With evidence of recession mounting, consumers and financial institutions alike are worried. Most of them perceive a recession would negatively impact their growth and financial well-being.

Today’s macro-economic conditions, while challenging, present a unique opportunity for credit unions to capitalize on member engagement by leaning into their key differentiators — delivering personalized, community-centric relationship banking and meaningful support in times that members need it most.

Events in the past two-and-a-half years have significantly impacted global markets, breeding financial uncertainty and trepidation. Most recently witnessed in the 2008 recession, when economic upheaval caused a myriad of financial stressors for individuals, businesses, and organizations alike.

Once again, the economy is top of mind. Inflation, rising interest rates, a cooling housing market, and the possibilities of recession are all significantly influencing the behavior of credit unions — and the members they serve.

Data from Engageware’s annual survey of banking professionals and consumers examined sentiments around a possible recession and the crucial role member engagement plays.

Recession Worries Impact Consumers And FIs

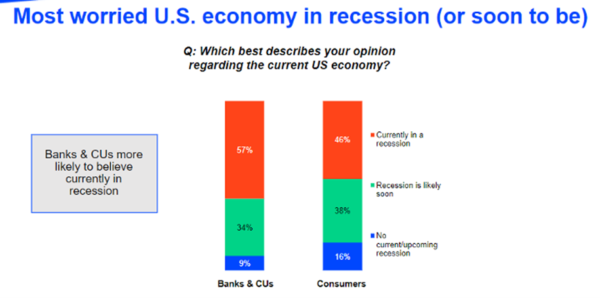

At the time of the survey (August 2022), nearly all banking professional respondents (91%) and a large majority of consumers (84%) said they think the U.S. economy is either currently in a recession or will be in one soon. Financial institutions were more likely to believe the country is already in recession (57% versus 46% for consumers).

Almost 90% in both groups were also at least a little worried about a recession’s impact. That said, relatively few were “very worried” about the impact to their institution’s customer relationships (13% of financial institutions) or their own personal financial situation (36% of consumers).

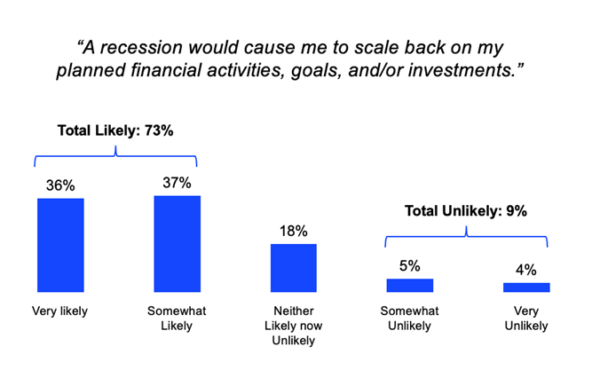

It is no surprise that an economic downturn would have an effect on banking behavior. In the event of a recession, 75% of consumers said they plan to scale back their planned financial activities.

Consumers also said that, in challenging economic times, they expect their primary financial institution to provide additional support beyond the obvious products and services offered. In addition to expecting lower fees, more competitive rates, and late payment forgiveness, consumers indicated they would also expect recession strategy planning (34%) and one-to-one financial planning (16%).

According to J.D. Power’s 2022 U.S. Retail Banking Study, customers value and are more loyal to financial institutions that deliver a meaningful customer experience and make the effort to support them in challenging economic times. In that report, 63% of customers said if their financial institution delivered this kind of support, then they “definitely will not switch banks,” and 78% said they “definitely will reuse their bank.” Financial institutions, according to JD Power, must use engaging methods to provide the support customers need most — especially when the economy is sour.

Rivel, a data-driven management consulting firm, predicts that while a recession might slow overall banking activity in terms of new deposits and loan demand, consumers will still need key accounts and seek the flexibility that financial institution can offer them — most likely from their current primary FI.

Member Engagement In An Unpredictable Economy

Human expertise is a critical component to delivering meaningful member engagement. But getting the support in place exactly when it is needed can be challenging in an increasingly digital and self-serve environment.

In some channels, support means enabling members to serve themselves more efficiently. In other channels, support means the ability to readily access human assistance. Strong member engagement provides ample access and support across all channels, allowing members to choose what works for them at any given moment.

Three ways credit unions can set member engagement into motion:

1. Enable Self-Service: Answer the high-volume, common interactions that can easily be handled digitally (ex. technology help; basic transactions).

2. Hybrid: Self-Service and/or Human Assistance: Provide easy access to digital or human assistance for high-value interactions (ex. loan applications).

3. Enable Consistent Human Assistance: Ensure interactions with your staff are consistent, accurate, and efficient.

A Growing Focus On Member Engagement

Today’s consumers have more ways than ever to interact with their financial institutions — which means leveraging technology can be a double-edged sword for credit unions that must now ensure they are providing seamless consistent experiences across all channels.

The brass ring for credit unions will be to enable, support, and sustain a consistent pattern of satisfactory member experiences that build loyalty no matter where members interact.

Doing so requires offering ample opportunities for members to engage with the products and services offered. This can look like proactive recommendations, personalized offerings, the ability to seek guidance or help from a financial professional, or providing related information.

It can be the ability to easily schedule an appointment during a digital interaction or making your financial experts instantly available through video, chat, phone, or ITM.

Credit unions must contend with today’s rapidly evolving economic conditions as they look to stand out, compete, and grow. For credit unions to be successful in these challenging times, they must further their efforts to deliver truly holistic member engagement. Engagement breeds loyalty, driving member retention, higher satisfaction, and stronger growth.

Engageware is the industry-leading provider of customer engagement solutions with more than one billion appointments scheduled via its award-winning appointment scheduling software. Trusted by hundreds of financial institutions, Engageware’s appointment scheduling customers outpaced the industry by 222% in Q3 loan growth (7.41% versus 2.31% industry average).