Build it and they will come even if you haven’t yet told them that it’s there. That was the experience of America First Credit Union ($6.8B, Ogden,UT) after building a mobile app that supports five kinds of loan applications on three different platforms: Android, iPhone, and iPad.

These loan application options currently include auto and RV, personal signature, personal lines of credit, and Visa credit cards. The large Utah credit union also runs a cards rewards program through the same app.

| BRICE MINDRUM, MOBILE SERVICES MANAGER, AMERICA FIRST CREDIT UNION |

The credit union launched the offering in mobile app stores at midnight on June 16, 2014, and according to mobile services manager Brice Mindrum,there were 40 loans waiting for us when we got in at 8 a.m.

Currently, approximately 30% of the mobile loan applications are for credit cards and 45% are for auto loans results that have helped keep overall lending metrics strong.

Although not wholly attributable to the app alone, America First’s ROA of 1.66% in the first quarter of 2015 was the eighth highest among the 237 billion-dollar credit unions nationally, according to data from Callahan & Associates. Here, Mindrumshares some details on the development and deployment of the credit union’s first all-in-one mobile lending solution.

CU QUICK FACTS

America First Credit Union

Data as of 03.31.15

- HQ: OGDEN, UT

- ASSETS: $6.8B

- MEMBERS: 696,493

- 12-MO SHARE GROWTH: 8.20%

- 12-MO LOAN GROWTH: 11.23%

- ROA: 1.66%

- MOBILE PROVIDER: Fiserv Mobiliti

- DECISIONING PROVIDER: MeridianLink

- CREDIT CARD PROCESSOR: Visa/First Data

- CORE PROCESSOR: In-House

After More Than Six Months In Development, How Did You Feel Seeing Applications Come Through That First Morning After The Launch?

Brice Mindrum: We were pleasantly surprised but not really shocked. After all, we knew the demand was there. This effort was based on member feedback as well as on months of watching people trying to complete applications that were meantto be executed on a full-size laptop or PC screen using their smartphones. We saw that happening and knew the time was right.

Are There Different Apps For Each Loan Type Or One That Serves Them All?

BM: One app rules them all. All the features sit right there alongside one another in a very prominent way. The only real difference between them is in the auto application, where we wanted to add the ability to shop for a vehicle andhave an approved loan before the salesman ever gets to you. Other than that, the design work primarily involved shrinking the list of questions and making some assumptions, so that we could compress the application into a mobile environment.

Could You Describe The Process Of Creating, Testing, And Deploying The App?

BM: We worked with Fiserv Mobiliti, MeridianLink, and Cardlytics to integrate the mobile app with decisioning and merchant-funded rewards elements. We also worked with CUDL to include the ability to search for vehicles across their network.

Our group at the credit union focused on the layout, structure, and flow, and the vendors did the design architecture and testing. Then we made sure the user experience was where it needed to be before we launched.

My own role was to keep everyone talking to one other and to make sure they all had the documents they needed to put together the application program interface that allowed this to work.

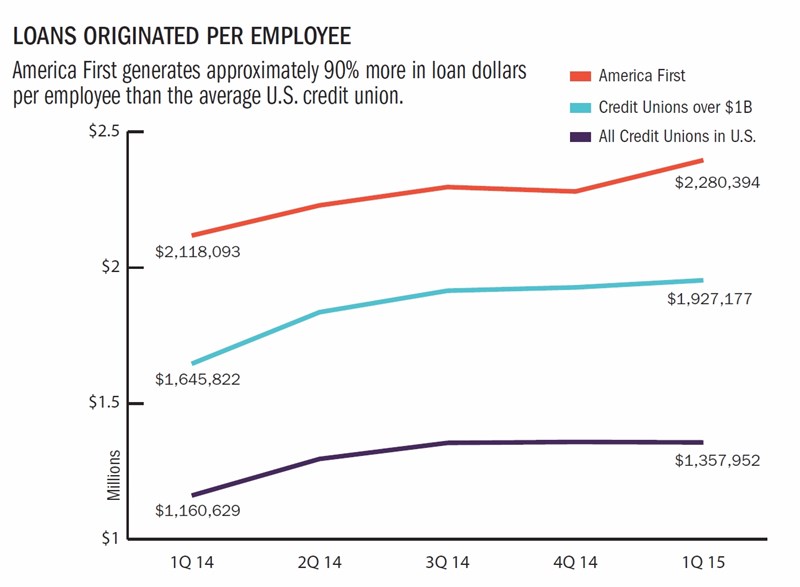

Source: Peer-to-Peer Analytics by Callahan & Associates

Do Loan Officers Still Have A Role To Play In These Electronic Interactions?

