Total loan balances outstanding as U.S. credit unions grew 19.4% annually as of Sept. 30, 2022. Shares, on the other hand, expanded just 6.5%. Consequently, the industry loan-to-share ratio increased to 78.3% — an 8.4-percentage-point jump from one year ago.

Although this key liquidity measure remains below pre-pandemic levels, it has increased at the fastest pace in more than 20 years. Additionally, rising interest rates have left many credit union investment portfolios holding large balances of unrealized losses. Naturally, many CFOs are unwilling to sell these bonds and “realize” these losses, which puts further strain on cash and liquidity.

Total Investments Decline To Fund Lending

Total investments held by credit unions — including cash balances — declined 7.4%, or $49.0 billion, during the third quarter to $608.3 billion as of Sept.30. In total, $115.7 billion has flowed out of investment portfolios during the past two quarters, the largest decline in a six-month period on record by nearly $50 billion.

This outflow has reversed a sizable portion of the liquidity expansion posted during the pandemic. Total investments are now in line with industry totals at year-end 2020.

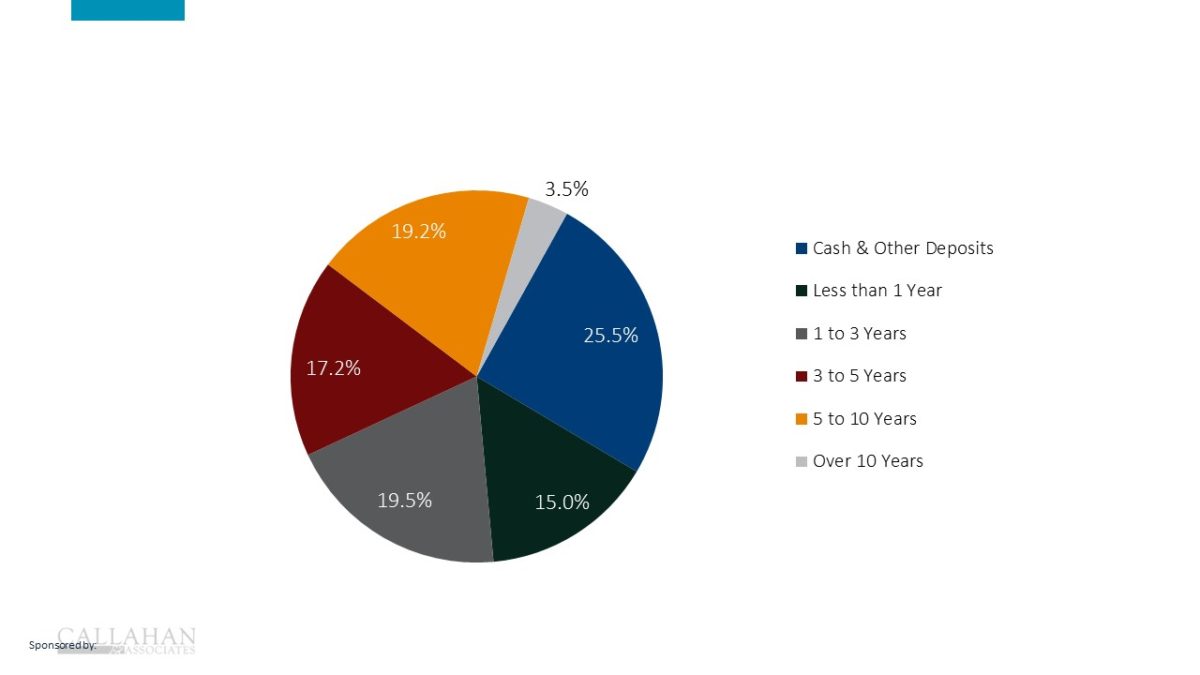

The primary driver of this decline in investment portfolios comes from cash balances, which declined 16.9%, or $31.4 billion, in the third quarter. Totaling $153.4 billion at the end of the third quarter, cash and equivalents comprised 25.4% of investments, down from 28.3% one quarter ago and 37.5% on year ago.

Despite the cash decline, cash balances on hand at credit unions increased 10.3% from June 30. This was the only investment category to expand during the quarter. Credit unions reduced cash held at the Fed by 23.8%, or $28.6 billion, quarter-over-quarter. Cooperatives have used significant cash to fund loans during the past six months; now, they will have to consider how best to generate liquidity to fund lending and help members.

Balances of non-cash investments decreased 3.7% quarter-over-quarter to $453.9 billion. U.S. government and federal agency securities — the largest investment asset category — suffered the largest quarterly decline in dollar terms. It contracted $15.0 billion, or 4.2%. Because this was a relatively small percentage decline compared to cash balances, this category’s share of the investment portfolio increased by 2.2 percentage points to 56.8% as of Sept. 30.

