Top-Level Takeaways

-

Rising rates on the 2-Year U.S. Treasury note have tightened the margin on indirect loans at credit unions.

-

As a result, credit unions are changing their indirect loan programs.

The economics of indirect lending have changed.

Four years ago, the rate on the 2 Year U.S. Treasury note was 0.48%; two years ago, it was 0.81%; today, the rate is 2.84%. Financial institutions have typically set their auto loan rates based on the 2-Year Treasury, but that hasn’t been the case in recent years, especially at credit unions, says Travis Goodman, advisory services principal at ALM First, a financial services provider for banks and credit unions.

Credit unions in particular are slow to raise rates because they’re not moving with the market, he says. They’re trying to compete against the guy across the street, and that puts downward pressure on rates.

The competitor across the street aside, auto rates as an asset class aren’t as correlated with movements in market rates.

When market rates move, mortgage rates typically move between 90%-110% of that movement, Goodman says. Auto loans move between 20-25%.

Since the third quarter of 2014, the average interest rate on new and used auto loans at credit unions has moved little, according to data from Callahan & Associates. On used loans, the interest rate has fallen 3 basis points in four years, from 4.95% in 2014 to 4.92% in 2018. On the new side, interest rates have dropped 9 basis points, from 3.74% to 3.65%.

ContentMiddleAd

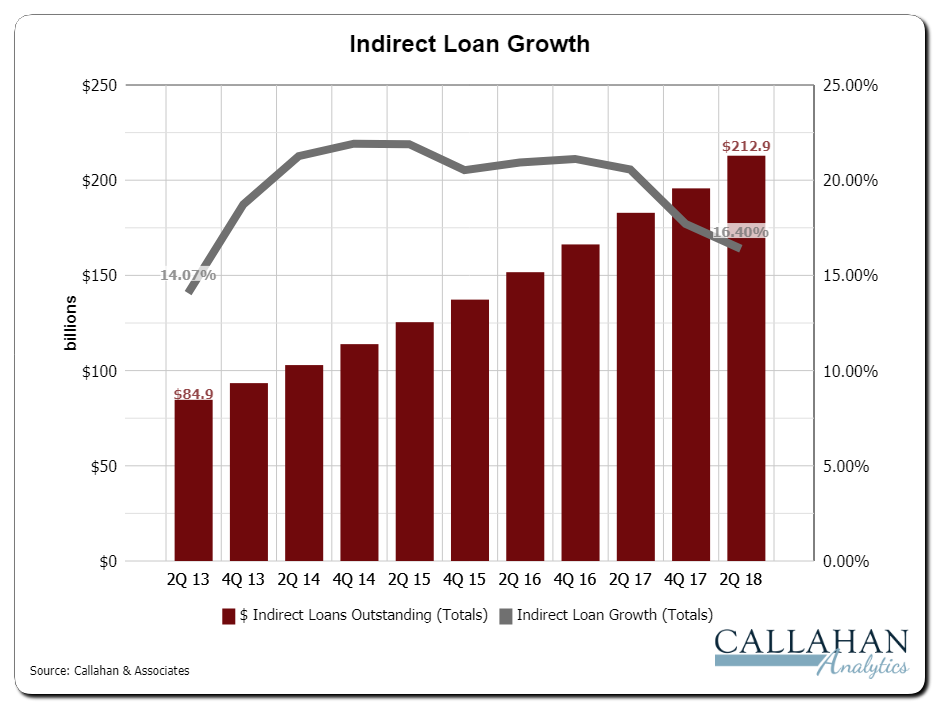

That means, overall, the margins on auto loans have shrunk. That’s something banks noticed on their indirect portfolios more than a half-decade ago, Goodman says, and started pulling out of the market. But since third quarter 2014, indirect auto loan balances in the credit union industry have nearly doubled, from $107 billion to $212 billion in third quarter 2018, according to Callahan data.

A lot of the banking competition recognized that profitability on indirect was low and exited the marketplace, he says. Credit unions filled that need by coming into a space that is unprofitable to begin with and are now competing against one another.

INDIRECT LOAN GROWTH

FOR ALL U.S. CREDIT UNIONS | DATA AS OF 06.30.18

Over the past four years, indirect loan balances at credit unions have nearly doubled.

Source: Callahan & Associates.

Are Indirect Auto Loans Profitable?

From an accounting perspective, says Goodman, indirect auto lending is still profitable. Because the industry’s cost of funds remains low 0.70% at third quarter 2018 funding loans through deposit products such as checking, savings, and money market accounts is relatively inexpensive.

When I fund a loan at 50 basis points and make 250 or 300 basis points, even if I take some credit losses, I make money at the end of the day, Goodman says.

