CU Quick Facts

Name: Wright-Patt Credit Union

Headquarters:Fairborn, OH

Assets:$1.8 billion

Members:190,000

Branches:23

FTE Staffing:424

Wright-Patt is the largest credit union in Ohio. With assets nearing the $2 billion mark, the financial institution is a testament to the power of the network. It is fully committed to the credit union model, and its two-year report shows just how successful that model can be.

- As of March 31, Wright-Patt’s delinquency rate is 0.99%. That is substantially better than the delinquency rate for the industry (1.77%) and nearly half the rate of its asset-based peer group (1.9%).

- Wright-Patt has grown its loan portfolio 10% over the past year, an impressive feat during a time period when the average loan portfolio remained stagnant. The credit union posted double digit growth in its real estate portfolio (11.2%) from first quarter 2009 to first quarter 2010. It also increased its credit card balances 23.6% over the past year. The increase in credit card balances might be a reflection of members seeking refuge in the credit union’s credit card program in a post-Reg E and CARD Act environment.

- In the past year, the credit union cut its marketing expenses by more than 30%, yet it is still growing its member and shares (by 6.8% and 19.2%, respectively). The positive media coverage during the Great Recession no doubt contributed to this growth; however, Wright-Patt has developed a number of outreach initiatives that have returned measureable success while keeping expenses in check.

- Wright-Patt continues to manage its operating expenses and generate consistent levels of income through its loan portfolio growth. Consequently, the credit union closed first quarter 2010 with an annualized 1.06% ROA, more than double the industry average of 0.50%.

Wright-Patt is a 21st century credit union with leadership that embraces a modern outlook. The credit union has the financial heft to make aggressive strategic decisions in its quest to be the dominant provider of financial services in the Daytona area. It wants to make sounder the overall well-being (not just the financial well-being) of its members and its community.

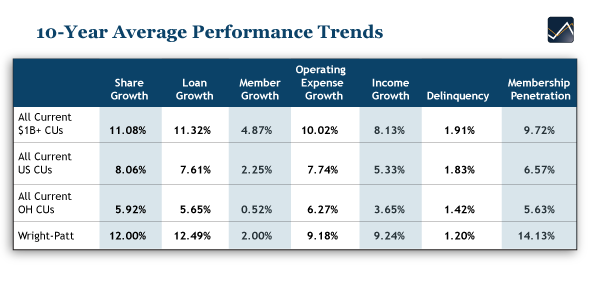

- Over the past 10 years, Wright-Patt has grown its loan and share balances at a rate faster than national and state averages as well as faster than its asset-based peer group.

- The credit union manages to grow its income at a faster rate than its operating expenses. This is notable because such trends are not prevalent across the other peer groups.