10 Steps To Better Business Intelligence

It takes the right people, the right tools, and the right processes to create a data-driven culture.

It takes the right people, the right tools, and the right processes to create a data-driven culture.

Worried the CPI on a borrower’s loan might increase the likelihood of default? Good news – it’s actually an opportunity to protect your member.

Overdraft fees are an early warning sign of potential delinquency. Proactive communication is critical.

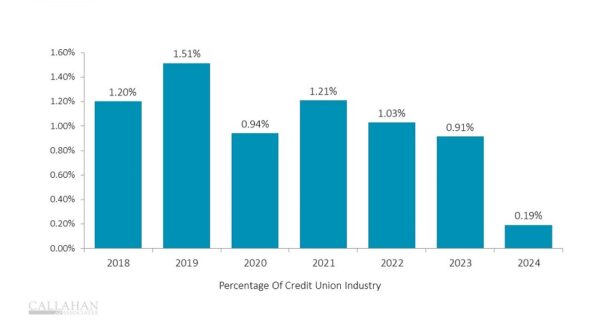

After a decline in consumer spending during the pandemic, the end of government relief programs has contributed to an increase in credit card usage – and a rise in delinquencies.

Efficient, easy-to-use software eliminates administrative work while helping managers keep track of member accounts.

In today’s environment, credit unions will need to focus on modernizing their collection operations.

STCU’s financial relief team pulls risk mitigation and member financial wellbeing under the same umbrella with employees who are simultaneously loan underwriters and financial counselors.

Collections strategies should consider the outsourcing of early stage delinquency to experience the cost savings and compliant expertise as the delinquency rate remains uncertain.

The many facets of a tech upgrade can make the process overwhelming. Bridgeforce’s nine-step guide ensures a best-fit solution is chosen.

A scalable solution for outsourcing collections can save up to 50% compared with in-house efforts.

How Member Loyalty Group grows credit unions’ ability to understand and act on feedback through AI-powered analytics.

Although the industry is chock-full of foundations, some institutions rely on donor-advised funds as a pathway to giving back.

The Fortera Foundation is breaking the cycle of generational poverty by providing essential resources and financial aid to single-parent students.

The United Nations FCU Foundation helps the New York-based credit union make an impact on multiple continents.

The regulator’s Community Development Revolving Loan Fund distributed $3.8 million in grant funding last year, benefitting more than 140 credit unions.

Five years after launching a successful mortgage digital campaign, the New York-based credit union has expanded into other business areas.

After two large Minnesota credit unions merged, staff set to work creating a new brand identity.

Three seasoned marketers share tips and tactics to turn everyday sponsorships into avenues for connection and prosperity.

Marketing spend is up since the onset of COVID-19, but fewer institutions are pursuing new identities, choosing instead to embrace familiarity.

Technology partnerships offer a path to innovation and enhanced member service.