Top-Level Takeaways

-

The former Pacific Northwest Ironworkers FCU changed names after getting a national charter and now has members in 17 states.

-

Word of mouth online, on the job, and in union halls is its best marketing tool, and digital offerings seal the deal.

-

Longtime CEO Teri Robinson says her small shop shows that single-focus credit unions can still do big things for members when they need it most.

CU QUICK FACTS

Ironworkers USA FCU

Data as of 12.31.19

HQ: Portland, OR

ASSETS: $39.5M

MEMBERS: 6,676

BRANCHES: 3

12-MO SHARE GROWTH: 16.0%

12-MO LOAN GROWTH: 25.5%

ROA: 1.94%

Ironworkers USA Federal Credit Union ($40M, Portland, OR) has a simple strategy for getting business from its members. We ask them for it, says president and CEO Teri Robinson. And then we earn it.

This little lending engine that could has earned enough business to go from the brink of extinction to sharp growth and now nationwide expansion as it keeps a tight focus on the particular needs of its labor union membership.

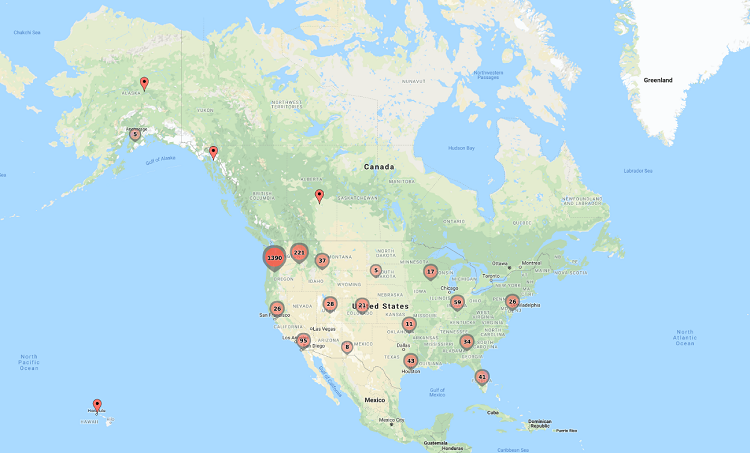

Until recently, Ironworkers USA was Pacific Northwest Ironworkers FCU. The new name results from a 2018 charter expansion that allowed members to join from beyond the original FOM of Oregon, Washington, and Idaho. There now are members in 17 states and one Canadian province.

Marketing consists primarily of word-of-mouth – in person at union halls and on the job, and on the internet. The credit union has been gaining two or three new members a day online, Robinson says, and a single posting recently on closed Facebook page for union ironworkers generated 40 new members in one day.

This is how our members are. They talk to each other, and they’re our best promoters, Robinson says.

This map shows where Ironworkers FCU now has members as the credit union grows from its Pacific Northwest base.

For its part, Ironworkers USA delivers the goods with modern banking tools such as a robust website, Android and iPhone mobile apps, RDC, and electronic document signing. They also closely track member activity on the back end, gleaning credit reports, watching transactions, and seizing opportunities to reach out with a better deal.

For instance, Robinson says, When a member or dealer calls in for a payoff, we ask for the new loan. We make the member talk to us and then we show them the kind of deal we can make them.

Ironworkers USA is organized to handle that strategy. The credit union has 11 employees based at three branches with no traditional teller lines. Everyone is trained as a loan officer and the credit union plans to continue its growth nationally by serving members via phone and other digital channels, in any way they can.

We all are responsible for knowing a little about a lot, Robinson says.

Such proactivity has resulted in an operation that currently is 114% loaned out and now looking at selling loans and non-member deposits.

It hasn’t always been this way.

A Decade Of Recovery

This progress sits atop a decade of recovery that began at a low point, with the tiny cooperative facing a future uncertain at best. Its membership also was in crisis.

Teri Robinson, President and CEO, Ironworkers USA FCU

Robinson joined Pacific Northwest Ironworkers as lending administrator in 2009 after 20 years in the movement with a variety of other cooperatives. She was made CEO in March 2010 after the NCUA downgrade forced a change in management.

