Total loans and leases at commercial banks in the third quarter increased 5.1% year-over-year to $9.9 trillion, according to the Federal Reserve Bank of St. Louis. That’s up from 4.8% one year ago. Consumer loan growth, however, slowed 1.6 percentage points to 2.8% amid economic uncertainty and falling consumer confidence.

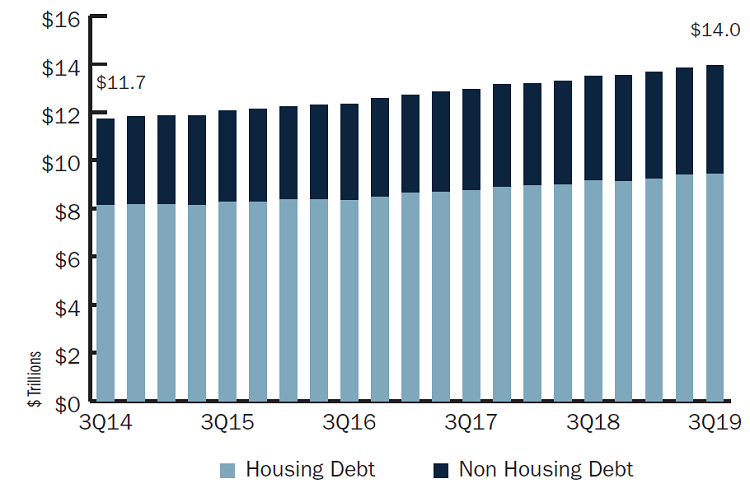

Total household debt has increased for 24 consecutive quarters and hit an all-time high of nearly $14.0 trillion in the third quarter. Of this, mortgage debt increased $270.0 billion year-over-year to $9.8 trillion; consumer debt was up $170.0 billion to $4.1 trillion.

Key Points

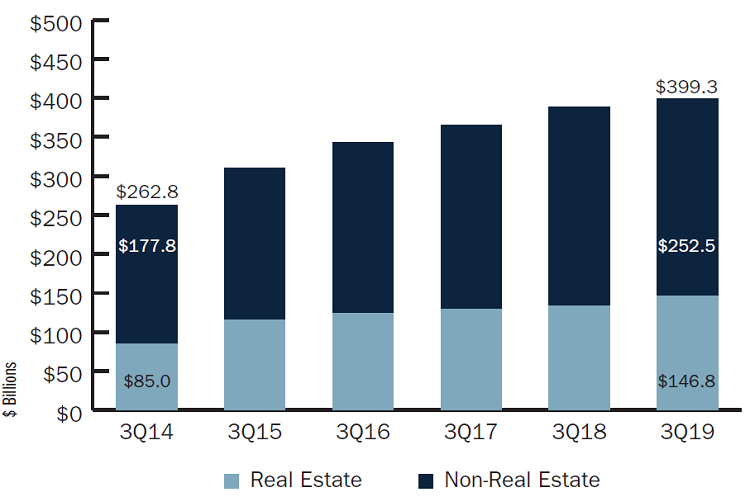

- Credit union loan originations in the third quarter of 2019 hit $151.0 billion that’s up 12.8% from the prior quarter and is the highest quarterly origination total for any quarter on record.

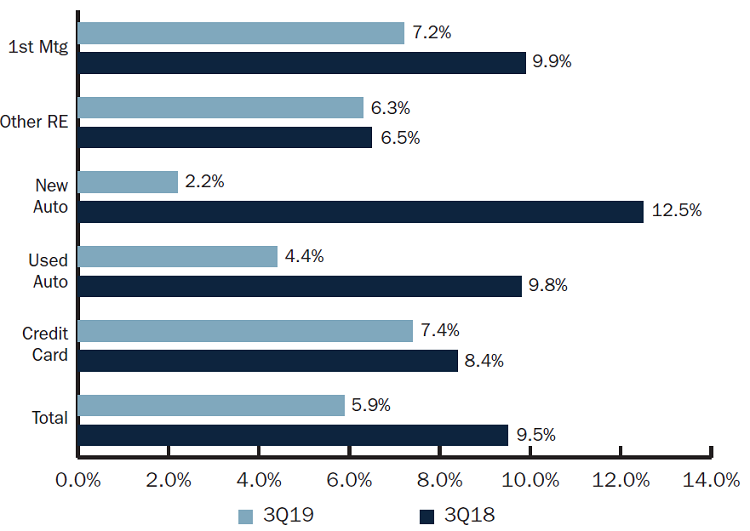

- Total loan growth at U.S. credit unions was 5.9% as of Sept. 30, down from 9.5% one year ago. Abnormally slow mortgage production in the first quarter and decreasing demand for auto loans throughout the year have contributed to this slowdown.

- Year-to-date first mortgage sales to the secondary market increased 25.8% annually to $43.5 billion. This is the highest level reported through the first nine months since 2013 and coincides with a shift in originations to more fixed-rate products.

- Delinquency in the total loan portfolio held steady at 0.67%.

Click the tabs below to view graphs.

HOUSEHOLD DEBT

HOUSEHOLD DEBT

FOR U.S. CREDIT UNIONS | DATA AS OF 09.30.19

Callahan & Associates | CreditUnions.com

At $14.0 trillion, total household debt in the third quarter was the highest it has ever been.

YTD LOAN ORIGINATIONS

YTD LOAN ORIGINATIONS

FOR U.S. CREDIT UNIONS | DATA AS OF 09.30.19

Callahan & Associates | CreditUnions.com

A third quarter surge in first mortgage loan production reversed the declining origination trend set during the first six months of the year.

LOAN GROWTH BY TYPE

LOAN GROWTH BY TYPE

FOR U.S. CREDIT UNIONS | DATA AS OF 09.30.19

Callahan & Associates | CreditUnions.com

Auto loan growth slowed as consumer demand weakened and cooperatives pulled back on indirect lending.

The Bottom Line

Lending at credit unions rebounded from a slow first half of the year. In the third quarter alone, credit unions booked $52.8 billion in first mortgage originations. That’s up 39.7% from one year ago. Strong loan growth and low delinquency together suggest credit unions have a robust balance sheet. Moving forward, monetary policy and consumer confidence levels will continue to influence credit union lending. The Federal Reserve has not indicated whether it will change rates in the short term, but continued uncertainty in the larger economy could affect member sentiment on loans.

This article appeared originally in Credit Union Strategy & Performance. Read More Today.