Wright-Patt Credit Union ($7.2B, Beavercreek, OH) has walked the talk for decades when it comes to building financial equity and inclusion and expanding its reach across diverse communities.

Now, Ohio’s largest member-owned financial cooperative has committed a full-time position to directing those efforts as diversity, equity, and inclusion has taken on a particularly prominent role in the past few years.

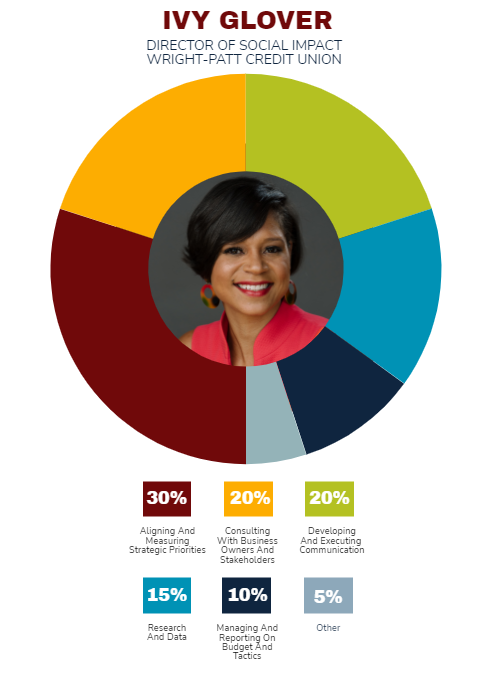

Ivy Glover became WPCU’s first director of social impact in March 2021 after 10 years as a community development specialist at the credit union. Now she’s responsible for ensuring DEI is more than just a buzzword at WPCU as she works to expand those principles’ impact across the enterprise and the greater community.

“I envision a world where my five sons’ opportunities, safety, and wellbeing far exceed my own”, Glover says. “As a result, success to me looks like making a positive splash that causes a ripple effect of kindness, equality, and possibility. Long-term, I envision generational wealth gaps being closed for families in our community.”

Here’s more on Glover’s vision, goals, and strategies.

Why did WPCU create the title of director of social impact? Was it specific to you?

Ivy Glover: WPCU created the role to intentionally focus on internal and external diversity and inclusion initiatives. The overall focus is on ensuring WPCU is making a positive impact through our programs, policies, products, and processes for our partners [employees], members, and communities.

There’s also some meaning to the words that make up the title. Social reflects the world and people around us, and impact is a verb that means to have a strong effect on someone or something. Considering everything we want to accomplish on behalf of the organization and our employees, it seems fitting.

WPCU did not initially develop the role specifically with me in mind, although many have said I was made for it.

What challenges and opportunities does your role address? How do you plan to address them?

IG: As an organization, taking great care of people has always been a priority for WPCU. For the past 90 years, we have actively embraced the people helping people philosophy that drives the credit union movement.

We also recognize that the financial services industry, in general, has historical ties to systemic issues that might have negatively impacted the access, wellbeing, and trust of some whom we serve.

We recognize we have an opportunity through our programs, products, processes, and policies to make an impact that could break barriers, bridge wealth gaps, and create greater financial flexibility and freedom for all.

Job titles say as much about the organization as they do the person. The “What’s In A Name” series on CreditUnions.com dives into notable, important, interesting, or just plain fun roles to find out what’s happening at the ground level and across the industry. Browse the whole series only on CreditUnions.com.

How would you like to be able to describe WPCU’s social impact program in five years?

IG: Our social impact tagline is connecting through similarities, learning through differences, making an impact. In five years, I hope we can say we’ve developed a best-in-class department that helps our employees, members, and communities connect through similarities, learn through differences, and experience the positive impact of the credit union each day.

How do you envision working across the enterprise to create and execute on WPCU’s DEI initiatives?

IG: It’s already happening. Our IDEAS [Inclusion, Diversity, and Equal Access to Services] Collaborative is championing our initiatives and acting as liaisons to partner-employees across department lines. I work closely with our human resources, learning and development, and marketing teams, and I also partner with our member business services team on executing our minority, women, and veteran-owned small-business programs.

As our programs continue to expand, I see more collaboration and more ideation within the enterprise. There’ll never be a worry about working together throughout the organization I worry we’ll have so many great ideas that it will become harder and harder to prioritize which ones to start first.

How will growing social impact improve member service and bring more value to a WPCU membership?

IG: Our new president has introduced the Take Better Care Circle, which supports our three-stakeholder model: When the credit union takes better care of its employees; our employees take better care of our members; and our members take better care of WPCU.

As the credit union focuses more on identifying and serving the specific needs of our members, our members will naturally experience increased access. They’ll have the right tools to meet their needs. They’ll experience better service and, ultimately, an organization that is reflective of and embraces members where they are to help them thrive.

I see this initiative as a catalyst to keeping the cycle moving. When individual members thrive and businesses thrive, communities thrive.

What makes you a great fit for the job?

IG: I strive to embody the following qualities and believe they’re the strengths needed to make this role successful:

Relatability: This role is focused on making change happen and sometimes addressing challenging topics. It can be uncomfortable. As a result, it’s important to be able to relate and connect to people at all levels and of all backgrounds so I can develop the required trust. I’ve always prided myself on being able to connect and relate with others.

