Member satisfaction is more than a metric at Truliant Federal Credit Union ($3.6B, Winston-Salem, NC), where a growing team of experts is combining people and analytics to forge deeper, broader member relationships.

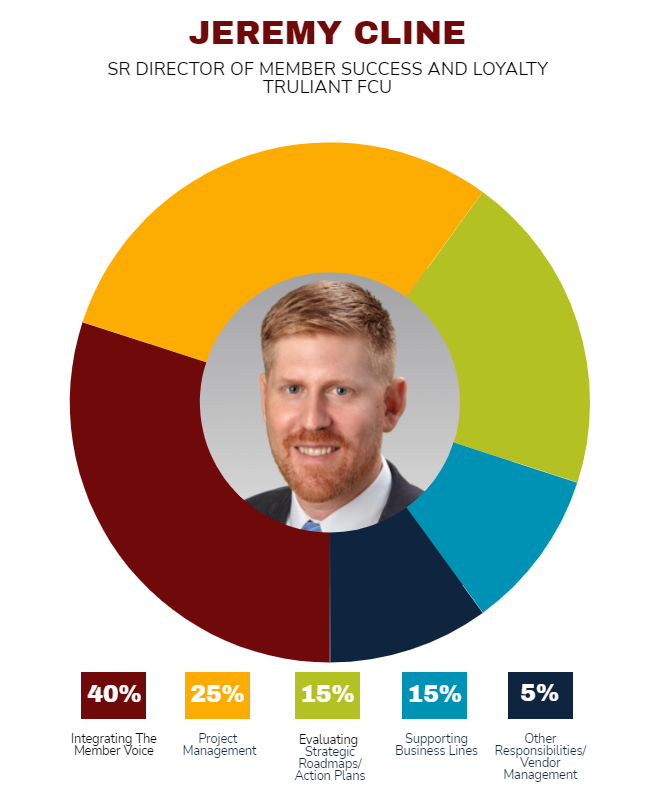

Jeremy Cline helps direct that effort as senior director of member success and loyalty. It’s a title the 15-year veteran of the credit union has held just since October, when the Tarheel State cooperative expanded his role as director of member satisfaction itself just created in 2020.

Here, Cline describes his role and Truliant’s approach to member satisfaction.

Why did Truliant create this new title and role?

Jeremy Cline: The title is meant to communicate Truliant’s commitment to understanding and meeting members’ needs. We believe we earn and retain their loyalty by consistently delivering products and services in ways that reduce the effort needed to work with us and exceed what they tell us they need and expect.

Accomplishing this requires constant assessment and proactive efforts to create long-term value in addition to quickly reacting to real-time feedback as members interact with us. All our different teams at Truliant are intensely focused on member experience within their lines of business.

My role’s main responsibility is to help the organization focus on how all those collective efforts connect to create that optimum member experience for which we strive.

Did Truliant create the role specifically for you?

JC: It was an opportunity that came from expanding my previous responsibilities to include overseeing the implementation of an organization-wide client relationship management (CRM) system as well as the recently formed product strategy and development department. Within that, I oversee our member satisfaction group.

Who do you report to? Who reports to you?

JC: I report to Chris Murray, our chief member experience officer. I have worked with Chris in many different capacities at Truliant. His tireless dedication to delivering exceptional member service has been influential in how I approach this role at Truliant.

Lis Mulcahy is our new director of member satisfaction and reports to me. She has more than 16 years of financial services experience, including training in innovation, customer journey mapping, and design thinking. I’m actively interviewing for a product strategy and development manager who will also report to me as we build strategic roadmaps and action plans for future enhancements.

What makes you a great fit for this job?

JC: The variety of opportunities and experiences I have been able to enjoy at Truliant are the main contributor for my fit and passion for this role.

This is my ninth different role in 15 years at Truliant. I have held roles in member service, financial advising, consumer lending, risk analysis, product management, and, most recently, member satisfaction. In each role I have maintained a strong curiosity about why we do the things we do and constantly looked for ways to improve what we provide to our members. Working in so many different areas and departments has allowed me to form some unique perspectives on how we all connect to deliver value to our members.

I’ve also been involved in large-change initiatives and corporate projects to improve member experiences.

Additionally, Truliant has supported me as I continue my education. Most recently, I will finalize my MBA degree this December from the McColl School of Business at Queens University at Charlotte with a concentration in leadership and change.

What challenges and opportunities around member success and loyalty does your role address?

JC: Member expectations around financial products, banking services, technology, and general customer service have changed rapidly over the past decade. Our members’ expectations are influenced by their experiences with us and at other financial and non-financial service organizations.

Delivering excellent, consistent member service is the foundation; however, if our products and technology solutions do not work like members expect or miss the mark on what members really need, then they will find another option. There are simply more competitive alternatives for our members to consider than in the past.

The increased adoption of digital self-service banking also is forcing us to be creative with how we design support and guidance for members interacting with us through those methods. We must constantly assess our staff structures and internal processes, which were once optimized to deliver a fully guided beginning-to-end experience through an in-person or phone interaction, for effectiveness within today’s environment. It places demands on us to become increasingly agile to meet those changing expectations and be there for our members when and how they need us.

