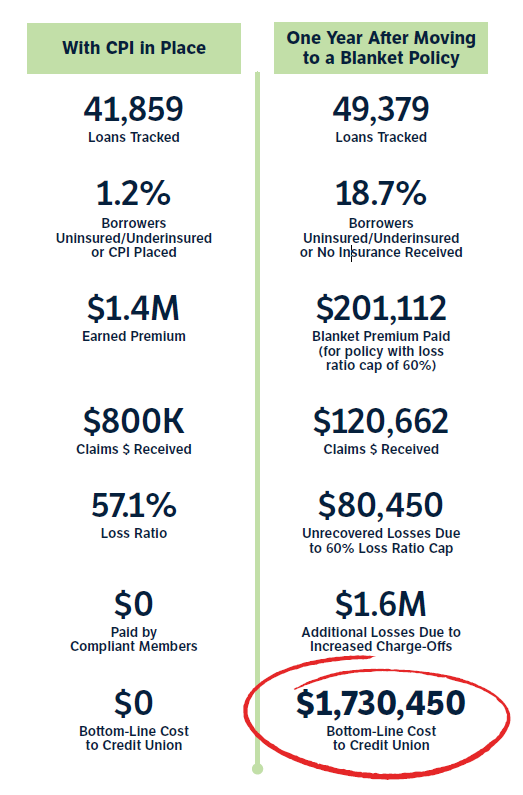

Unintended consequences often surprise lenders that switch their portfolio protection solution from collateral protection insurance (CPI) to a blanket policy. For many credit unions, it seems like a good option — until both their number of uninsured borrowers and their premiums keep rising.

Without the monitoring of the loan portfolio that comes with CPI, it has been shown time and again that the number of uninsured borrowers will increase and the credit union’s losses will grow larger.

To show how this plays out in a real-world example, one of our current clients (to ensure its privacy, we’ll call it “Best Lending Institution”) recently worked with us to continue tracking its borrowers’ insurance status after it decided to move to blanket coverage.

These results are for year one. If Best Lending stays with a blanket policy, it can expect to see the number of uninsured borrowers go up, monetary losses rise, and premiums paid for its blanket policy increase.

The evidence is clear — a blanket policy:

-

- Increases charge-offs.

- Increases the number of uninsured borrowers.

- Increases the number of policies missing the lienholder.

- Increases the number of policies where borrowers are out of compliance with their loan agreement because they have raised their deductibles or reduced coverages.

- Removes any enforcement mechanism to encourage uninsured borrowers to obtain coverage.

- Leaves the credit union with significant blind spots regarding where the risk is in its portfolio.

- Removes borrower participation coverage and requires the credit union to repossess the collateral.

- Will continue to increase in cost as the credit union’s loan portfolio grows, regardless of loss ratio.

In contrast, a well-run, well-managed CPI program has the following advantages:

-

- You can identify where your risk is and keep it from rising.

- It’s a fairer and more equitable program for not only compliant members but also your membership as a whole.

- There is incentive for uninsured borrowers to become insured.

- There is a positive impact on the lender’s bottom line, and the lender can redistribute cost savings to members.

- There are no up-front fees — it costs the credit union little or nothing.

- There is extra lender coverage options, such as towing coverage, mechanics lien coverage, waiver of actual cash value, and skip coverage available.

- There are no yearly increases in blanket insurance premiums.

- Borrowers are able to file claims under Waiver of Repo coverage, offering additional protection to your members.

Want to learn more about safeguarding your lending portfolio? Contact State National for information about how our CPI program can benefit your credit union.

About The Author: Christy Dempsey has been with State National Companies for 15 years, working initially as a Sr. Client Executive based out of Chicago and later Reno before moving into the Director of Client Services role in 2019. Christy graduated from Illinois State University with a Bachelor of Science degree in Business Administration and a minor in Insurance. Her career includes roles within underwriting, service, and sales spanning 23 years. In her current role she manages seven Client Executives across 17 states supporting 240 financial institutions.

— This originally appeared on CreditUnions.com on Jan. 15, 2024.