The Great Recession was in full bloom and unemployment was 20% to 30% among the credit union’s membership in Portland and to the north in Spokane and Seattle, WA. Loan losses combined with corporate credit union investment losses and the NCUA bailout assessments depleted capital to the point where the NCUA put Pacific Northwest Ironworkers under a net worth restoration plan and Letter of Understanding.

Times were hard, and it was also time to see if our members still needed us. I thought they did, and we forged forward, more determined to survive than ever, Robinson says.

The rebuild began. One of the first moves was to purge dormant accounts, which dropped membership from 7,100 to 4,800 in just a few months. When Robinson took over, there were only about 600 checking accounts. Today, there are about 6,700 members with 3,000 checking accounts.

The credit union also secured two injections of secondary capital, $250,000 each in 2012 and 2014, and finished paying that back in 2019. And assets have quintupled from the $7.6 million the credit union had when Robinson took the helm.

Person-to-Person Marketing And Education

Financial education stands side-by-side with person-to-person marketing in Ironworkers USA’s secret sauce for sustained success. It began with the basics, with financial education provided during the apprenticeship training at union locals.

Those new ironworkers talked to others about the experience they had with us. It was a real grassroots effort by our members that helped start spreading the word about us, Robinson says.

Next, we doubled down on our focus to help ironworkers who were being preyed upon by predatory lenders, Robinson says. She those members are easy to spot in the data. They comb their ACH and debit transactions, looking for such payees as LendingClub, One Main, Harley Davidson, and anything with Cash’ in the name,” Robinson says, and they find members paying up to 700% for loans.

From there, the credit union’s staff reaches out to the members with a better offer. One example: a member who saved $568 a month by combining a car and personal loan into one note with his credit union.

The credit union’s RDC app also doubles as an alarm system, showing members depositing checks they got in the mail from a high-interest finance operation. They get a call from us trying to head that off, Robinson says.

FACEBOOK POST

Word of mouth, such as this Facebook post, provides much of the marketing muscle for Ironworkers USA FCU.

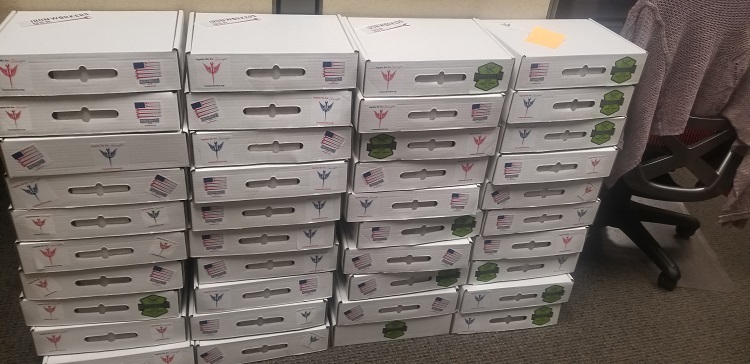

BOXES LINED UP

Here are boxes full of swag readied to be mailed out to new members soon after the credit union initiated its new membership push.

