until next year, Affinity Federal Credit Union ($2.1M, Basking Ridge, NJ) has an affinity program with Hillsborough Township. The town’s name and design are on the front of a card, and Affinity gives back a portion of the fee income back to the community, says John Fenton, CEO of Affinity.

They’d love for us to be on the other side of their transaction, which is to take deposits, because we have such a big branch presence in the municipality, Fenton says. It’s just a natural fit. They’d rather do business with us because we have a bigger relationship with them on a lot of different fronts.

Fenton says he expects the looser law, which applies to government entities like fire departments and school districts, will allow Affinity to deepen relationships with state universities like Rutgers and local community colleges. Affinity opened a student-staffed branch at Raritan Valley Community College in North Branch, NJ, in April and college officials have since told Fenton that they’d like to do more business with Affinity they need loans and financing for several projects on campus.

We’re all saying the same thing we’re looking to increase business because of these relationships, Fenton says. But we can’t do that right now. [Municipalities] have to go to a bank.

As players in the municipal deposit market, credit unions can foster more competition, which results in higher rates and lower fees for government’s money, says Paul Gentile, president of the New Jersey Credit Union League.He says New Jersey credit unions lobbied hard to get equal access, with efforts like printing postcards so members could send them to the state representatives and the governor.

Credit union collateral in lobbying lawmakers is consumer voice, Gentile says. Bring the consumer into the fight early to put pressure on the law makers.

States That Allow Municipal Deposits

The states shaded red allow municipal deposits to some degree. The blue states prohibit municipalities from depositing with credit unions. Source: Callahan & Associates.