BM: Every loan is different. Some are automatically approved by the decisioning engine and others aren’t. But rather than reject a loan, we’ll forward those applications to our loan officers.

They can then contact the applicant and look for a way to make the loan work perhaps by finding a co-signer.

You can turn weaknesses into opportunity with cards and personal loans, too. Say someone applies for a personal loan they might not get but don’t know they are qualified for a Visa card. Or maybe they’re qualified for $8,000 but asked for$10,000. We take the opportunity to get in front of them and let them know their options. The referral rate has been fantastic and our loan officers love it.

Source: Peer-to-Peer Analytics by Callahan & Associates

How Does Additional Technology Such As Geolocation And Smartphone Vin Scanning Work Within The App?

BM: We use geolocator technology from CUDL to allow members to conduct a search such asshow me all Audis within 50 miles. At the dealership, we integrated a scanner into the app that reads the VIN and creates a basic valuefor that vehicle. We could have made it much more detailed, including mileage or other features that could add to the experience, but we decided these benefits were not enough to justify the complexity and time that would add on our end.

We got all our people into a room and a lot of them wanted to include about 20 questions in the applications. I knew that would kill the project, so I cornered the loan guy and made him my champion.

Are You Using The Same Authentication And Booking Procedures For Loans In The App?

BM: Yes, the authentication is embedded in mobile banking and we use the same credentials regardless of the product, so that really wasn’t a challenge. As for credit cards, we do all our own issuing and hold all the balances, soit all works off our core. We just book the loan as a credit card loan instead of an auto loan.

What Was A Challenge With The App?

BM: People don’t want to have to enter a lot of information for a loan on mobile. We knew that going in, but when we got all our people into a room and a lot of them wanted to include about 20 questions in the applications. I knewthat would kill the project, so I cornered the loan guy and made him my champion. Now, we’re able to make assumptions using information in the core system, including for instance, where you live. It makes those procedures more complicated forus but much easier for the end user, and that’s what has to happen if we want this to be successful.

Source: Peer-to-Peer Analytics by Callahan & Associates

What Are Some Lessons You’ve Learned Along The Way?

BM: Every time we do an app, it’s always a learning curve. Maybe we could have communicated certain things better with our partners or among our internal teams. In addition, the respective app stores each make changes that you haveto keep up with.

It’s easy to go down the rabbit hole regarding the complexity of your project. I suggest keeping it as easy as you can. A good example of that is the VIN scanning. We could have done much more with that, but why? Our goal is to get you a loan, notthe most detailed VIN scan you can imagine. Be ready to pump the brakes and keep the focus on what you’re really trying to accomplish.

How Do You Know You Are On The Right Path, Both With Members And With Management?

BM: We do member surveys, application reviews, and other kinds of feedback all the time. Sometimes it’s hard to hear, because it’s the unhappy experiences that get fed back to you, but our mantra is to delight the member and that’s my charge.

I’m fortunate that I work in an organization that views mobile banking as a strategic initiative. I speak to the president regularly and I have our leadership team’s support in everything we’re trying to do. They may sometimes play the devil’s advocate, but they understand our vision and support it.

What’s Next For America First In Mobile?

BM: We’d love to fund loans online, too. That sounds easy, but it’s not. It’s a huge project for a credit union our size, and we have about a dozen other things in the pipeline right now.

We’d also like to move mortgages and business lending onto mobile, and we will when the time is right. We don’t rush things here. Of course we want to automate everything we can, but we won’t move forward until we know it’s downright perfect.