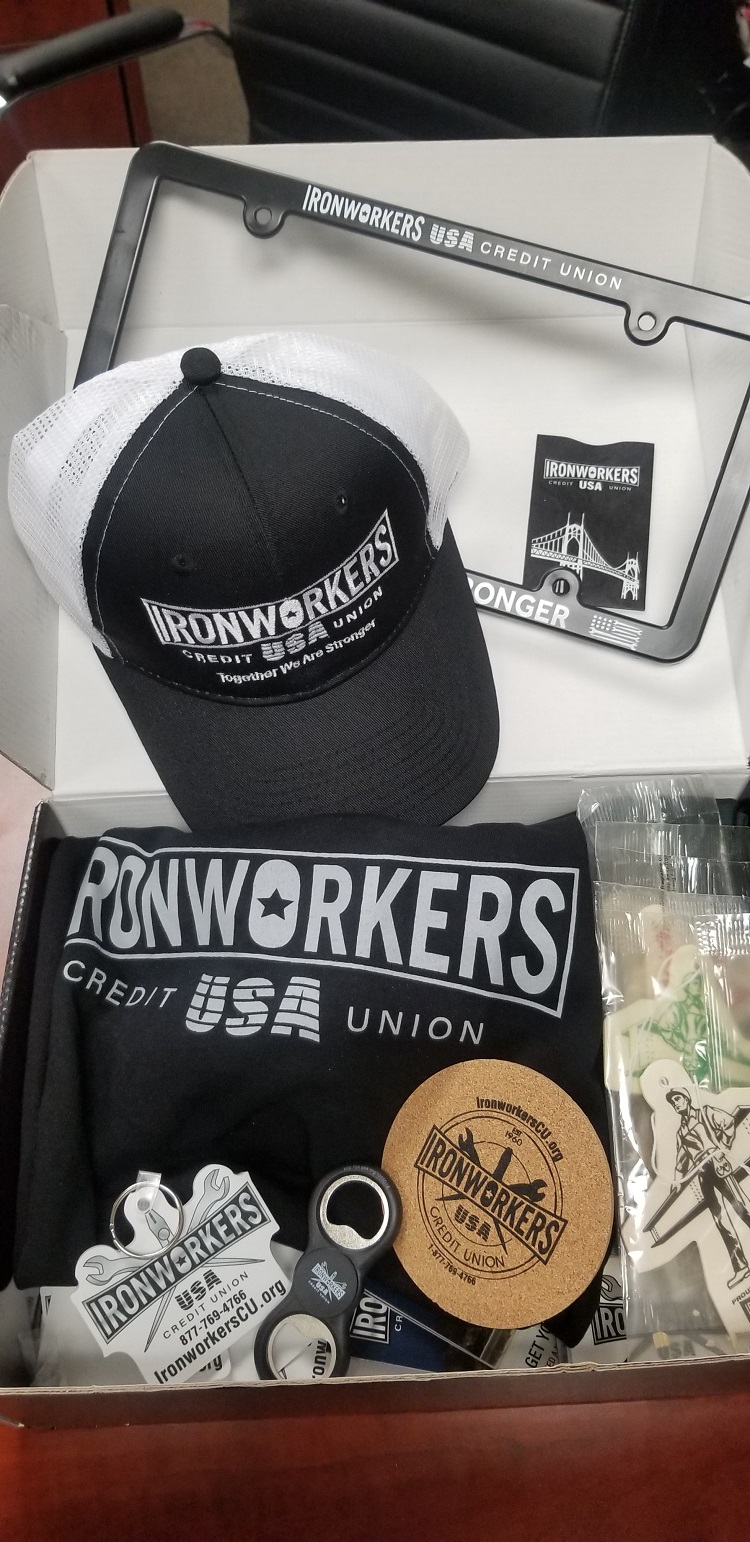

IRONWORKERS SWAG

Hats, shirts, license plate brackets, and hardhat stickers are among the swag that new members get when they join Ironworkers USA.

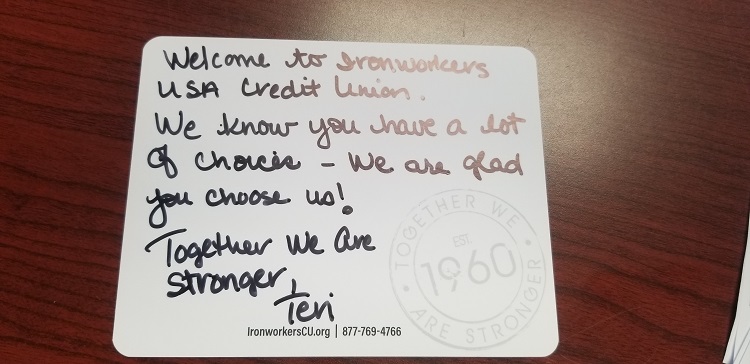

WELCOME CARD

New members also get this personalized note from the president of their new credit union.

REDESIGNED BOX

Ironworkers USA just redesigned the box that carries the swag the Oregon-based cooperative sends to new members.

Better Credit Than Karma

Whether it’s an online loan or cashing that unsolicited check, the question that comes to mind, the veteran credit union manager says, is what would make people sign up for this stuff. She says the answer is clear. It’s the ease of doing it combined with the fear of being denied.

That’s why being so proactive is the only way to counteract the effectiveness of fintechs like Credit Karma, which sells its lists to finance outfits who offer loans that are easy to get but hard to swallow, Robinson says.

The rank-and-file members weren’t the only ones who had to be sold on the credit union’s approach. The credit union’s board not only had to buy in on the charter change, but also needed to accept the reality that such aggressive lending will result in some casualties.

