Top-Level Takeaways

-

The Oregon state legislature made business grants and relief checks available to tens of thousands of Oregonians.

-

The state’s credit unions stepped up to serve members and non-members alike.

When the Oregon state legislature provided emergency funding to help state residents save their businesses and feed their families, the state’s credit unions stepped up to help out. Twice.

First, four CDFI credit unions joined forces with a state program to provide grants to struggling businesses especially those owned by women and minorities that didn’t get Payroll Protection Program or other federal relief funds. In three rounds, those credit unions have provided nearly 400 grants averaging nearly $3,000. Another round continues through November.

Troy Stang, President and CEO, Northwest Credit Union Association

They have done and continue to do remarkable work, says Troy Stang, president and CEO of the Northwest Credit Union Association (NWCUA). This is a collaboration beyond those four credit unions, really, because other credit unions in Oregon are referring businesses owners who might qualify. A business owner doesn’t have to be a credit union member to apply, so it’s a shining example of the people helping people’ philosophy.

Then, on Aug. 19-21, eight cooperatives and two banks distributed relief checks for $500 each to approximately 70,000 residents whose lives and livelihood had been wracked by pandemic and wildfire.

State lawmakers saw how credit unions worked with the state agency Business Oregon to make the business grant program successful, and they knew the cooperatives would come through for the relief funds effort as well, Stang says.

Click here to see the grant application for the Business Oregon program.

It was all hands on deck, Stang says. Staff set aside other work to help process payments and provide water and shade to those standing in line. We heard heartfelt stories of the need expressed by Oregonians who sought the payments and how much the help meant to them.

That program was funded by the state legislature using federal CARES Act funds. It was initially intended to support people waiting to collect unemployment benefits but eventually anyone who met the income requirements could tap into the assistance.

And all along the way, the NWCUA worked with credit unions and government officials to make the programs happen.

For the emergency checks program, it was the first time a partnership such as this had been established, Stang says. We worked with state leaders through every aspect determining processes for eligibility, tracking, fraud prevention, state reimbursement, and communications.

The credit unions didn’t make money or gain members through participation, but Stang says the movement did attract a lot of positive press. More importantly, the movement won the trust of important allies.

Legislative leadership trusted that credit unions could get this done quickly and fairly, Stang says. When approached, their leadership and their teams knew it was the right thing to do. As not-for-profit cooperatives, credit unions step up.

Consolidated Community Federal Credit Union, Trailhead Credit Union, Point West Credit Union, and Central Willamette Credit Union all participated in the business grants program. Central Willamette also participated in the emergency relief program, along with Clackamas Federal Credit Union, InRoads Credit Union, Old West Federal Credit Union, OnPoint Community Credit Union, Oregon Community Credit Union, Rogue Credit Union, and SELCO Community Credit Union.

Here, four of these cooperatives share insight about their experience.

Central Willamette Credit Union

Central Willamette Credit Union ($395.3M, Albany, OR) facilitated business grants totaling $474,000 to 153 applicants including delivery drivers, spa owners, fishing guides, and more

and provided $500 relief checks to 1,652 applicants. The investment of 500 or so staff hours was worth it, the credit union’s senior leader says.

Stacie Wyss-Schoenborn, President and CEO, Central Willamette Credit Union

It was hard work, but I can’t say enough about the pride we took in demonstrating the value and mission of credit unions, says Stacie Wyss-Schoenborn, president and CEO. You can tell in a person’s voice when they’re close to losing it all, and you’re there to help them. That alone made it worth it.

The credit union had after-hours conversations with small-business owners trying to get a grant. It had conversations with hundreds of people who stood in line to receive a $500 relief check. And, it heard stories of people driving two or three hours to queue up as early as 3:30 a.m.

Central Willamette Credit Union has made a meaningful difference in the lives of its community small business owners thanks to its participation in the Business Oregon grant programClick here to see a one grant recipient sent to president and CEO Stacie Wyss-Schoenborn.

Once they made it in front of a credit union staffer, the relief program required 10 minutes or less per person. The credit union verified identity and eligibility; then, it cut a check.

Central Willamette might have been efficient, but it wasn’t impersonal.

I spent a lot of time working the lines to make sure people felt valued and respected, Wyss-Schoenborn says. I made sure they knew we were there to assist them in an approachable, professional, caring manner.

Central Willamette uses text messaging to keep members informed amid a pandemic that has forced branches to close. Learn how in A Better Member Experience Is Only A Text Message Away.

Consolidated Community Federal Credit Union

Consolidated Community Federal Credit Union($279.1M, Portland, OR) processed 335 of the Business Oregon grants and got to shake the dust off some old technology in the process.

Larry Ellifritz, President and CEO, Consolidated Community Credit Union

We processed their applications by any means necessary, usually by email, and then answer questions over the phone, says Consolidated president and CEO Larry Ellifritz. I even got to use our fax machine, and I’m not sure that thing has been used in over five years.

According to Ellifritz, the average grant was slightly more than $2,900, and the credit union met a lot of small-small business owners in the process. In return, the credit union received numerous thank you notes and even some zucchini bread from one grateful businessperson, who like most of the recipients was not a member, Ellifritz pointed out.

