Twenty years ago, the sum total of many employee ideation programs took the form of a dusty suggestion box hanging on a breakroom wall. Today, businesses actively seek innovative ideas from their staff — some are even paying for them.

In late 2018, TruWest Credit Union ($1.5B, Tempe, AZ) launched an initiative to gather ideas on how to save money and improve services to members. The Brilliance Program allows employees to log in to an in-house platform, post new ideas, and comment on others. They can even earn thousands of dollars in incentives if the credit union selects their idea. So far, the program has saved $4.7 million in labor and expenses.

Initially, the credit union charged a group of vice presidents — the Brilliance Squad — with finding ways to control costs and reduce friction for members. One of the group’s ideas was to ask employees, the people that live and breathe this every day, for their ideas and let the best ones bubble up, says Sarah Hancotte, vice president of strategy at TruWest.

Hancotte’s three-member team, which serves as a project management office for the credit union, runs the Brilliance Program. The team reports to the CIO but works with all departments, keeping a “holistic” connection with the different areas, she says.

New Ideas In A Crowded Market

TruWest serves approximately 90,000 members via 270 employees and 11 branches in the fast-growing communities of Phoenix and Austin, TX. Competition for members in both markets is fierce, so the credit union is constantly looking for ways to stand out.

Hancotte started her career as a teller 25 years ago. She joined TruWest in 2007, working in branch operations and IT before moving to the strategy department three years ago. That’s when she inherited the Brilliance Program. A key duty of Hancotte’s team is to host the idea platform and manage the projects that arise from it.

“The idea was to create this process where anybody throughout the organization can submit an idea to this platform,” Hancotte says.

The credit union’s development team built the submission tool, which allows employees to describe the friction they’ve identified and offer a suggested solution. Hancotte’s team rates the ideas as good or great, with great indicating the idea could result in measurable savings of expenses, labor costs, or member time. The team then submits the idea to the Brilliance Squad, a group of vice presidents or their designees.

“We picked them because they would have a certain level of knowledge to be able to do a high-level review of an idea,” Hancotte says.

Among the many variables, the Brilliance Squad must consider whether the idea is viable from a regulatory standpoint, if it makes sense, how much friction the problem creates, how widespread the problem is, and what kind of value the idea would bring to the credit union.

If the squad green-lights an idea, Hancotte’s team validates the potential benefits with metrics related to frequency, cost savings, and time savings. Then, the team sends its findings and a recommendation back to the Brilliance Squad. If the investment is small and the value to the organization is big, the squad sends it to the senior leadership team for final approval.

Hancotte says the squad’s review process, which TruWest has opened to a wider range of managers, is helping to break down silos in the organization.

“Having people with different opinions from different work areas representing each senior leader is an opportunity for employee engagement and growth,” she says. “When you’re part of the squad, you have conversations with different business units on a biweekly basis. You build relationships and your understanding of how you connect to the larger web of all the other credit union areas.”

Ideas To Improve The Member Experience

Although many of the initial ideas focused on metrics such as total realized savings and department capacity, Hancotte says the credit union is starting to focus on ideas that save time for members and improve their experience.

“The spirit of brilliance is that we want to double our assets without doubling our workforce,” the VP says.