What does improved member success and loyalty at Truliant look like? How are you working to achieve that?

JC: We hear from loyal members thanking us for their service experiences every day. They tell us the reasons they recommend Truliant to their friends and family, and we pay attention to those factors.

Our goal is to improve our ability to understand what it takes to consistently deliver those common drivers of satisfaction. We mainly accomplish that by listening to and learning from our member and service team perspectives. Then we bring business units together to identify, prioritize, and co-design our work efforts to improve our ability to exceed member expectations. Earning their loyalty is simply a byproduct of being successful in those endeavors.

Loyalty occurs when they think of Truliant first when they have a financial need because, over time, they have grown to trust we work hard to understand what they need and have their best interest at heart.

What role does technology play in member success and loyalty at Truliant?

JC: We tend to think about our member experience within channels and specific technology capabilities, but it’s clear our members do not. They expect seamless interactions among channels and for us to deliver fast, knowledgeable service no matter how or when they choose to do business with us.

This reality puts pressure on our various internal teams to document and effectively communicate the service preferences and expectations of individual members. That’s where we hope to leverage technology such as CRM to not only integrate systems for improved visibility but also support our employees in providing personalized and timely service across all touchpoints.

Additionally, we leverage our survey vendor’s platform to help us initially organize our member feedback by sentiment drivers so we can quickly be alerted to areas of concern or opportunity for further analysis.

Please talk more about the member satisfaction group. How many people are in it? What does it do? Why is it important?

JC: We receive, on average, 1,500 to 2,000 unique surveys every month; approximately 85% of respondents provide open-ended feedback in their own words about their experience and reasons for scores. We commit to our members that we will read every survey response when we invite them to take it.

The member satisfaction group helps facilitate the surveys, organize feedback, analyze scores, interpret results, and ensure proper follow-up to close service loops with our members.

The group also chairs a monthly member satisfaction committee comprising senior leaders and subject matter experts across the organization. Our chief executive planning team has charged this committee to integrate the voice of our members into our strategic plans and operation decisions.

CU QUICK FACTS

TRULIANT FCU

DATA AS OF 09.30.21

HQ: Winston-Salem, NC

ASSETS: $3.6B

MEMBERS: 284,015

BRANCHES: 33

12-MO SHARE GROWTH: 15.6%

12-MO LOAN GROWTH: 9.7%

ROA: 1.40%

The actual department is small with a director and a survey analyst. We plan to hire a second analyst next year.

Thankfully, everyone in the credit union is involved in delivering satisfied member experiences to varying degrees. For example, leaders within lines of business that are directly surveyed daily reach out to members who give us low scores or indicate they still need help resolving a problem. This helps our leaders act on member issues quickly and stay connected with our members’ perceptions of the service we deliver. That knowledge can then influence training, coaching, service staff recognition, and identification of root causes for member pain points.

What does your daily routine look like?

JC: I typically start my day reviewing survey trends, including some key scores we pay attention to. I stay in daily contact with Muranda Duncan, Truliant’s survey analyst, to understand what themes we’re noticing as surveys come in each day.

We maintain a list of member experience opportunities and are constantly organizing and keeping that list up to date with research findings. I attend project and planning meetings every day that tend to revolve around a variety of initiatives impacting member experience.

It’s important for me to keep a wide perspective of our corporate initiatives so I can do my part in helping the organization understand connections and impacts to the member from our individual tasks or projects.

Job titles say as much about the organization as they do the person. Have you seen a title you’d like to know more about? Let CreditUnions.com know at editor@creditunions.com.

How has the COVID-19 pandemic affected what you do at Truliant?

JC: I officially gained responsibility of the survey program in March 2020 right as the pandemic was beginning to negatively impact our in-person service availability. One of the results of that restriction was forcing members to interact with us through channels that were not always their preferred method.

The survey program became another outlet for members to communicate their needs with us, especially as our call center experienced spikes in volume and our drive-thru lanes became busier than normal.

Although the pandemic was difficult for our communities and employees, it helped Truliant understand the needs of our members during challenging times. We learned about how we could improve our service delivery, and members shared how much our relief practices meant to them and their families.

How do you track success in your job?

JC: Our Net Promoter Score (NPS) and Member Effort Scores are the primary measurements sourced from our survey responses. We track trends by delivery channels and experiences every month. On top of that, we keep running lists of different initiatives we have influenced or supported that led directly or indirectly to improved member experiences.

For example, we might target a reduction in supervisor escalations as a way to measure success of increasing first point of contact problem resolution. We’re actively working on integrating our survey data into our data warehouse and looking to develop tracking methods and KPIs in 2022. I believe there are many engagement and attrition metrics we should be tracking along with satisfaction scores to improve our ability to be more proactive in our efforts.

How do you stay current with topics that fall under your role?

JC: I digest quite a bit of industry white papers, studies, consumer surveys, and articles every month from various sources. There’s a great deal of dedicated customer service material available through online blogs, like SixteenVentures, which I reference often.

I recommend the 2018 book Listen or Die by Sean McDade for anyone considering building a voice of the member program as that was my initial education into this space. It outlines basic information and best practices for turning customer feedback into meaningful action that I go back to frequently.

This interview has been edited and condensed.