Other equity security balances, primarily mutual funds, declined 21.3% since June 30 and comprised slightly less than 1.0% of the investment portfolio.

INVESTMENT PORTFOLIO

FOR U.S. CREDIT UNIONS | DATA AS OF 09.30.22

© Callahan & Associates | CreditUnions.com

Long-Term Securities Grow In Dominance

With the Federal Reserve’s interest rate policy still setting the tone for the economy, termed investment portfolios have proven quite volatile throughout the past quarter and past year. Rising rates on newly issued securities have reduced the market values of held and available-for-sale investment securities, creating high levels of unrealized losses on credit union books.

Unrealized losses diminish as a credit union holds a security to maturity, when the institution can redeem the security at par. However, the need to hold onto investments to maturity — to avoid a realized loss — reduces a credit union’s liquidity profile.

For much of the year, credit unions have used cash holdings to fund loans. As a result, the overall concentration of investments on credit union books has shifted into longer-term securities. However, this occurred largely because the decline in cash was relatively greater than the decline in balances of securities and investments, not because credit unions were actively moving money into longer-term securities.

Credit unions did increase their holdings of securities maturing in more than 10 years by 3.5% quarter-over-quarter. This was the only maturity segment that expanded in dollar balance since June 30, although these long-term securities remain the smallest portion of the overall portfolio.

Yield on U.S. treasuries increased in the third quarter, compounding the growing gap between the two-year and the 10-year. The two-year increased 79 basis points in September alone to 4.28% at quarter’s end. The 10-year, however, increased to only 3.83%. The gap between the two-year and 10-year finished the quarter inverted 45 basis points.

Although liquidity to fund lending is the most pressing issue for many credit unions, right now, these yield curve dynamics are not making life easy for portfolio managers.

INVESTMENT COMPOSITION BY MATURITY

FOR U.S. CREDIT UNIONS | DATA AS OF 09.30.22

© Callahan & Associates | CreditUnions.com

REQUEST YOUR FREE REPORT

To request a complimentary copy of this quarter’s complete Investment Trends Report or to compare your institution against the industry or a specific peer group, contact Trust for Credit Unions at 800-237-5678 or TCUgroup@callahan.com.

Portfolios Lengthen

The average life of credit union investments increased to 2.95 years, up from 2.83 years in the second quarter. As credit unions fund loans with cash, the average remaining investment dollar has grown in term length.

Since the second quarter of 2020 — right after the first and largest pandemic-era liquidity shock, courtesy of the CARES Act — credit unions have gradually increased the average maturity of their investment portfolio. In 2020 and 2021, they did this by investing in longer-term securities to generate whatever excess yields were available. In 2022, lengthening has been more a result of contracting cash balances than yield-chasing investment strategies.

WEIGHTED AVERAGE LIFE

FOR U.S. CREDIT UNIONS | DATA AS OF 09.30.22

© Callahan & Associates | CreditUnions.com

Notional Balances Fall

Notional derivative balances increased $4.7 billion in the second quarter of this year; however, they declined $269.4 million in the third quarter and closed September at $33.0 billion. However, this is only a slight decline compared to growth during the past 12 months.

Year-over-year, total derivative balances outstanding have grown 27.2%, or $7.1 billion. One more credit union than last quarter reported using derivative, bringing the total number for the third quarter to 120. With further interest rate hikes forecasted in 2022 and 2023, more credit unions might turn to derivatives to manage interest rate risk.

TOTAL NOTIONAL DERIVATIVES

FOR U.S. CREDIT UNIONS | DATA AS OF 09.30.22

© Callahan & Associates | CreditUnions.com

Roman Ojala contributed to this report.

Trust for Credit Unions (TCU) helps credit unions succeed in serving their members by providing a professionally managed family of mutual funds — exclusive to credit unions — as well as the information and analysis they need to support investment decisions. Created by some of the leading credit unions with oversight by a board of trustees, TCU’s mutual fund options allow credit unions to meet their short duration needs, are professionally managed, and are based on the cooperative values of credit unions. Visit www.trustcu.com or call 800-237-5678 to learn more.

The Trust for Credit Unions (TCU) is a family of institutional mutual funds offered exclusively to credit unions. Callahan Financial Services is a wholly owned subsidiary of Callahan & Associates and is the distributor of the TCU mutual funds. ALM First Financial Advisors LLC is the investment advisor of TCU mutual funds. To obtain a prospectus which contains detailed fund information including investment policies, risk considerations, charges and expenses, call Callahan Financial Services, Inc. at 800-CFS-5678. Please read the prospectus carefully before investing or sending money. Units of the Trust portfolios are not endorsed by, insured by, obligations of, or otherwise supported by the U.S. Government, the NCUSIF, the NCUA or any other governmental agency. An investment in the portfolios involves risk, including possible loss of principal.