Willingness to learn and grow: One of my favorite quotes is, Have a mind that’s open to everything and tied to nothing. While it’s my ultimate responsibility to develop and direct our programs, I recognize the need to be a constant learner. I approach each day with an open mind and the assumption that someone else has a perspective that might help move us forward.

Commitment and loyalty to the mission and vision of the credit union: I have worked for WPCU for 11 years, and I believe in what we do and why we do it. I believe we can make a difference in other peoples’ lives and always help more people.

I also develop and execute creative approaches to addressing practical issues and needs. Being a creative problem-solver with a people-first approach is key to building an inclusive and accessible environment for all.

4 Prongs Of DEI

Ivy Glover, the newly hired director of social impact at Wright-Patt Credit Union, is charged with leading the enterprise’s efforts to meet its goals for diversity, equity, and inclusion in its workplace and in the communities it serves. Here, she describes how that looks while the program is in its infant stages.

FOR THE ORGANIZATION

-

Articulate and demonstrate organizational commitment, especially among senior leadership. This includes publishing our social-impact promise through several channels, commitment memos to employees, quarterly roundtables, and meeting annual training/engagement requirements.

-

Develop a DEI snapshot to identify WPCU’s current state and future opportunities for seven represented audiences (BIPOC communities/families, women, military and veterans, LGBTQ+ community, people with disabilities, families with low-to-moderate economic means, and minority/women/veteran-owned businesses).

-

Formally integrate pronouns throughout organizational communications and collateral.

-

Tri-annual compensation and benefits reviews to ensure equity.

FOR THE PARTNER EMPLOYEES

-

“Ideas” (inclusion, diversity, and equal access to services) chats. Facilitated, curious, and courageous conversations that create a safe space for our employees to discuss challenging and trending topics.

-

Ideas collaborative. A cohort of volunteer employees who represent a cross-section of the organization. This group champions initiatives, acts as liaisons to employees, and provides insights and direction as programs are developed.

-

Socializing and training on the social impact promise. This is WPCU’s diversity and inclusion commitment statement.

-

Ongoing policy and management practice reviews to ensure representation and protection for all, in language and in practice.

-

Dress code updates that formally allow for visible non-ear piercings, tattoos, and hair color that is not its original color for all employees.

-

Active planning for employee resource groups (to be launched in 2023).

FOR THE COMMUNITY

-

We provide eight paid volunteer hours per employee so they can dedicate time to serving the community for causes that are important to them.

-

We’re hosting listen-and-learn sessions to amplify the voices of small, minority, and women-owned businesses with a plan to develop/evolve our products and programs that act as a catalyst for these organizations.

FOR OUR MEMBERS

-

Amplify member voices (especially underrepresented audiences) through a series of channels and events.

-

Support product and process analysis to ensure financial inclusion and accessibility across all markets and make recommendations for adjustments.

How did your career at WPCU so far prepare you for this role?

IG: Prior to my current role, I worked most of my career at WPCU as a community development specialist. I was responsible for managing and facilitating many of our financial learning programs and key community partnerships.

This was a great learning experience for this role. I learned how to engage with diverse audiences through training and conversation and the importance of flexing to where others are. I also had the opportunity to develop and evolve several programs, strengthening my creativity and program development, budgeting, and management muscles.

Prior to the credit union, I spent seven years at a local social service organization, serving low- to moderate-income families and leading our marketing, communications, and outreach efforts. This role helped me to better understand the challenges facing many of our underserved communities and how to amplify their voices.

Who do you report to? Who reports to you?

IG: I report to our chief administrative officer, Amy Reilly. Currently, my team includes an intern from one of our local universities and groups of partner-employees that make up a volunteer collaborative championing our initiatives. We are exploring the addition of two full-time equivalents over the next two years.

What’s your daily routine at the credit union?

IG: Every day is a bit different, which I appreciate, but includes many of the same tasks, including:

- Checking in with our leadership through email and in-person communications on organizational priorities and how they align with social impact tactics.

- Reading articles and insights from peer DEI professionals, exploring trending topics.

- Meeting with departments, virtually or in person, to facilitate mini learning engagements or conversations.

- Reviewing current progress toward internal KPIs and metrics.

- Researching relevant data to build out our DEI Snapshot.

- Listening! I spend much of my day listening to employee feedback and providing resources and perspectives on a one-on-one basis.

How will you track success in your job?

IG: We have developed quantitative key performance indicators that we want to achieve for the role by 2024. We want to: achieve a score of 80+ on the National Diversity Council’s Annual Assessment; maintain an organizational NPS score of 90+; maintain a score of 5.0/6.0 on our Quality of Work Life Survey, with DEI-related questions answered favorably; increase diversity mix throughout our organization to exceed AAP data benchmarks, especially for senior-level jobs; and improve the financial wellbeing of local businesses and families in our service footprint.

We also have several secondary tactical goals to help us ensure we are moving in the right direction.

How do you stay current with topics that fall under your role?

IG: I am a sponge looking for information to soak up. I read blogs, articles, and books daily. In addition, I am a certified diversity professional and access resources and training through my certifying organization, the National Diversity Council.

Finally, I am a member of a regional diversity officers group, professionals who meet monthly to discuss topics and concerns surrounding diversity, equity, and inclusion. I find this group to be a great resource, not only to assist in staying current but in managing the demands of the role.

This interview has been edited and condensed.