I have a very aggressive and supportive board, Robinson says. They all understand the direction their credit union is headed in and understand we are here to loan to ironworkers. Things happen, they realize that, and sometimes a loan or two will go bad, but statistically we know those members will eventually pay when they get back on their feet.

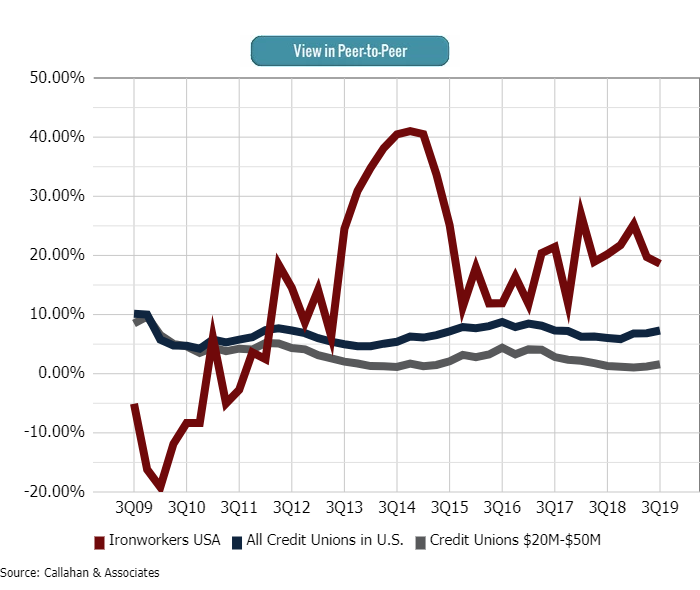

ASSET GROWTH

FOR U.S. CREDIT UNIONS | DATA AS OF 09.30.19

© Callahan & Associates | CreditUnions.com

After plummeting during the Great Recession, Ironworkers USA’s asset growth has outpaced both its peer group average and the credit union movement as a whole. Assets have nearly quadrupled in that period, from $10 million to morethan $38 million.

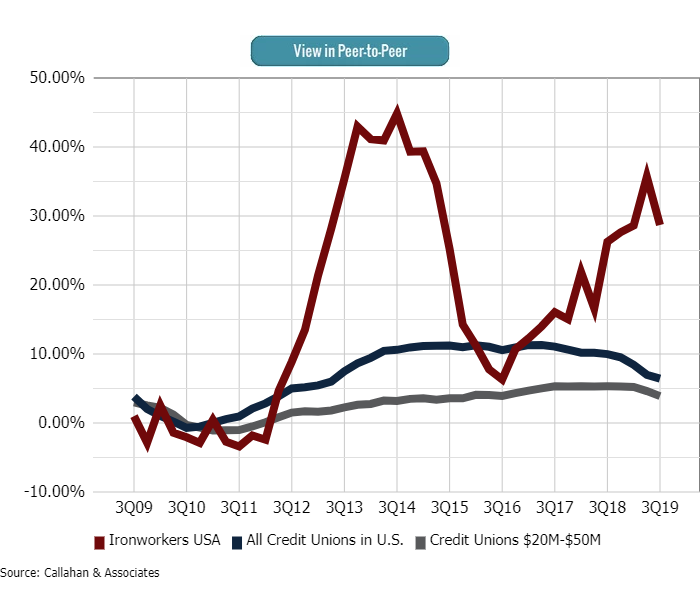

LOAN GROWTH

FOR U.S. CREDIT UNIONS | DATA AS OF 09.30.19

© Callahan & Associates | CreditUnions.com

Ironworkers USA has been punching well above its weight class in loan growth for several years. That includes 28.7% year-over-year in the third quarter of 2019, compared with 6.43% for all 5,396 credit unions in the Callahan database and3.90% for the 1,014 in the $20 million to $50 million asset group.

