Credit unions have heard it all before. The regulator says the Allowance for Loan Losses (ALL) is understated. The CFO says it is just right. The CEO is convinced the ALL balance is overstated and can’t understand the rationale of either the regulator or the CFO.

Why is there still so much confusion over this critical accounting measurement? Will the confusion diminish over time? Or will it increase with the pending changes to the allowance accounting model?

Credit unions have only been following ALL accounting standards since the mid 1970s. Before that, credit unions charged loan losses directly to the Regular Reserve, which was funded through an allocation of undivided earnings based on set percentages of gross income. As credit unions built capital, regular reserve levels increased. These reserves could more than adequately absorb loan losses; however, there was no income statement recognition for impaired loans. So credit unions’ financial statements, most importantly their income statements, didn’t truly reflect their financial performance. ALL accounting provided an accrual-based approach to recognize loan impairment and bridged the timing gap between when an impairment event occurred and when the credit union charged off of the loan balance. To this day, some credit union executives compare the volatility in earnings created by the new accounting standards to the old approach and long for the good old days.

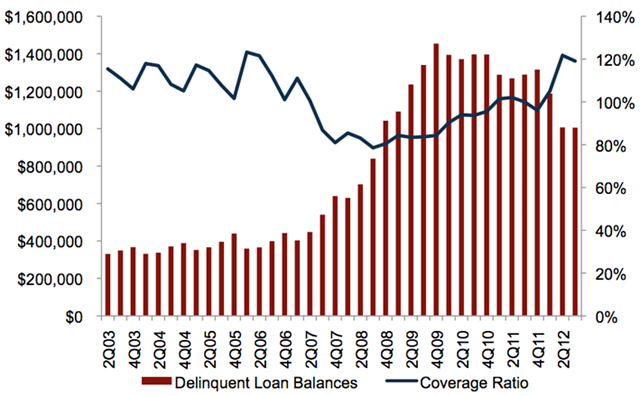

GAAP standards, especially with respect to the ALL, have had a major impact on credit union financial performance and net worth levels. For example, NCUA changed the rules on how credit unions report delinquent troubled debt restructured loans this past quarter. Subsequently, credit unions posted a significant decline in delinquent loan balances, which appears to have reached a peaked in fourth quarter of 2011, and an increase in ALL coverage ratios. (Click here to see which state has the highest coverage ratio.)

DELINQUENCY & COVERAGE RATIO | DATA AS OF SEPTEMBER 30, 2012

Callahan & Associates | www.creditunions.com

Generated by Callahan & Associates Peer-to-Peer Software.

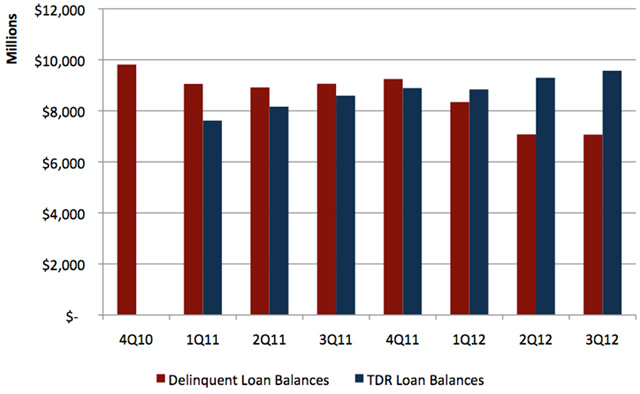

This favorable trend is most likely caused by a combination of factors, including improved economic conditions and the regulatory change to delinquency reporting of TDR loans. However, it appears the amount of loans categorized as TDR is increasing. There is still a lot of variability in the manner in which credit unions are accounting for TDR loans, especially with regard to re-default rate assumptions (see more in item 3 below).

DELINQUENCY & TDR BALANCES | DATA AS OF SEPTEMBER 30, 2012

Callahan & Associates | www.creditunions.com

Generated by Callahan & Associates Peer-to-Peer Software.

CFOs should be aware of a potential sea change coming down the pike on the ALL and the significant, negative impact this change will have on credit unions. FASB is seriously considering revising the ALL accounting model from the incurred loss approach to the expected loss approach. Under the new model, credit unions would fund the ALL based on estimates of total lifetime expected losses as of the measurement date as compared to estimating loss on loans when an impairment event has already occurred. This change in accounting models could increase the ALL balance by a factor of two to three times current levels. Consequently, capital levels could significantly decline, causing yet another negative impact to credit union financial structures simply due to changes in the accounting rules.

As year-end approaches, credit union executives should be alert to this potential change in the ALL accounting model. It is likely to occur over the course of the next few years, and under current rules, credit unions will be required to conform to these changes. In addition to evaluating pending expected loss model issues, credit unions should evaluate the following issues before closing the books at December 31, 2012:

1. Improving Economic Conditions Should Have Favorable ALL Impact Although the U.S. economy is still weak, improvements in many parts of the country should result in favorable Q&E factors and reduced ALL balances. Remember, it is not conservative to overstate the ALL balance. The objective is to have an ALL balance based on appropriate estimates that consider current economic conditions and internal loan portfolio characteristics.

2.Appropriately Document Q&E Factors It’s been almost four years since the topic of Q&E factors has been a hot topic, yet many credit unions still fail to appropriately document their Q&E factors. Auditors and examiners are going to challenge this area be prepared.

3. TDR Loans Require Re-Default Estimates Proper TDR accounting requires an estimate of future cash flows, which then are discounted to their present value. A critical aspect of estimating those future cash flows requires re-default estimates. As a simple example, a TDR mortgage loan with a $400,000 loan balance and a property value of $350,000 might have much different cash flow predictions as compared to a $400,000 loan balance with a property value of $200,000.

4. Review The New NCUA Regulation On Loan Workouts, Nonaccrual Policy, And TDR ReportingIt is critical credit unions review new regulation because it contains many important accounting implications. It also significantly impacts governance, which has implications for the members of the board of directors and supervisory committee.

What You Need To Know About ALL

Join Mike Sacher and Callahan & Associates for the latest on

credit union asset quality trends and changes in regulatory

reporting. Then review tips on what to prepare for in 2013.

Learn More