Community Financial Credit Union ($702.0M, Plymouth, MI) has learned a thing or two in 15 years of automatic loan decisioning. That includes treating itas a work in progress.

We tweak the tables whenever we feel we might be able to open them up more or close them down some, says Jill Johnson, chief lending officer at the suburban Detroit credit union.

She says the credit union automatically approves approximately 25% of its consumer loans including direct and indirect auto, personal, Visa, and some equity lines but would like to boost its auto-decisioning rate to 35% to 40% overall.

CU QUICK FACTS

COMMUNITY FINANCIAL CREDIT UNonData as of 12.31.15

- HQ: Plymouth, MI

- ASSETS: $702.0M

- MEMBERS: 61,887

- BRANCHES: 11

- 12-MO SHARE GROWTH: 10.58%

- 12-MO LOAN GROWTH: 13.57%

- ROA: 1.24%

Her vice president of lending, David Heffner, says indirect loans are a prime area for growth, as only about 10% of those are auto-decisioned.

We can take more risk in the tables overall, Johnson says.

For example, CFCU recently added parameters that allow members with medical collections, and even some non-medical collections, to go through. Heffner says the results of that move are not yet in, but they can only add to the savings because auto decisioningis a lot cheaper than manual underwriting.

The cost of an auto decision is basically zero, Johnson says. That drastically offsets the cost of underwriters looking at loans. Our underwriters review most loans in 10 minutes or less, but the challenging ones may go back and forth quite a few times.

SECU of Maryland($3.0B, Linthicum, MD) also constantly refines its automatic loan decisioning, even though the credit union doesn’t have a firm goal for automation percentage, says chief lending officer and vice president Kevin Kesecker. Instead, the credit union reviews manual decisions to identify opportunities to improve automation.

Both credit unions cite the value of auto-decisioning.

According Kesecker, each auto-decisioned loan at SECU of MD costs $9 less than a manual review.

Johnson at CFCU says, There’s nothing better than immediately letting the members know they’ve been approved. It’s important we say yes’ immediately to the easy stuff because those members can likely go anywhere andwe want to have the time spend on the more challenging deals.

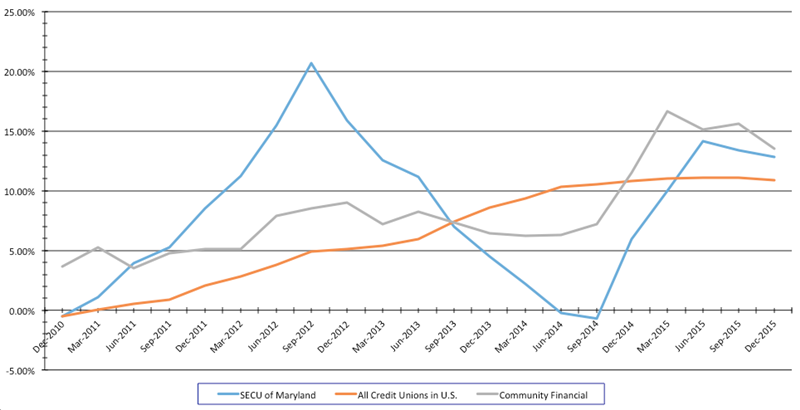

LOAN GROWTH

For all U.S. credit unions | Data as of 12.31.15

Callahan & Associates | www.creditunions.com

Source: Peer-to-Peer Analytics by Callahan & Associates

Year-over-year loan growth as of Dec. 31, 2015, at Community Financial and SECU of Maryland both exceeded the national average, coming in at 13.57% and 12.83%, respectively, compared with 10.89%.

A Way To Yes’

CU QUICK FACTS

SECU of MarylandData as of 12.31.15

- HQ: Linthicum, MD

- ASSETS: $3.0B

- MEMBERS: 234,737

- BRANCHES: 22

- 12-MO SHARE GROWTH: 6.64%

- 12-MO LOAN GROWTH: 12.83%

- ROA: 0.53%

Both lenders have increased their portfolios at rates higher than the national average. That means finding ways to say yes if possible. Johnson says CFCU doesn’t reject loan applications automatically. Instead, those not automaticallyapproved by the decisioning software go to underwriting.

We approve about 75% of all deals; auto approvals are about 25%, so tons of loans that don’t make it through auto approval get approved, Johnson says. We have no hard policies about credit scores. I’m working right nowon an equity for a member scoring in the high 400s.

The experience is similar at SECU MD, which has approved 42% to 58% of applications in the past four years that didn’t make it through auto-decisioning. These are typically downsell or counteroffer scenarios that the credit union’s directloan system doesn’t support, Kesecker says.

Don’t reinvent the wheel. Get rolling on important initiatives using documents, policies, and templates borrowed from fellow credit unions. Pull them off-the-shelf and tailor them to the credit union’s needs. Visit Callahan’s Executive Resource Center today.

We have a group of lending specialists that review auto-denied applications for any potential missed opportunities and a data analyst who reviews denied loans on a quarterly basis to confirm our auto-decisioning is functioning as designed,the SECU MD executive says.

He also says there has been no measurable difference in performance between the loans that were auto approved and those that were referred and then approved.

To set up an automatic loan decisioning system that fits the credit union’s appetite for risk and reward, Kesecker offers the following advice:

- DO: Establish a credit box the credit union is comfortable automating.

- DO: Regularly complete a comprehensive review of applications manually decisioned to identify common credit characteristics and delinquency or charge-off performance.

- DO: Obtain a periodic score or model validation from a trusted industry partner.

- DO: Regularly monitor the lending origination system’s performance.

- DON’T: Fail to test and validate system configurations.

- DON’T: Fail to maintain a detailed change log.

- DON’T: Fail to provide consistent coaching to the underwriting team.

- DON’T: Fail to adjust parameters in response to changes in portfolio performance.

You Might Also Enjoy

- 3 Ways To Offer Auto Draft Pre-Approvals

- Lending Highlights From Third Quarter 2015

- A Strategy To Reward Members For Positive Behavior

- How To Make Lending Easy For Members