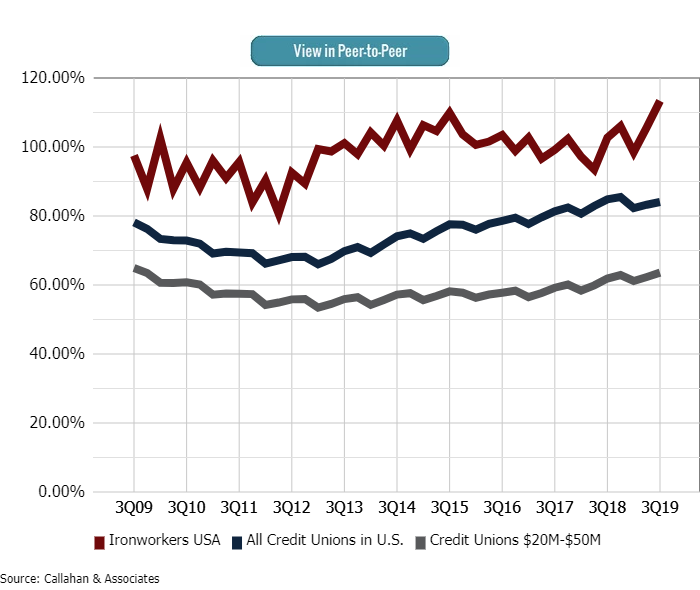

LOAN-TO-SHARE RATIO

FOR U.S. CREDIT UNIONS | DATA AS OF 09.30.19

© Callahan & Associates | CreditUnions.com

Even during its lean years, Ironworkers USA stayed well loaned out. At the end of the third quarter 2019 its loan-to-share ratio was 113.37%, among the highest in the movement, especially among small credit unions.

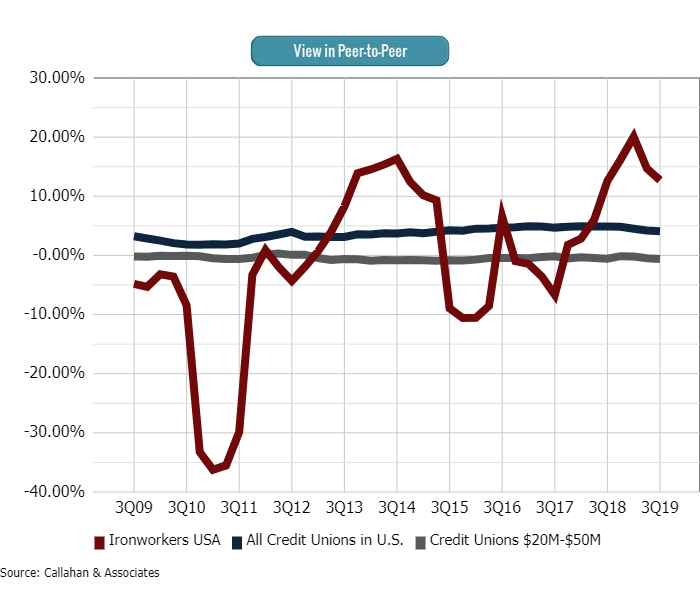

MEMBER GROWTH

FOR U.S. CREDIT UNIONS | DATA AS OF 09.30.19

© Callahan & Associates | CreditUnions.com

Cleaning the books of dormant accounts caused a sharp drop in membership in Teri Robinson’s first years at then-Pacific Northwest Ironworkers FCU. Since then, membership has grown from a low of about 4,800 to nearly 6,800.

The Tale Of The Tape

Ironworkers USA’s delinquency rate and net charge-offs for the fourth quarter of 2019 were 1.53% and 0.70% respectively, compared with 0.66% and 0.47% for all 5,396 credit unions nationally.

However, unlike many small credit unions that serve low-income markets, Ironworkers USA members make solid union wages, although they are susceptible to the vagaries of the economy. So instead of offsetting risk with higher rates, Ironworkers USA’s rates are actually at or below average. For instance, used car loans currently average 7.34%, compared with 10.14% for the 1,014 credit unions in the $20 million to $50 million asset class nationwide and 9.14% for all credit unions.

The credit union also is now profitable. Capital grew a healthy 22.36% year-over-year, and its ROA was 1.94%, a full percentage point above the national average of 0.90%. And tellingly, its Return of the Member score, a proprietary Callahan measure of member usage and value, was a strong 84.71 out of 100.

It hurts my heart to see so many credit unions just going away, saying they can’t compete, they can’t handle the regulations, they can’t offer the services their members want and need, Robinson says. We’re out there every day showing they can. And credit unions like ours are needed more now than ever.