CU QUICK FACTS

TruWest Credit Union

DATA AS OF 12.31.22

HQ: Tempe, AZ 85288

ASSETS: $1.5B

MEMBERS: 90,309

BRANCHES: 11

EMPLOYEES: 269

NET WORTH RATIO: 10.5%

ROA: 0.78%

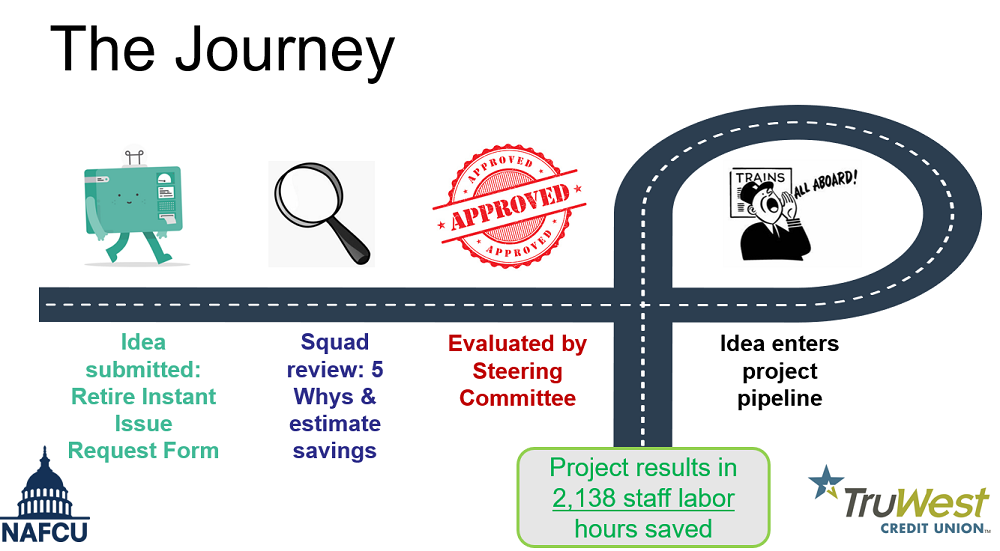

For example, someone in branch operations suggested eliminating a request form for an instant-issue debit card to replace a lost or stolen card. The form had been in place for years, and the credit union already had the information it requested on file; still, the member had to wait for an employee to complete the form before getting the new card.

That was the friction, Hancotte says. Why did employees have to fill out this form to make a card for a member? The credit union challenged the form, asking if it was needed. Was it required for compliance? If so, was there another way of doing it? Ultimately, TruWest eliminated the form and estimates that action saves 2,100 staff hours a year.

“That’s more than a whole person of time savings just by not doing a form anymore,” Hancotte says.

Eliminating the form also trimmed as much as five minutes off the time it takes to provide members with a new card — which can be precious savings for someone stopping by the branch during a lunch break.

Another employee idea implemented in February 2022 streamlined the process for clocking in after lunch or other absences. Multifactor authentication meant employees had to wait two minutes for a text or email message with a verification code to clock in. The tech team created an API widget that now allows employees to clock in on the intranet without multifactor authentication.

The credit union pushed out the widget within two months, saving the credit union 3,200 hours a year.

“If you think about the frequency of how often employees are having to do this and how many nonexempt employees we have, it’s amazing how it adds up,” Hancotte says.

New Money, And Social Recognition, For New Ideas

Hancotte attributes the success of the program to the fact TruWest incentivizes employees to contribute ideas. If the credit union implements an employee’s idea, that employee receives a cash award of 5% of the projected annual cost savings.

For example, an idea by the network and records teams to consolidate printers — many of which were rarely used — saved the credit union $42,000 a year. The two employees who submitted the idea received an award of $2,100.

“Recognition and communication is huge,” Hancotte says. “That is the biggest way we’ve been able to keep the steam going on. We’re recognizing not only the people who do the work but also the people who submit the ideas.”

The credit union generally looks for a return on investment in the first year, and the savings must be repeatable over three years to be counted in the Brilliance Program results.

The credit union recognizes successful projects via email to all employees. At the annual awards ceremony in January, employees receive plaques in a variety of categories, including the most liked (based on likes the idea received on the platform), highest dollar savings, and savings by department.

“People see stuff being done with these ideas,” Hancotte says. “They’re not just submitting ideas to a platform, and they sit there and die. It builds trust. Then, people continue to submit more ideas.”

Another key success factor is the social nature of the idea platform. Unlike the old-fashioned suggestion box, ideas submitted for consideration are open for all employees to like and comment on. Even if an employee never submits an idea, they can help highlight and build momentum for others’ ideas.

Early on, the credit union discussed allowing employees to submit ideas anonymously to remove potential inhibitions and generate more ideas. It added an option for three months to submit ideas anonymously, but only one person did so.

“Maybe at first it was tough for people to trust it enough to submit, but let me tell you, there are people who are not afraid,” Hancotte says.

Lessons Learned

Among the lessons learned from the program is that the credit union must engage employees, but the ideas need to be grassroots. When the platform launched, TruWest managers encouraged employees to submit ideas. But for some employees, doing so was like checking a box.

“Some of the ideas we got were ‘I don’t like the level of potato chips in the vending machine,’” Hancotte says. “There’s not much I can do about that. There’s no friction. But on the other side, it got people used to the program. People knew how to submit ideas. They knew what it was about.”

Some ideas might not identify a friction, but the credit union can still work with the feedback. For example, ideas focused on personnel issues are redirected to HR for follow-up.

Another crucial element is management support. According to Hancotte, CEO Alan Althouse has supported the program since its inception and helps keep the program — which saves the credit union about $1 million a year — top of mind throughout the organization.

The program has been successful enough that the next steps are to expand its philosophy.

“Our next step is doing this in everything we do,” Hancotte says. “Every corporate project that comes up, we ask the questions, ‘What is the value to the organization? How can we document and track this? What metrics are we using?’ So, that’s what’s next, letting it be part of everyday life and part of every strategic initiative.”

How Do Your Expenses Compare?

LEARN MORE