Top-Level Takeaways

- Strategic Social Media Management: Financial institutions now hire dedicated personnel to manage corporate social media, reflecting its essential role in driving sales and brand visibility.

- Balancing Risk And Compliance: Engaging on social media requires navigating regulatory compliance and setting clear guidelines to mitigate risks while maintaining a strong presence where members are active.

- Quality Engagement And Targeted Advertising: Emphasizing engaging content and targeted ads helps institutions like BCU and Interra Credit Union effectively reach diverse audiences, increase traffic, and foster meaningful interactions.

Social media isn’t just for status updates anymore. These days, Facebook, LinkedIn, Instagram, and others are central to marketers’ ability to drive sales and increase brand visibility.

“This is my twenty-sixth year working in the financial world, and I was part of the early discussions of whether you should even dip your toes into social media,” says Meegan Siegwarth, vice president and senior marketing manager at Interra Credit Union ($1.8B, Goshen, IN). “Now we’re hiring people specifically to manage corporate social media, strategy, and plans. Things certainly have expanded.”

Engaging via social media comes with risk, but so does abstaining. Credit unions need to be where their members are. That’s why a growing number are navigating regulatory compliance, setting guidelines, and establishing approval processes to help mortgage, investment, and deposit teams establish a presence on social.

Interra allows its mortgage staff to post on social — after completing a 90-minute training course on social media do’s and don’ts and sending the post for review and approval.

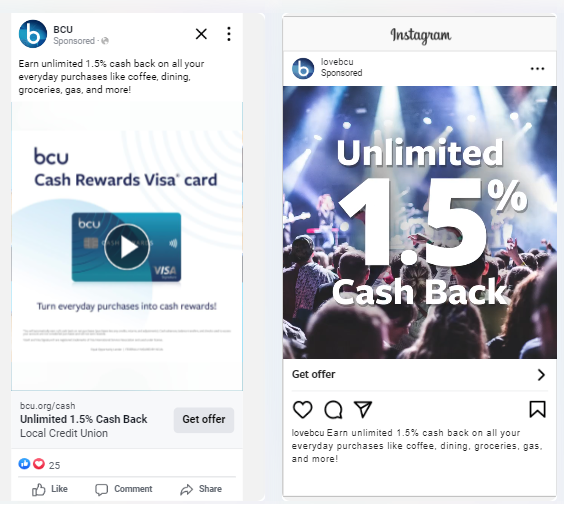

In Illinois, BCU ($6.0B, Vernon Hills, IL) has revamped its social media policy to include online-exclusive offers and lead generation forms that track members and prospects coming in through social.

“Paid social campaigns are a great way to drive brand awareness, increase visibility, and reach potential new members,” says Erin Macasek, senior director of integrated marketing at BCU. “It is a lower cost paid media channel and has become one of the top drivers of traffic to our website, which is a key engine for member growth.”

Social As A Vehicle For Service And Engagement

Interra boasts a social following that includes 10,600 Facebook followers and 5,000 LinkedIn connections, and its weekly Facebook postings have increased 28% as the credit union shares information about community activities, fraud, and finances alongside the occasional post about product information.

“We also share information individuals might not know, such as ways to make good financial choices and great ways to save,” Siegwarth says. “With inflation and the cost of living increasing, we’re trying to make sure our social media messaging is more informative to help people through some of the challenging times.”

For its 26,071 Facebook, 18,648 LinkedIn connections, and 1,855 Instagram followers, BCU focuses on quality engagement across platforms versus simple volume, which, Macasek says, is a departure in the past year from its past strategy.

“We prioritize engaging content, especially video, which has proven to be highly effective in capturing attention and fostering interactions,” Macasek says. “This change reflects our recognition of the diversity of our audience. While we continue to create content that resonates with our current followers, we are also strategically growing our presence on platforms like Instagram, where there is a significant opportunity to connect with a younger demographic.”

BCU is assessing a variety of online ad formats, including animation and video. The ability to target specific demographics to make the most of ad purchases is a major benefit of advertising on social, and BCU’s marketing team is particularly encouraged by the results of one recent animated ad, which returned an above-average click-through rate of 2.42% and a low cost-per-click of $0.19. This summer, the credit union will post its first social-exclusive offers.

Notably, although TikTok is viewed by marketers as the premier social platform for young people, Interra has a small presence on the platform and is taking a wait-and-see approach to determine whether it will dedicate more resources to the short-video platform. Siegwarth says a credit union’s voice and engagement must be in sync with whatever social platform it’s on, and dedicating resources to TikTok, which Congress might ban in a few months, might not make sense.

“Instagram and X require instantaneous responses and capabilities,” Siegwarth says. “We want to make sure we have staff that can handle the appropriate responses that match the company’s voice. TikTok has different messaging and different mediums, more videos and more reels than just a straight message.”

Social As A Vehicle For Sales And Employment

At Interra, mortgage and investment teams have their own pages on LinkedIn and have been anxious to use the platform to build relationships and uncover leads.

A Standard For All Staffers

All BCU employees must sign off on a list of do’s and don’ts for social media that include:

Don’t:

-

Disclose confidential info obtained through employment.

-

Respond to members posts unless you are authorized to do so.

-

Post photos of fellow employees without their consent.

-

Create social media accounts on behalf of BCU.

Do:

-

Share your fun experiences at BCU events.

-

Show your volunteer work.

-

Ask friends to follow BCU.

“Our mortgage team uses social media to tout their relationships along the same lines of how real estate agents use their social media,” Siegwarth says. “We have lenders who love to post pictures that show a recent closing or a new business partnership.”

Before taking advantage of social media opportunities, however, Interra first had to ensure it had the right resources in place to monitor an environment in which posts appear 24 hours a day. After learning about a social media management company during a Callahan & Associates roundtable, Siegwarth turned to the third-party service for support reviewing content before posting it for staff members and monitoring media channels for coverage of Interra.

To address regulatory requirements surrounding lending, last year Interra put its mortgage lenders through an hour-and-a-half training course on proper protocols for posting on social channels while staying compliant. For example, they can’t use the words “free” or “guaranteed.” Posting rates is prohibited, as is altering branding, logos, or font. And all images must be approved.

“When posting an image of a home, the image has to represent the general public we’re serving,” Siegwarth says. “A lot of our 24 counties do not have multi-million-dollar homes, so when we’re posting images of homes, we need to have homes that represent us.”

Like Interra, BCU’s social media policy helps maintain the integrity of the brand by ensuring employees remain compliant with privacy laws and protect sensitive information.

“It provides clear guidelines for employees on what they can and cannot share, which fosters trust and consistency across all online interactions,” Macasek says.

BCU does urge employees to share positive experiences and accomplishments to create a relatable, trustworthy presence in the digital landscape. Interra encourages the same types of posts, particularly on LinkedIn where job seekers are likely to visit.

“People look at social media to say, ‘How do they treat their employees? What can I find out about the culture of the company?’” Siegwarth says. “So, we’re deliberate in sharing and celebrating employees’ successes, our hiring standards, even some of our benefits.”