Let’s say a new member walks into your branch, opens an account with their mobile driver’s license, and registers biometrics. Two weeks later, they’re able to access online banking with ease using facial recognition. When applying for an auto loan through your mobile app, identity verification is instant, with no need for redundant paperwork. As a result, while other institutions struggle with fragmented systems, identity continuity allows your credit union to deliver the frictionless experience members expect.

For credit unions to compete against large national banks, adapting identity technology matters. Strategic partnerships like Daon’s collaboration with CU*Answers or DigitalFI give credit unions access to the same enterprise-level identity technology that powers major banks. This creates a key opportunity to level the playing field and deliver superior member experiences that rival mega-banks.

The Challenge: When Identity Systems Create Friction

Fragmented identity experiences remain a major pain point in financial services. Members expect seamless interactions, yet most institutions operate with siloed systems treating each touchpoint as isolated. A member might verify identity during account opening, then face entirely separate verification for online banking, mobile apps, and member support.

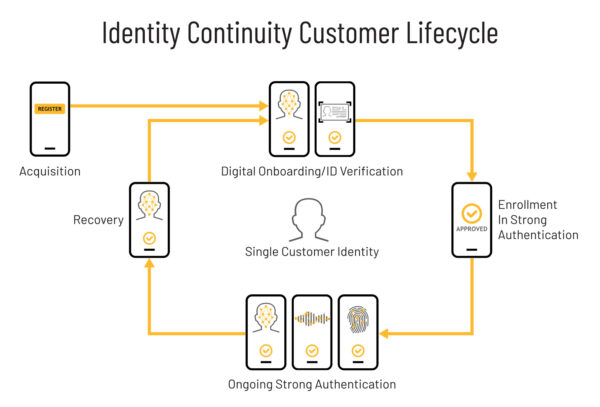

Identity continuity operates on a simple principle: “One Member. One Record. One Platform.” Instead of requiring reregistration across channels, this creates a single, central identity authenticated consistently. It’s a unified framework connecting verification, authentication, and recovery.

Rising Expectations Meet Emerging Digital Threats

Identity Continuity empowers credit unions to deliver seamless, secure, and adaptive member experiences by unifying physical and digital authentication into one persistent identity framework—closing the technology gap with large banks while combating emerging fraud threats.

As digital banking compresses years of change into months, fraud tactics are evolving just as quickly. Deepfakes now mimic voices and faces with alarming accuracy while synthetic identities seamlessly blend real and fabricated information. According to Deloitte, synthetic identity fraud is the fastest-growing financial crime in the United States, with projected losses exceeding $18 billion by 2030.

Even amid a surge in sophisticated fraud, the average member’s patience for authentication friction has vanished. Experian research shows one-third of consumers abandon online transactions taking longer than 30 minutes, with people abandoning purchases nearly five times daily due to forgotten passwords.

Identity continuity addresses these threats by establishing persistent connections between members’ physical and digital presence. By linking trusted biometric factors with verified identity records, fraudster access becomes significantly harder. Members’ patience for authentication friction has disappeared. Experian research shows one-third of consumers abandon online transactions taking longer than 30 minutes, with people abandoning purchases nearly five times daily due to forgotten passwords. Biometric authentication eliminates these hurdles, as face or voice recognition verifies identity in seconds.

Another clear sign of changing consumer behavior is the rise in digital wallets. Identity continuity ensures these credentials remain valid across channels. Mobile driver’s licenses represent a substantial development in the financial services ecosystem. These government-backed digital credentials offer higher assurance than plastic IDs and supporting them signals that a credit union understands the future of identity.

The Business Impact

Beyond fraud prevention, identity continuity delivers measurable benefits:

- Reduced overhead – Eliminating redundant identity systems streamlines operations.

- Lower support costs – Password resets account for 40% of IT support calls.

- Enhanced satisfaction – Consistently recognizing members creates adaptive experiences.

- Simplified compliance – Centralized records ease KYC and AML maintenance.

This unified approach transforms routine transactions into competitive advantages. The same member who initially registered biometrics during account opening can now transfer $25,000 for a home down payment seamlessly because their identity is continuously validated. Or, if the member loses their phone, simple account recovery is available through biometric re-authentication.

Identity continuity offers credit unions a clear path forward. The question isn’t whether to adopt this technology, but how quickly credit unions can implement it to transform the member experience and secure their competitive future.

Daon empowers credit unions with biometric identity continuity, enabling secure, frictionless member experiences across digital and physical channels—reducing fraud, simplifying authentication, and strengthening trust at every touchpoint.