In 2022, consumers experienced the highest inflationary pressure since 1981. For some, it was the highest in their life. Rising consumer goods and services prices paired with steep interest rate hikes led numerous credit union members to overdraft their accounts more often in the third quarter of 2022.

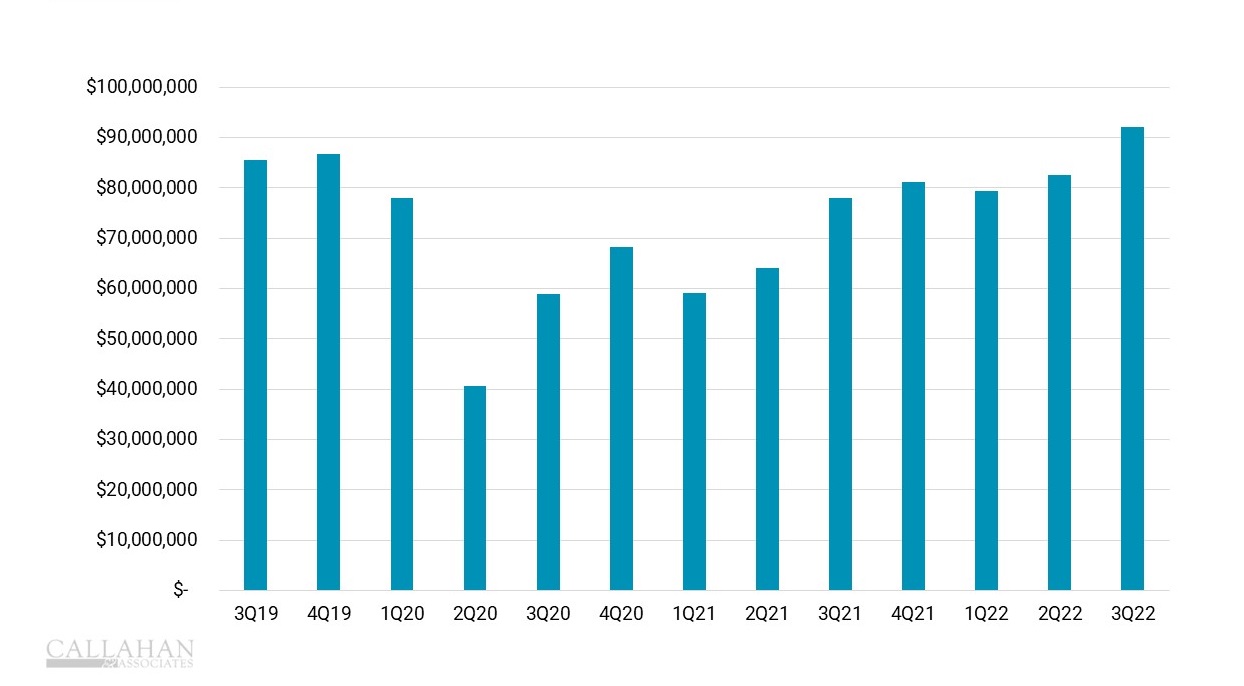

QUARTERLY NSF AND OVERDRAFT FEES

FOR U.S. CREDIT UNIONS | DATA AS OF 09.30.22

© Callahan & Associates | CreditUnions.com

Overdrafts had slowed during the pandemic thanks to lower consumer spending and government stimulus funds that bolstered account balances, but higher prices and pressure on household budgets made it more challenging to keep up in the third quarter.

Credit unions participating in a recent study reported an 18.1% year-over-year increase in non-sufficient funds (NSF) and overdraft fees as of Sept. 30, 2022.

Average consumer savings rates were lower in September, with consumers saving just 2.4% of their discretionary income — down from 7.9% in 2021.

Credit union members paid an average of $24 in NSF and overdraft fees year-to-date, up $4 from the same period the year prior.

How do rising overdraft fees influence your credit union’s collections activity? And how can you implement an early-intervention communications strategy to help keep your members with overdrawn accounts from falling into the collections cycle?

Collections Connections: The Relationship Between Overdraft Fees And Delinquency

From a credit union’s perspective, overdraft fees and delinquency are connected in several ways.

Overdraft fees can contribute to delinquency by increasing the financial burden on members struggling to make ends meet. Members who frequently incur overdraft fees might have more difficulty paying their bills on time, which can lead to delinquency.

To reduce the financial burden of incurring overdraft fees for members, many credit unions allow their members to link their checking account to a savings account. If the member overdraws their checking, the credit union will automatically transfer money from their savings account to cover the overdraft. The Consumer Financial Protection Bureau is watching overdraft fees very closely in 2023, helping members avoid fees and credit unions avoid compliance issues.

Credit unions that are smart about leveraging internal data might also use overdraft fees to monitor the financial behavior of their members, as frequent overdrafts might indicate a member is having financial difficulties, which could lead to delinquency in the future.

Think of overdraft fees as an early warning sign of potential delinquency. Members who incur multiple overdraft fees in a short period of time on their checking accounts are probably struggling financially, which means defaulting on their loan payments could be imminent. This is where proactive communication becomes critical.

Collections Communication: Early Intervention And Building Strong Member Relationships

A strong collections communication strategy is vital for credit unions for several reasons. It expands early intervention opportunities, it builds member trust, it helps credit unions understand their members better, and it improves compliance as well as brand reputation.

Expanding Early Intervention Opportunities

The connection between overdraft fees and delinquency highlights the importance of early intervention. By identifying members struggling to maintain positive account balances and communicating with them early on, credit unions can help prevent delinquency and reduce the need for more aggressive collections efforts down the road.

Building Member Trust

A strong collections communication strategy can help credit unions build trust and maintain positive relationships with their members, even during financial stress. Communicating with members in a respectful and empathetic manner can help credit unions reduce the likelihood of delinquency, increase borrower retention, and improve overall member satisfaction.

Leveraging Internal Data To Understand Members Better

A thoughtful collections communication strategy can also help credit unions better understand their members’ financial needs and tailor their collections efforts accordingly. Credit unions can improve their chances of successfully collecting on past-due accounts by gathering information about members’ financial circumstances and using that information to develop customized collections communication plans.

Leveraging internal data can also help credit unions identify and address systemic issues contributing to delinquency. For example, suppose many members are incurring overdraft fees due to a lack of understanding about how overdraft protection works. In that case, credit unions can improve education and communication.

Improving Compliance And Brand Reputation

A robust collections communication strategy can also help credit unions comply with regulations and best practices in the industry. Credit unions can avoid legal issues and reputation damage by being transparent and respectful with members with delinquent accounts.

In the face of a looming recession and rising delinquencies, leveraging reputable outsourced collections services can be an efficient, cost-effective way to minimize collections queues and the time employees spend on the collections process. SWBC’s omnichannel collections communication strategy allows credit unions to meet borrowers on their preferred channel, substantially improving their member experience.

To learn more about how your credit union can prepare for a new collections landscape in 2023, check out our latest white paper, Modernizing Your Collections Operation. Download your free copy today!

Steve Castner is regional vice president for The Financial Institution Group at SWBC.