Arizona Federal Credit Union ($1.4B, Phoenix, AZ) is at the leading edge of mobile technology. The billion-dollar institution allows members to deposit checks from their smartphones, make payments through their iPhone or Apple Watch, and even control their credit union debit or credit card in near real time. And now, members can ditch their clunky, complicated passwords in favor of touch and eyeprint identification.

Here, Eric Givens, senior director of digital banking for Arizona Federal, discusses the credit union’s digital banking department, how to streamline the mobile experience, technical education for membership, and of course eyeprint ID.

How long has Arizona Federal had a department dedicated to digital banking?

Eric Givens: About two years ago we established a future payments task force, which included our CEO, vice president of customer experience, marketing, and cards. We met regularly and ultimately decided to create a new department focused on digital banking. We have had a department focused on digital banking since approximately the year 2000. It used to be called E-Services.

CU QUICK FACTS

Arizona FCU

Data as of 06.30.15

HQ: Phoenix, AZ

ASSETS: $1.4B

MEMBERS: 121,464

BRANCHES: 18

12-MO SHARE GROWTH: 4.4%

12-MO LOAN GROWTH: 8.3%

ROA:1.55%

The credit union established the Digital Banking department in March of this year to drive innovation and serve as a think tank. I was previously focused on risk management in our plastic cards area, but as we started to focus on the future of payments, my role changed significantly.

How big is the department?

EG: There are four of us in the department currently myself, a digital banking manager, and two digital banking specialists.

Where does the unit fall within the credit union’s org chart?

EG: I report to the chief experience officer, who oversees all of our branches, operations, and marketing.

As you can imagine, we partner heavily with IT, marketing, and the branches. This organizational structure encourages ongoing interaction with those areas. We are finding that as we add new digital products, we need to spend time educating our branch staff so they are comfortable having discussions with members.

How long have you been offering Eyeprint ID? How does it work?

EG: We’ve been offering Eyeprint ID to our members since September 2, 2015, so just about a month and a half. However, we began discussing the option back in April with our online/mobile vendor and internally had access to technology back in July so we could fully test it before rolling it out to the membership. We were one of the beta institutions to first to pilot the technology in mobile banking.

How does it work?

EG: The latest version of our mobile banking app allows members to activate Eyeprint ID on both Apple and Android devices. Eyeprint ID uses the smartphone’s camera to scan and map the unique vein pattern in the user’s eyes and creates a digital key.

Members have to position their phone to allow the app to scan the whites of their eyes instead of keying in a password. The process is meant to be extremely quick, especially for members with newer phones that include higher resolution cameras. Early morning or late night scans can take longer due to the lighting, but this is the first iteration of the technology so we expect the functionality to improve in the future. Our ultimate goal is for Eyeprint ID to allow a member to hold their phone down, just as they normally would, and simply glance at it for the scan.

Why did the credit union implement this? How did the idea surface?

EG: Our goal is to consistently provide new and more secure ways for members to access their accounts, so we are always on the lookout for new technology that will help us do that. We want to give members the options and let them choose which is most convenient for them.

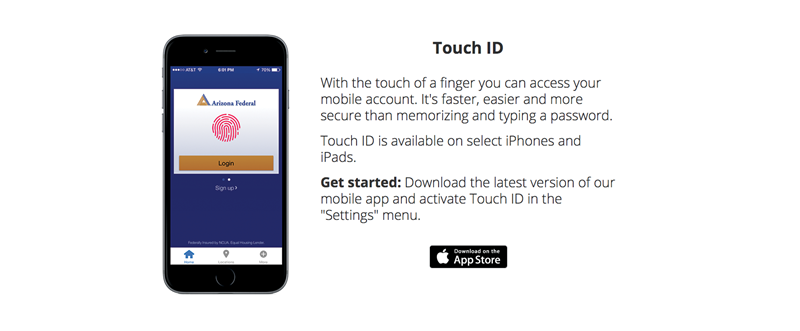

The credit union launched Touch ID back in June of 2015, but that was only for certain Apple devices. So we were looking for something similar to offer our Android and non-Touch ID users. Our membership’s Android-to-iPhone usage is almost exactly 50/50. We have approximately 50,000 unique mobile logins each quarter and on average we see about 400 more logins from an Android device, so we needed to offer something for those members. Coincidentally, we talked with our mobile vendor, Digital Insight, about Android options at that time and expressed our interest in being part of its Eyeprint ID pilot.

