Futureproof Your Credit Union: Transform Your Membership

Join JR Pierman as he demonstrates how ASAPP Financial Technology can create seamless, personalized experiences across all touchpoints through advanced omnichannel solutions.

Join JR Pierman as he demonstrates how ASAPP Financial Technology can create seamless, personalized experiences across all touchpoints through advanced omnichannel solutions.

Community Financial Credit Union, a $1.5B institution with over 83,000 members across Michigan, is on a mission to uplift its community, reach younger demographics, and deepen member relationships. By modernizing its digital account opening experience with MANTL, Community Financial doubled its approval rate, eliminated fraud in the onboarding process, and created a frictionless member

In this Partner Perspective, Callahan & Associates and JR Pierman, president and CEO of ASAPP Financial Technology, explore how credit unions can future-proof their operations through digital transformation. From navigating resource constraints and rising fintech competition to delivering hyperconnected member journeys, Pierman shares how integrated platforms and thoughtful change management can position cooperatives for long-term

Join TRK Advisors and Elan Credit Card as they explore how credit unions are performing against dominant credit card issuers and what to expect in 2025.

This presentation looked at the role of scenario analysis in Asset Liability Management (ALM) for credit unions.

In this webinar, you’ll learn how to use these tools to eliminate inefficiencies and accelerate key processes, while strengthening member relationships.

Stay up-to-date with the latest changes, opportunities, and compliance requirements for CDFIs, including certification, grants, and legislative updates for 2025 and beyond.

What Is This Webinar About? Profitability systems deployed at financial institutions, whether publicly or privately owned, are designed with one primary goal: maximize the profitability of every customer to maximize the return to the owner(s) and shareholders. However, profitability systems deployed at Credit Unions focus on creating earnings to sustain the institution in support of

Discover how tailored financial products and seamless digital experiences simplify money management for parents and teens while engaging key demographics like Gen X, Millennials, Gen Z, and Gen Alpha to ensure sustainable growth. Webinar attendees will learn: Simplifying Financial Management for Families: Parents and teens need a suite of financial products and a seamless digital experience

Since generative AI burst onto the scene in 2022, AI chatbots or virtual agents have dominated the headlines—becoming a top investment priority for businesses across the customer experience landscape. While AI chatbots represent one key element of a modern member experience strategy, they’re just the beginning when it comes to creating a truly differentiated end-to-end

A cross-functional team comprising nearly 20% of staff helped the Maryland-based credit union manage the crisis while staying focused on helping members.

When money stops making sense, people suffer a crisis of financial confidence. Now’s the time to reconnect with members to help them establish long-term stability.

From the teller line to the corner office, CEO Cheryl Sio’s story spans five decades of industry transformation and enduring leadership lessons.

Structured protection strategies provide potentially higher long-term total returns than bonds while muting the volatility and downside risk traditionally associated with equities.

The CEO of Peninsula Community Federal Credit Union highlights how active listening and lessons from the basket court shape a culture of inclusive banking that serves members and employees.

Look beyond the headlines to better understand what is driving current market trends and how they could impact credit union investment portfolios.

Four executives share how they are skilling up and soothing nerves as they navigate the AI revolution in real time.

The future of leadership starts now. This week, CreditUnions.com is diving into the strategies shaping tomorrow’s talent: from a bold overhaul of succession planning to how credit unions are tackling the AI skills gap.

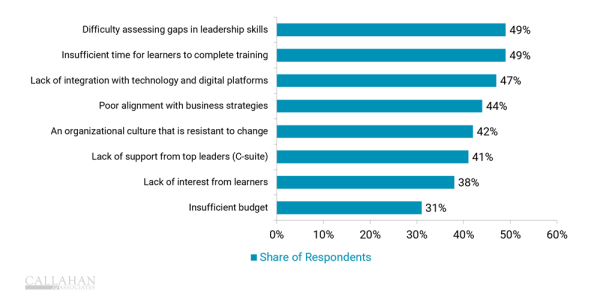

Assessing skills gaps among leaders and providing time to complete training are major hurdles today, but strong leadership development strategies are essential in building a future-ready credit union.

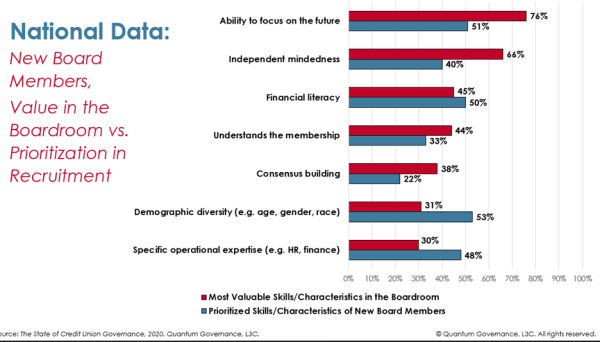

A report from Quantum Governance reveals a gap between board recruitment priorities and the most valuable skills in governance.