SHARE GROWTH VS. PERSONAL SAVINGS RATE

FOR U.S. CREDIT UNIONS | DATA AS OF 12.31.22

© Callahan & Associates | CreditUnions.com

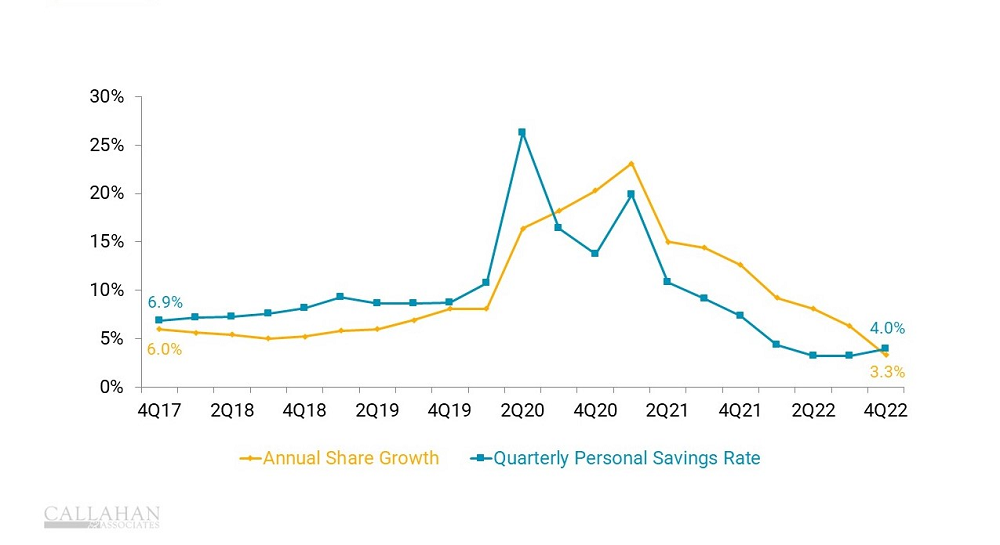

- Americans saved just 4.0% of their disposable income in the fourth quarter, according to data from the U.S. Bureau of Economic Analysis and the Federal Reserve. That’s better than the previous quarter but down from 7.3% in the fourth quarter of 2021.

- The personal savings rate typically moves in tandem with share growth and would likely have to increase for the credit union industry to see a widespread growth in deposits.

- Credit unions have recently increased interest rates significantly on share certificates, or CDs, to attract funds. Balances of share certificates increased 19.7% in 2022 for U.S. credit unions, whereas core deposit growth was flat over the same period.

How Does Your Share Growth Compare?

Use industry data to determine how your credit union performs against others, uncover new areas of opportunity, and support your strategic initiatives. Callahan’s credit union advisors are ready to show you how — are you ready to see how you stack up?

Schedule Your Peer Demo