Besides funding businesses in dire need of help, Consolidated met another of the state’s goals: 67% of the grants went to women-owned businesses and 32% to minority-owned businesses.

We’re still totaling the data, but we were very prescriptive about that part of it, the CEO says. The results have been amazing.

Ellifritz says his credit union invested more than 300 hours on the program from July through September, but it was well worth it.

It’s kind of like when you restore an old car, the 25-year Consolidated employee says. You don’t want to add up your time and money spent, you just want to enjoy the outcome.

Consolidated Community Credit Union includes a security deposit loan among its package of new mortgage products that address the housing crunch in the Northwestern city’s market. Learn more in Putting Portland Rentals Within Reach.

OnPoint Community Credit Union

OnPoint Community Credit Union ($7.3B, Portland, OR) distributed 23,700 relief payments, accounting for 40% of the total statewide. Recipients did not have to be members, but some were.

Tory McVay, SVP and Chief Retail Officer, OnPoint Community Credit Union

One of my members started crying at my desk when I gave her the money, says Akacia Ritmiller, assistant manager of the big credit union’s Bend South Branch. She said she has been without a working toilet or water in her RV for two months and hasn’t been able to find employment. She was excited to be able to have these necessities again.

Tory McVay, OnPoint’s senior vice president and chief retail officer, said like others, his credit union experienced long lines at branches on those three days in August.

We quickly implemented a plan to serve as many people as possible while observing social distancing and requiring masks, he says.

The credit union also deployed extra staff to help with the lines, printed information to hand out, and implemented a ticketing system to streamline the process. What it didn’t do was accept administrative fees from the state that wasn’t the point of participation.

Although the credit union incurred costs, we were focused on delivering needed aid to our community, McVay says. The need was great, and it warranted our help.

OnPoint Community Credit Union was one of the national leaders in Payroll Protection Program participation. See which other credit unions topped the charts in National Leaders In PPP Lending.

Rogue Credit Union

Rogue Credit Union($2.0B, Medford, OR) distributed slightly more than $11 million of the $35 million handed out statewide to Oregonians in financial crisis.

Krista Jantzer, VP of Marketing, Rogue Credit Union

We spent weeks preparing for this, says Krista Jantzer, vice president of marketing.

The preparation included setting up its website so members could easily apply online, making forms available for non-members, training staff, creating signage for branches, reconfiguring staff to handle the volume, and more.

Rogue was one of two financial institutions participating in the relief check effort in Southern Oregon, and Jantzer says she knows of residents who drove more than two hours from rural areas because of their desperate need for the funds.

data-ride=”carousel” id=”myCarousel”>

A generous soul dropped off food for Rogue Credit Union to distribute to Oregonians who came into its branches to receive emergency relief funds.

A generous soul dropped off food for Rogue Credit Union to distribute to Oregonians who came into its branches to receive emergency relief funds.

Rogue Credit Union set up tents to help shade relief applicants as they made their way through the line at the credit union’s South Medford branch.

Rogue Credit Union set up tents to help shade relief applicants as they made their way through the line at the credit union’s South Medford branch.

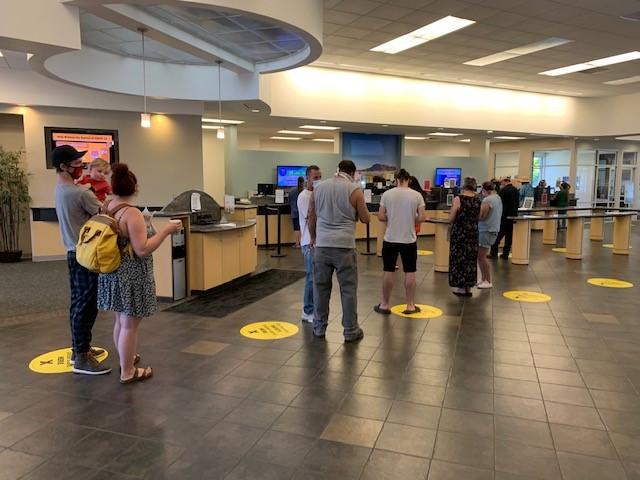

Oregonians queued up inside Rogue Credit Union’s North Medford Branch to process and receive funds from the state’s emergency relief program.

Oregonians queued up inside Rogue Credit Union’s North Medford Branch to process and receive funds from the state’s emergency relief program.

People are struggling in a significant way due to the ongoing shutdowns, Jantzer says. These funds can make the difference for paying for essentials, housing, and food.

It wasn’t just the credit union that stepped up, either. Someone who wasn’t applying for a relief check themselves brought cases of water and non-perishable food to branches for recipients to take on their way out.

Jantzer says the only negative feedback she heard was about wait times.

We didn’t require appointments like some other financial institutions did, so lines were wrapped clear around the parking lot at many locations, the Rogue vice president says. We just wanted to help as many people as possible.

Click here to learn how Rogue Credit Union uses a unique account and loyalty filter to double down on member service in its Southern Oregon market.