You promote Apple Watch access and Apple Pay on your website. Do you receive any negative feedback from non-Apple users?

EG: You see more Apple options because it has the functionality already. Our fear was that we would be too Apple heavy, but there just haven’t been comparable options on the Android side yet, and we didn’t want to withhold anything from our members who might benefit from using what is available.

We try to do things like upgrade both versions of our app at the same time to keep things as equitable as possible. We are also researching other smart watches/mobile wear and looking to implement other mobile payment options in the future.

How does Eyeprint ID usage compare to Touch ID?

EG: The usage so far has been greater than we expected. We’ve had 3,700 unique users so far in October, so the adoption is growing rapidly. By comparison, the unique user count of Touch ID is 6,600 members, which represents 40% of eligible devices over the past four months.

The most surprising thing is there are a lot of members using both Touch ID and Eyeprint ID. Internally, we assumed Touch ID would be the simplest option, but we’re finding some members like Eyeprint ID better or are using both.

This goes back to the credit union providing options. In some ways, Touch ID served as training wheels to help members feel more comfortable adopting biometrics of all kinds. If you’re used to using your thumbprint already, the Eyeprint technology is not as big a leap.

What advice would you give other credit unions that want to enhance their mobile options?

EG: Train staff, especially in the branches and call center, on new features and functionality. If you engage staff and they are comfortable using the new options, they will be more likely to talk with members and encourage adoption.

We don’t expect every staff member to be able to troubleshoot every issue we have specialized support to do that but we do want everyone to understand the basics and try out the technology.

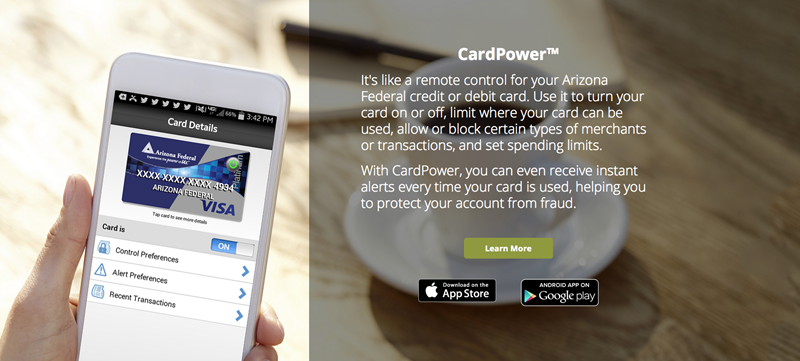

One thing we’ve done is hold a mobile day at one of the newer branches. The entire, four-person digital banking team spent the whole day in the branch working with staff and talking with members about the new options we offer. From that day alone, we saw 32 new registrations for mobile banking, mobile deposit, and our CardPower app, which acts as a virtual remote control for your debit card. You might assume a 65-year-old grandmother who visits the branch every Friday wouldn’t have an interest in our new mobile capabilities, but the CardPower app interested a lot of our baby boomer members. Some of these members had never downloaded an app but were so excited about having this type of added security that we were able to walk them through the process.

We’re hosting our first open event, a Mobile Solutions Workshop on November 5 to help other members that might still feel leery about going mobile.

Lastly, I would remind other credit unions that not everything is going to be a roaring success when you’re trying out new technology. We know there might be failures along the way, but we will learn from those. We can’t be afraid to fail.