Leaders Of The Pack: The Top 20 Cores For Credit Unions

Explore the subtle shifts redefining the credit union core processing space and how these movements shape growth, innovation, and member experience.

Our Technology page is the best place for news on core processing, conversions, fintech partnerships, machine learning, AI, next-gen banking, and more.

Explore the subtle shifts redefining the credit union core processing space and how these movements shape growth, innovation, and member experience.

From bonuses to candy budgets, Credit Union 1 and Purdue FCU offer tips to successfully manage one of financial services’ biggest hurdles.

The Wisconsin cooperative has implemented auto-decisioning for consumer lending and gives the technology high marks for its impact on member satisfaction, employee engagement, and the

Critical security controls from Center for Internet Security can help credit unions better protect member data.

In five years, Americans will shop differently. How will this shift affect credit unions?

In a sky full of glittering opportunities, maintaining the industry’s guiding principles becomes more crucial, not less.

BECU’s head of Internet talks strategy and skill set in a changing financial services environment.

What can credit unions learn from HBO about innovating in the face of competition and the corresponding branding challenges?

Community institutions are leading the big banks in rolling out apps for Apple and Android wrist gear.

What can these seven companies teach credit unions about marketing?

Learn the four ways GECU differentiates itself.

Investments in products, technology, and personnel contribute to tremendous mortgage loan performance at Ventura County Credit Union.

Jay Tkachuk, vice president of online services for Security Service FCU, discusses why the credit union built its own online banking platform, how its online services have paid off, and why a long-term view is critical.

A radical shift is taking place in the way consumers move money and engage with their financial institution.

How the Michigan-based cooperative’s “Culture of Finance” curriculum is reframing financial education.

The gulf between the haves and the have-nots has widened in recent years. Credit unions can help members catch up.

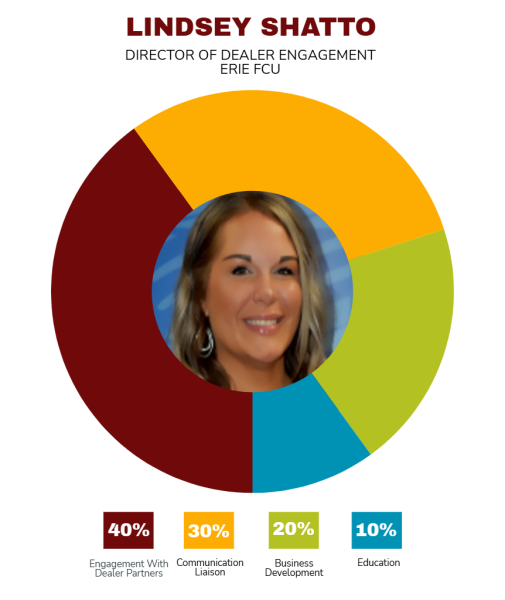

A veteran branch manager takes indirect lending to a new level at Erie FCU.

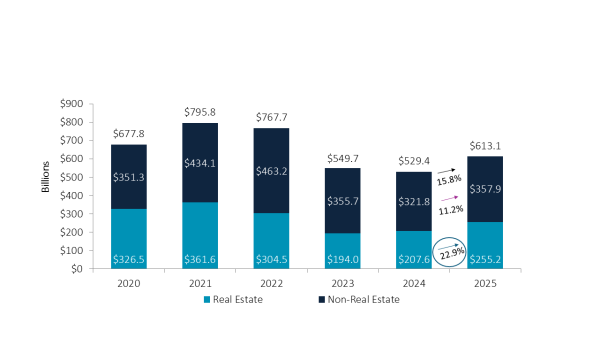

As the Federal Reserve cuts interest rates, credit unions are adapting in tandem, balancing membership needs with asset quality. This balance will be one of many topics discussed during Callahan’s quarterly Trendwatch webinar.

Callahan & Associates provides an early look at quarterly performance results. Sneak a peek at the latest trends here.

On-site coverage at the National Association of Latino Credit Union Professionals’ 2026 conference explores how representation, emotional experience, and community trust are converging to shape the future of credit unions.

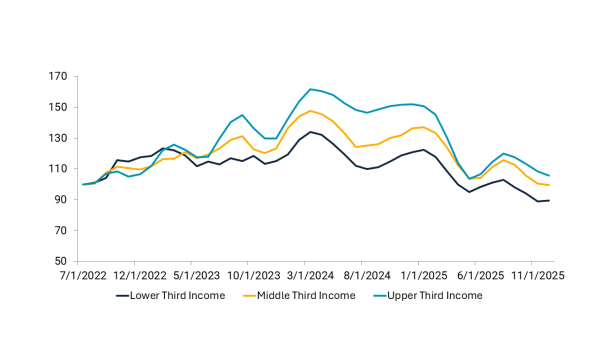

Look beyond the headlines to better understand what is driving current market trends and how they could impact credit union investment portfolios.

This year’s finalists are reimagining how credit unions use data to boost service levels and improve efficiencies.

In order to adopt a more proactive strategy, the Iowa cooperative is using a dedicated product development team to promote visibility and follow-through from idea to launch.