Top-Level Takeaways

- After successfully launching a geofencing campaign around mortgages in 2019, Northern Credit Union has revamped that offering to benefit additional areas of its loan portfolio.

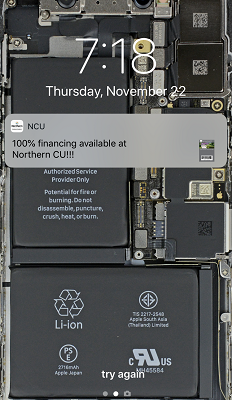

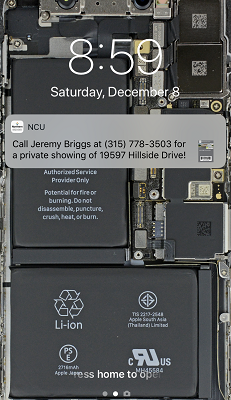

- Geofencing alerts members every time they’re in parking lots of competing financial institutions or even near Northern ATMs.

- Coupons associated with the technology are also helping members save a little money on their home loans.

Geofencing technology is revolutionizing the way businesses interact with customers, offering precise, location-based services and marketing that enhance engagement and drive sales in an increasingly mobile world.

Northern Credit Union ($602.2M, Watertown, NY) has been staking a virtual claim around a physical location and targeting promotional offers to consumers who enter selected zones for years. When it launched its Facebook page, Northern geofenced its own branches and parking lots to target display ads that encouraged visitors and passersby to follow the credit union on the social platform. For mortgages, the credit union offers a mobile coupon for $100 off a closed loan.

Today, new market realities have pushed Northern to shifts its focus and expand its geofencing efforts into new areas.

What Is Geofencing?

Geofencing is the use of GPS or RFID technology to create a virtual boundary that triggers a response when a mobile device enters or leaves the perimeter. It allows marketers to reach an intended geographic audience with the right messaging at the right time to increase loyalty and engagement.

‘Brick-And-Mortar’ Marketing With A Twist

Northern’s mobile mortgage coupons have retained their popularity throughout the years. The coupons allow interested members to scan a QR code and click a link to add the coupon to their mobile wallet. Alternatively, a loan officer also can text them the link.

“It’s pretty simple,” says Dan Estal, vice president of lending at Northern. “The way we present it to members is that it’s an easy $100 in their pocket.”

In addition to promoting across the usual marketing channels, the credit union also reminds members about the offer when it pre-approves them for a mortgage. And when someone adds the coupon to their mobile wallet, that’s when the geofencing begins.

In addition to its own locations, Northern also has geofenced many of its competitors’ branches. When a coupon-holder pulls into one of those locations, Northern serves them with a push notification that promotes the credit union’s home loan options.

“If a member decides to shop around, their phone screen reminds them about our interest rate guarantee program as soon as they pull into a bank’s parking lot,” says Rochelle Runge, vice president of marketing and digital engagement.

Northern Credit Union leverages new-age technology to enhance marketing for an age-old product. Read more in “Good Geofences Make For Good Mortgages.”

Expanding Realtor Partnerships

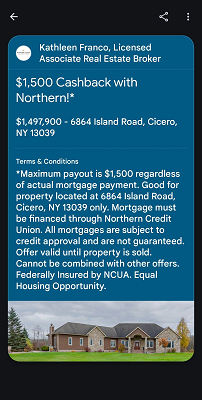

In addition to making home loan information easily accessible, Northern uses mobile coupons to ease the pain of house hunting by encouraging buyers to seek pre-approvals and providing loan officer information to kick-start the home-buying process.

The credit union serves coupon holders with push notifications for open houses hosted by its real estate agent partners. If would-be borrowers drive by a property, push notifications and lock screen messaging encourages them to reach out with questions and alerts them to price drops. Once they’ve visited a home, direct messaging promotes further engagement or even an offer.

These targeted, co-branded, cross-promotional opportunities have been a huge advantage for the credit union and opened the doors for local opportunities.

“When we initially launched this, one of our goals was to partner with bigger name realtors,” Estal says. “Now, we’ve got a huge partnership with Lake Ontario Realty.”

As higher rates, soaring prices, and low stock dampen the mortgage market, these types of partnerships are increasingly important for Northern. The higher average loan size of lake-front properties help make up for the lack of volume in the portfolio. Indeed, river and lake community listings reach into the upper $700,000 to $1 million range, according to Estal.

To make up for a decrease in overall mortgage opportunity, Northern also has had to think creatively about its home loan portfolio.

In the first half of 2024, the Empire State cooperative ran a niche adjustable-rate mortgage (ARM) special wherein it will allow the rate to drop up to 3% once during the life of the loan — as opposed to the standard 2% — while retaining the typical 2% ceiling should rates increase. Should rates drop further than 3%, members can take advantage of Northern’s $700 mortgage modification rather than going the route of a traditional refinance.

“Promoting that has been very lucrative,” Estal says. “It has driven more volume in a soft market.”

Now, the credit union is shifting gears again as it looks to drive more non-interest income through the secondary mortgage market.

Its new Lightning Quick mortgage helps buyers close faster in a market where inflated offers and bidding wars are the norm. The idea behind the program is to underwrite the loan ahead of time to save time and provide buyers with a pre-approval that’s as good as cash.

“Our goal is to close these loans in 15 days,” Estal says.

Geofencing With Northern

The Next Spike In Geofencing

For Northern, recruiting is the next frontier of geofencing.

CU QUICK FACTS

NORTHERN CREDIT UNION

HQ: Watertown, NY

ASSETS: $602.2M

MEMBERS: 43,901

BRANCHES: 10

EMPLOYEES: 147

NET WORTH: 11.2%

ROA: 0.30%

“We’ve targeted google ads for job seekers and geofenced competitors where we’ve had good success in the past,” Runge says. “If someone is in the lunchroom surfing the web, they’ll see we’re hiring and maybe even recall past co-workers who have joined us.”

Northern also uses geofencing to quickly adjust to time-sensitive opportunities. Such was the case when a local bank recently announced significant fee increases that could add up to one hundred dollars or more every year for individual accountholders.

“We’re sending a direct mail piece to everyone in a five-mile radius and geofencing its branches using the theme ‘Break Up with Your High Fee Checking Account. It’s not you, it’s the fees.,’” Runge says.

When bank customers walk into a branch, they’ll see Northern’s ad in the parking lot or while they are waiting in line.

Measuring Reach

Northern Credit Union boasts strong results from several recent geofencing campaigns.

-

40,000: Impressions on a single geofence campaign promoting Smart Choice ARMs.

-

240,000+: Impressions relating to the awareness campaigns for three recently launched advanced ATMs in Watertown, Harrisville, and Alexandria Bay.

Finally, Northern is geofencing areas where it has placed new ATMs. The message — there is a new ATM nearby — is simple but effective. In one location, the high ATM volume prompted the credit union to decide to add a second unit within a month.

Northern has tackled challenges across lending, hiring, member growth, and more. Runge says other credit unions can, too, if they are willing to push their boundaries.

“Try something new,” Runge advises. “There is a lot of focus in credit union marketing to deliver a hard ROI, which is important; however, it’s also vital to not limit yourself just because you can’t determine an exact ROI. Even if you can’t say this person walked through the door specifically because of geofencing, you can look at the overall success of your initiatives. If people are using the new ATM, geofencing is part of that.”

How Does Your Marketing Strategy Compare? Use industry data to dig into credit union performance, uncover new areas of opportunity, and support strategic initiatives. How do you compare to peers? Callahan’s credit union advisors are ready to show you. Request a Peer Suite demo today.