From a return per unit of risk perspective, however, there’s a problem. Just how well are credit unions paid for the risk they’re absorbing? In many cases, Goodman says, all or most of the loan yields are eaten up by interest rate risk, funding risk, and credit risk, among others. Credit unions also price dealer compensation fees into their rates. And at 2-2.5% of the total loan balance, Goodman estimates, this is not a small expense.

Add to this the amount of loan depression it takes to attract quality borrowers in the highest credit tiers, for which credit unions have a penchant, and the loan is now priced against the rates of others rather than commensurate with, admittedly low, risk. Sure, credit unions do exist to provide credit and are often willing to make less-profitable decisions to serve members. Goodman, however, argues that indirect loans operate more like investments, especially as credit unions struggle to cross-sell indirect members with more credit union services.

When you make a loan to a member, it’s easier to justify an unprofitable loan because the beneficiary is the member, he says. But when it’s not really your member it doesn’t make as much sense. It’s more like an investment, though it’s not treated with the same scrutiny.

Analyze With Ease

It takes minutes to compare your organization’s lending portfolio against other credit unions with Peer-to-Peer. Request a custom performance audit today, and Callahan will walk you through the numbers.

Goodman and his team advise clients to avoid falling in love with any one asset class, as there is always a point at which it’s no longer advantageous or beneficial to allocate resources to it. He believes credit unions have reached this point with indirect autos. More credit unions are seeming to agree with him.

Credit unions need to accept unprofitability or start raising rates, the ALM advisor says. Allocate resources to another asset class, or deal with slower loan volume. Credit unions are now seeing losses on high-credit paper and realizing they should be doing something else.

That something else could include taking advantage of a soon-to-be buyer’s market for purchasing auto loan participations.

Goodman admits credit unions that originate indirect autos well will be loath to turn off that volume, but as loan-to-share and loan-to-asset ratios at these institutions continue to rise, they will sell participations to fund new loan growth. That might sound like a win-win, but sellers will outnumber buyers, which will result in further changes to the economics of the portfolio.

Buyers will require higher and higher yields to justify buying pools, Goodman says.

Mortgage loan participations are common today and tend to reprice quickly. As more institutions participate out auto loans, Goodman says, they will realize the need to adjust pricing quicker, too. To do that, credit unions will need to raise rates.

Moving Into A Paper

CU QUICK FACTS

Workers Credit Union

Data as of 06.30.18

HQ: Fitchburg, MA

ASSETS: $1.7B

MEMBERS: 101,873

BRANCHES:16

12-MO SHARE GROWTH: 9.1%

12-MO LOAN GROWTH: 9.2%

ROA: 0.58%

Workers Credit Union ($1.7B, Fitchburg, MA) operates an extensive dealer network through most of its home state of Massachusetts. Its business also extends into neighboring New Hampshire, Connecticut, and Rhode Island. The credit union has historically stayed away from A-paper loans, focusing instead on lower credit tiers and used autos.

For our pricing on that A’ tier to be competitive, it had to be at really low rates, says CFO Tim Smith. It was not profitable for us, so we just didn’t do it.

According to Smith, interest rates have risen in his markets, especially on A paper. Before, institutions were offering rates as low as 1.99%. Now, borrowers with superior credit are paying rates in the 3s and 4s, Smith says.

For us, rates are becoming more reasonable, the CFO says.

In the last quarter alone, Workers added approximately $33 million in indirect balances to reach $277 million. And as high-paper loans have steadily increased, indirect delinquency has dropped from 3.25% in the third quarter of 2014 to 0.65% today.

Workers has also reduced dealer compensation to 1% across all markets. For indirect recreational vehicle loans, Workers doesn’t pay anything.

The dealers just want to make loans, Smith says. They like getting the incentives, but they really just want to be able to sell their cars. If they can get a deal done they’re happy.

All told, the credit union’s indirect loan volume in recent quarters has been more than expected, Smith says. And as total vehicle sales cool from a red hot past few years, Smith believes the used auto market will remain relatively robust. Pair that with the credit union’s active search to add more dealerships to its network, and Smith expects indirect volume to grow in 2019 and beyond. That’s why the credit union recently sold its first indirect loan participation and plans for many more.

We are expecting growth, Smith says. We’ll have to manage that by selling a bit more.

