Harvest Federal Credit Union ($26.3M, Heath, OH) is an occupational-based credit union that serves its approximately 2,500 members through its sole branch located on Licking View Drive in Heath, OH. The Buckeye State credit union has seven employees, among them a CEO and operations manager. What it doesn’t have is a dedicated marketing person.

In December 2014, Harvest brought in a local third-party firm, Two Score, to jumpstart its marketing efforts. Specifically, Harvest wanted to launch a referral program to attract new members.

CU QUICK FACTS

Harvest FCU

Data as of 09.30.15

HQ: Heath, OH

ASSETS: $26.3M

MEMBERS: 2,555

BRANCHES: 1

12-MO SHARE GROWTH: 3.3%

12-MO LOAN GROWTH: 6.3%

ROA: 0.52%

We had never tried something like this before, says Julie King, the credit union’s CEO. In the past, we’ve tried to do our own thing. We have people who have good ideas but none of us are really marketing people.

Find your next marketing partner in Callahan’s online Buyer’s Guide

A New Way To Attract Members

The credit union runs an annual referral campaign in April in conjunction with CUNA’s Youth Month. The savings challenge encourages parents to open accounts and deposit money for their children.

It’s helped open a lot of accounts for kids, King says.

Although members and employees enjoy the campaign, Harvest also wanted a way to attract adults, specifically, family members of current members.

That’s why the new member referral program Harvest rolled out in early 2015 asked members who walked into the branch to refer sisters, brothers, nieces, nephews, aunts, uncles, or whatever relation might want to join Harvest.

Because the credit union asked for names and contact information, it focused on its dedicated members those who come into the branch most often and have a close relationship with the MSRs. Service reps asked members if they liked the credit union, and if they did, the MSR asked if a family member might benefit from the credit union’s services.

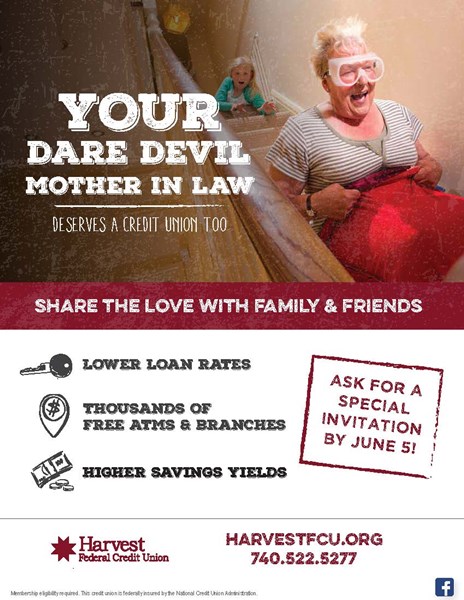

Example of Harvest’s new member referral marketing campaign. Image courtest of Harvest Federal Credit Union.

A lot of people don’t want to give up family members’ contact information, King says.

But many Harvest members did.

The credit union collected nearly 120 referral cards, complete with the names, emails, phone numbers, and addresses of potential new members.

The employee with the most cards turned in at the end of each week won a free lunch, King says, which made it fun for them as well.

From there, the credit union sent personalized invitations to each of the referred individuals. The invitations were larger than its traditional mailings and printed on higher quality card stock.

It almost looked like a wedding invitation, King says.

The invitations included the name of and message from the referring family member as well as facts that underscored the benefits of joining the credit union. A coupon for a 1% rate reduction for a refinanced auto loan was meant to sweeten the proposition.

We tried to explain the credit union, King says. We’re a cooperative. We can save you thousands of dollars of interest on your car loans and hundreds per year on checking account fees.

It took approximately two months to collect the referrals and send the invitations, according to King.

Then it waited.

Invitees started to respond within the first few weeks. MSRs made personal phone calls to follow up with those that didn’t. And because MSRs had to work in those calls around other daily responsibilities, the calling campaign took another few months.

Results And Takeaways

The credit union set a conservative goal 10% conversion for its new member referral campaign and ended up opening 14 new accounts, with seven of those individuals taking out a loan as well.

And slowly but surely, the credit union has been improving its 12-month member growth. At year-end 2014, it posted a negative 4.27% in that metric. Year-end 2015 data shows a much-improved negative 1.01%.

How Do You Compare?

Check out Harvest Federal Credit Union’s performance profile. Then build your own peer group and browse performance reports for more insightful comparisons

And King is quick to point out Harvest is doing so without offering referring members a bonus or incentive of any kind. No money. No rebates. Nothing.

We do a good job for our members that they are willing to refer us to family members and give us personal information, King says. I don’t think we’d be able to collect that information if we did not have a good relationship with them. We pride ourselves on that personal touch.