Top-Level Takeaways

-

Navy FCU simplified its mortgage process in June 2019 with a new platform that is accessible online or on mobile.

-

In its first few weeks, application completions are up and application times are down.

CU QUICK FACTS

Navy FCU

Data as of 03.31.19

HQ: Vienna, VA

ASSETS: $103.1B

MEMBERS: 8,446,032

BRANCHES: 332

12-MO SHARE GROWTH: 15.2%

12-MO LOAN GROWTH: 11.9%

ROA: 1.69%

In early March 2013, a video on Business Insider talked about 2010s being the Age of the Customer. Advances in technology have underpinned the proliferation of competitors in the field of financial services, pushing credit unions to work harder to differentiate themselves to attract and maintain members.

Nowhere on the balance sheet is that clearer than in the mortgage portfolio. In late 2017 online-only lender Quicken Loans overtook Wells Fargo as the nation’s largest mortgage lender, largely on the strength of its mortgage platform Rocket Mortgage. For credit unions to compete, simplifying the traditionally complicated application process is a good place to start.

We understand homebuying can be stressful, says Mounia Rdaouni, assistant vice president of mortgage specialized operations at Navy Federal Credit Union ($103.1B, Vienna, VA). As a credit union, we wanted to alleviate concerns and issues and simplify the process.

To that end, the nation’s largest credit union has launched HomeSquad, a mortgage application platform accessible on mobile or online.

Keep It Simple

For the past four years, Navy Federal has ranked first in customer experience, according to an index survey by Forrester.

The member experience is our guiding principle across all business lines, Rdaouni says.

In listening to members’ stories, however, the credit union realized its mortgage application process had room to improve, specifically as it related to communication, document exchange, and application questions.

Our members wanted to see improvements in these areas as well as an overall simplification, Rdaouni says. That’s why we took on this initiative.

Navy Federal’s previous mortgage process began with an easy-to-use smart application. However, the rest of the process lacked the simplicity and transparency members wanted from their mortgage experience. To address those problems, when it launched HomeSquad, which is powered by a third-party vendor, the credit union gave members the ability to follow every step along the way in the mortgage platform.

Click the tabs below to learn more about HomeSquad.

HOME PAGE

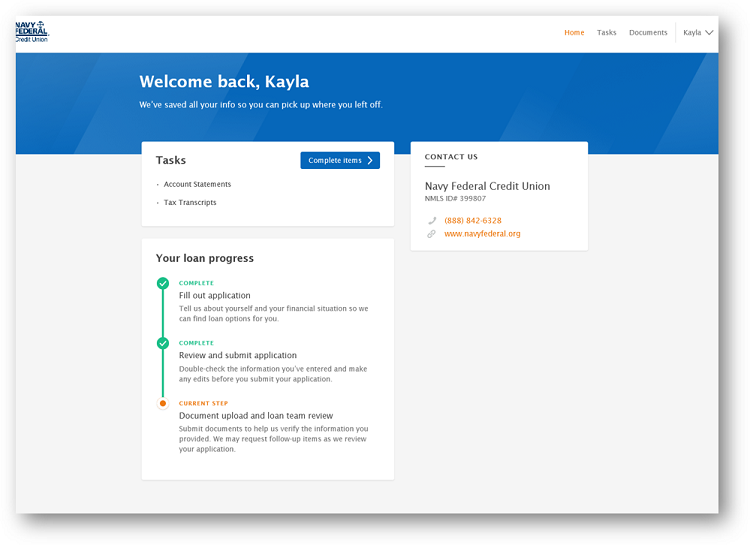

From the main page within HomeSquad, applicants can easily see, from a high-level, where they stand in the mortgage loan process.

IMPORT DOCUMENTS

Within the platform, applicants can import personal finance and tax information.

THE HOMESQUAD PROCESS

The application itself is broken down into eight sections.

Members complete the same step-by-step smart application that automatically adjusts depending on previous inputs. For example, if a member selects no to the question about whether they are active duty military, the application no longer prompts them with references or products suited to that designation.

That simplifies things, Rdaouni says.

Once members complete the application, they enter an entirely different process. To start, they receive notifications outlining next steps or requests for additional information. For Navy Federal, this meant integrating its back-office LOS into the platform using APIs, a straightforward process with big implications. Members can see where their application sits within the credit union’s back-end system. Is it in underwriting? Is it in processing?

Members are fully informed where their loans stand at all times, the mortgage VP says.

According to Rdaouni, one of the more difficult aspects of the mortgage process lies in the gathering of financial documents. But within the HomeSquad system, mortgage applicants can link assets from other financial institutions as well as from their employer’s payroll system. And, the system is fully configured with DocuSign.

We can send documents digitally for our members to view and sign within the platform, Rdaouni says.

The credit union ran a multi-month pilot for HomeSquad, from February to mid-June 2019, and made the platform the default mortgage process for all Navy Federal members in June.

Squad Goals

3 Tips To Live Well In The Age Of The Consumer

Mounia Rdaouni, assistant vice president of mortgage specialized operations at Navy FCU, knows this is the Age of the Customer. Here, she offers three ways to implement a better mortgage process in this modern age.

No. 1: Keep a laser-focus on the member. There will be distractions or system constraints that will make the experience more difficult than it needs to be. When that happens, remind yourself you are here to make the experience easier for the member.

No. 2: Find a leader who is more than a mortgage expert. Whoever leads the implementation needs to be more than a mortgage expert. They need to fully understand the user experience and what members want.

No. 3: Don’t rely on technology alone. If you want to improve the member experience, you have to improve the end-to-end experience. That includes the LOS, back-office employees, culture, and processes. You can’t put a new piece of technology on top of antiquated processes and expect it to work well.

The mortgage industry is heavily regulated, and regulation is frequently at odds with user experience. On the one hand, a better experience is often a simple one. On the other, regulations require the collection of detailed data.

From a principle standpoint, the two can be at odds, Rdaouni says. But I also think that in the Age of the Customer, companies understand the balance they need and have found a good way to achieve that.

Navy Federal had clear, untouchable legal standards that it worked with its platform vendor, Blend, to implement. The credit union couldn’t change some things about its legacy mortgage process, but it made it a priority to tackle the areas it could change. It had its three key areas of improvement going into the HomeSquad implementation, and the four-month pilot allowed the credit union to better understand how the platform held up technically as well as gauge, and improve, the member experience.

We wanted to make sure it was more than just a piece of software, Rdaouni says. We needed our people at the front and center of the experience.

As expected, the pilot helped the credit union gain a deeper understanding of how it could improve its approach to mortgages. The simplified process raised members’ expectations that Navy Federal would deliver a well-rounded experience, which included more quickly decisioning loans or contacting members who had outstanding questions. After all, if a member can link all their assets in seconds, then they likely expect a quick turnaround after they submit the application.

We had to make sure the end-to-end experience was up to par, Rdaouni says. That’s why we named it the way we did. We wanted members to know we are with them the whole way.

Since introducing HomeSquad, Navy Federal has focused on improving application times and submission rates. Anecdotally, Rdaouni notes improvements in these two areas during the short time the platform has been available to members. However, she declines to provide data until the credit union can collect a larger sample size.

Overall, the mortgage VP believes the platform has and will continue to reduce friction and increase ease in the mortgage-buying process. That’s a win for members craving a better experience without sacrificing the quality and thoroughness necessary for a mortgage application.

We’re putting everything members need in one place that’s easy to access, Rdaouni says. And if you think about it, we’ll know if it works pretty simply: If it’s easy, members are going to do it.