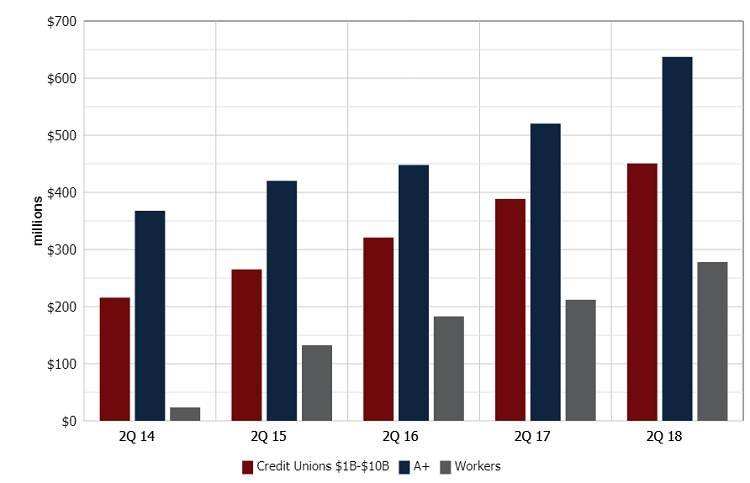

INDIRECT LOAN BALANCES

FOR CREDIT UNIONS $1B-$10B | DATA AS OF 06.30.18

Indirect balances at A+ and credit unions with assets between $1 billion and $10 billion have doubled over the past four years, but balances at Workers have grown by more than 10 times.

Source: Callahan & Associates.

Raising Rates, Cutting Dealer Compensation

CU QUICK FACTS

A+ FCU

Data as of 09.30.18

HQ: Austin, TX

ASSETS: $1.5B

MEMBERS: 151,710

BRANCHES: 22

12-MO SHARE GROWTH: 6.5%

12-MO LOAN GROWTH: 16.7%

ROA: 1.29%

Indirect lending is even bigger business at A+ Federal Credit Union ($1.5B, Austin, TX). The Texas cooperative holds nearly $640 million in indirect loans on its books and has spent the past few years expanding its market footprint.

Today, A+ has more than 300 partner dealerships in the Austin metro area as well as the large, neighboring markets of Dallas-Fort Worth and San Antonio.

The expansion of our footprint is important for what we want to do in the long-term, says John Demmler, chief lending officer at A+. There’s a lot that’s changing in this space, and we’re trying to position ourselves for those changes.

Those changes include mom-and-pop dealerships being sold into national auto dealerships such as AutoNation, Van Tuyl Group (owned by Berkshire Hathaway), and Sonic. National dealerships often have national financing partners, making it difficult for local financial institutions to compete for their business. To combat this, A+ joined CU Direct Connect to put itself on the radar.

The indirect market in Austin has also gotten more competitive, according to Demmler, with more financial institutions looking for B and C paper. As currently constructed, roughly 60% of the credit union’s indirect portfolio is in A+ or A paper, 20% in B+ and B, and the rest in C+ and below, although Demmler thinks that will change soon.

People have figured out that making a perfectly constructed top-tier auto loan with 2% gross yield doesn’t work, he says. More financial institutions have shifted their mindsets over the past 12 months to where they are trying to make these programs more profitable.

For its part, A+ has made changes to its indirect program to create a stronger, more profitable portfolio. But whereas the 2 Year Treasury rate is rising, many financial institutions in Demmler’s area are holding tight to their lower rates for marketing purposes, he says.

To stay there, they have to cut their costs somewhere else, the chief lending officer says.

Increasingly, this means financial institutions in his market are cutting dealer compensation. A+ is no exception. In addition to tightening LTVs and raising rates, the credit union has cut its dealer compensation by 75 basis points from 2.25% to 1.50%. Indirect loan volume immediately dropped 50%. A+ expected as much; however, the credit union could afford this reduction in loan volume because the loans it is making are more profitable. Plus, a growing dealer network has underpinned an uptick in the past two months that has helped volume rebound to approximately 30% of what it was before A+ made changes to its program.

We considered it from an analytical standpoint, Demmler says. If we lost 50% of our volume, we’d still have a program that was more profitable than what we had before. Now with a 30% reduction, it makes things that much more profitable.

A+ doesn’t participate out its indirect portfolio, although it might start as early as next year. Demmler knew expanding its dealer footprint would give the credit union more loans than it wanted to keep, but the economics weren’t quite right. Simplistically, if the credit union was paying 2.25% in dealer compensation and earning a 2% premium on the sale, then it was taking a loss, which made participations prohibitive. By reducing dealer compensation to 1.5%, participations have become more palatable.

Going forward, Demmler is looking to expand into an array of indirect merchant programs as he anticipates auto demand will continue its decline amid continued dealership consolidation. For a credit union that holds nearly 50% of its total loan portfolio in autos, increased consolidation is troubling. But by thinking about tomorrow while focused on today, the credit union stands ready to meet challenges head on.

We’re working to play the game while it’s here and position ourselves for the future by diversifying our income stream, Demmler says.