Total credit union assets remained near their all-time high of $1.1 trillion, according to Callahan’s year-end data, while total investments continued to decline due primarily to consumer lending.

The latest Investment Trends Review from TRUST for Credit Unions, showed that longer-term investment balances continued to shrink as credit unions increased Cash at Other Financial Institutions (The Fed) keeping their powder dry as they position their portfolios for more lending activity and await the opportunity to reinvest funds at higher rates.

Total Credit Union Investments

Balances Decline with Consumer Lending Driving Credit Union Activity

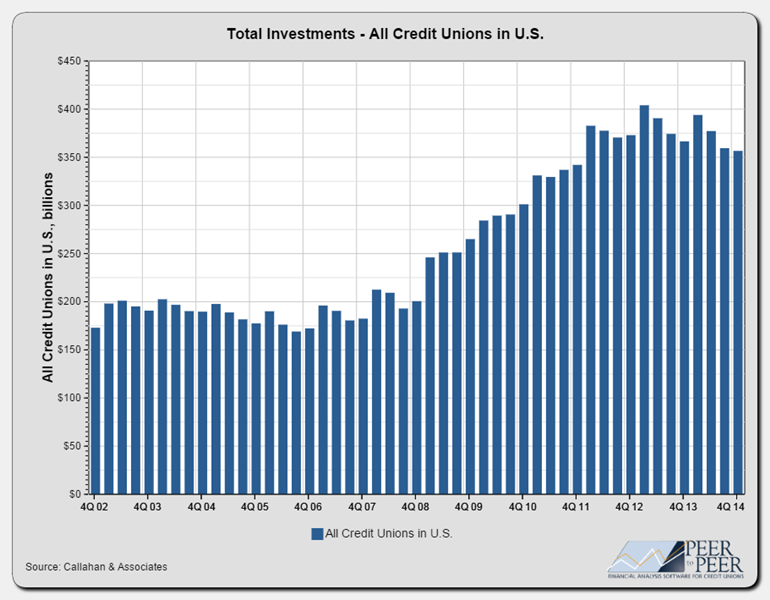

As of Dec. 31, 2014, credit unions held more than $349 billion in investments. As the chart below demonstrates, total investments decreased $11 billion from the previous quarter’s total of $360 billion. The seasonal pattern of higher investments in the 1st quarter followed by steady decreases in the following quarters has held over the last three years.

TOTAL INVESTMENTS

All credit unions in the U.S. | Data as of 12.31.14

Callahan Associates | www.creditunions.com

Source: Callahan Associates’ Peer-to-Peer Analytics

Investment Maturity

Longer-term Balances Continue to Shrink

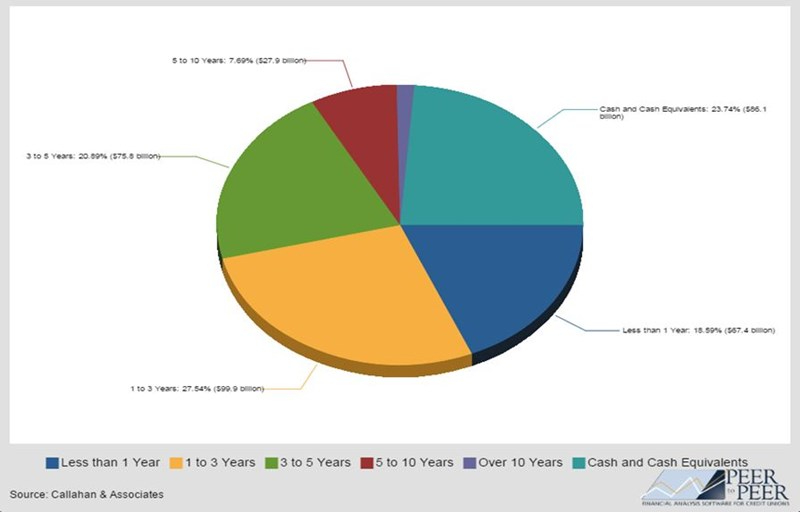

The average investment maturity for all U.S. credit unions declined in the fourth quarter of 2014. Specifically, the 5 to 10 Years and Over 10 Years bucket totals continued to decline. These longer-term securities peaked at $48.3 billion in 1Q2014 and now total $33.1 billion, representing less than 10% of total credit union investments. The declining balances in these categories were due to a number of factors, including securities rolling down the curve and the rally in the bond market. The rally allowed the agencies to call certain debt securities and reissue them at lower rates.

Credit unions also significantly increased their Cash at other Financial Institutions or cash balances held at the Fed this quarter.Could that be due to credit unions waiting for rates to rise before they reinvest in longer-term securities or is cash simply being stashed short-term so it’s readily available to make new loans?

INVESTMENT MATURITY

All credit unions in the U.S. | Data as of 12.31.14

Callahan Associates | www.creditunions.com

Source: Callahan Associates’ Peer-to-Peer Analytics

More Investment Trends Customized Investment Reviews

Interested in more information about the overall industry’s average yield on investments, new weighted average life data and investment growth rates? Download your complimentary copy of the full 4Q2014 Investment Trends Review from www.trustcu.com today or contact us at TCUGroup@callahan.com to learn more about the customized investment reviews we can provide for your credit union.

About TRUST

TRUST helps credit unions succeed in serving their members by providing a professionally managed family of mutual funds

exclusive to credit unions as well as the information and analysis they need to support investment decisions. Created by some of the leading credit unions with oversight by a board of trustees, TRUST’s mutual fund options allow credit unions to meet their short duration needs, are professionally managed, and are based on the cooperative values of credit unions.

Visit www.trustcu.com or call us at 800-237-5678 to learn more.

The Trust for Credit Unions (TCU) is a family of institutional mutual funds offered exclusively to credit unions. Callahan Financial Services is a wholly owned subsidiary of Callahan Associate and is the distributor of the TCU mutual funds. Goldman Sachs Asset Management is the advisor of the TCU mutual funds. To obtain a prospectus that contains detailed fund information including investment policies, risk considerations, charges and expenses, call Callahan Financial Services, Inc. at 800-CFS-5678. Please read the prospectus carefully before investing or sending money. Units of the Trust portfolios are not endorsed by, insured by, obligations of, or otherwise supported by the U.S. Government, the NCUSIF, the NCUA or any other governmental agency. An investment in the portfolios involves risk including possible loss of principal.