Each year, most credit unions expect a seasonal spike of shares on the balance sheet during the first quarter as tax refunds arrive, year-end bonuses are deposited, and members make New Year’s resolutions to save more after holiday spending ends. The same pattern was largely true in the first quarter of 2025. Delving deeper into deposit patterns, however, reveals changing behaviors: members are saving more, and they’re also preferring liquid, core deposits after years of share certificate supremacy.

12-Month Share Growth vs. the U.S. Personal Saving Rate

For U.S. Credit Unions | Data as of 03.31.2025

These pressures have also weakened many Americans’ economic optimism. More than half (53%) of consumers are pessimistic about their personal finances, according to Gallup’s annual Economy and Personal Finance survey – the lowest rate since Gallup began tracking in 2001. Despite that, Americans remain slightly more hopeful about the economy at large. Gallup’s monthly Economic Confidence Index has remained relatively steady since the start of the year and is actually elevated compared to most readings over the past four years.

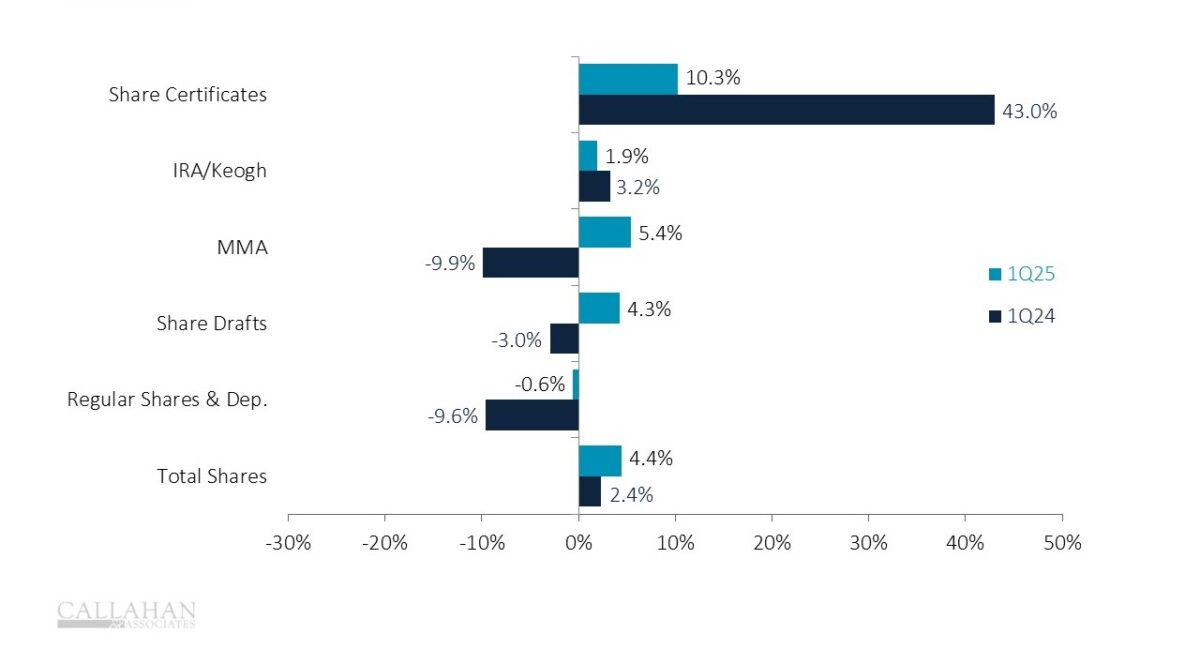

12-Month Share Growth by Type

For U.S. Credit Unions | Data as of 03.31.2025

Share certificate annual growth fell from 43.0% to just 10.3% at the close of the first quarter. Meanwhile, share draft and money market accounts made a complete reversal from the past year. With credit unions pulling back from share certificate promos and members balking at long term deposit types, the first quarter saw more shares flowing into lower interest-bearing accounts.

Core deposits allow members immediate access to funds without penalties. In times of economic uncertainty, people value quick access to cash. When Americans sense economic trouble on the horizon, they tend to pull back on spending and add deposits, but certificates can feel restrictive. Money market balances increased the most among the core deposit types, with members gravitating towards the highest-yielding, but less locked-in, core product types.

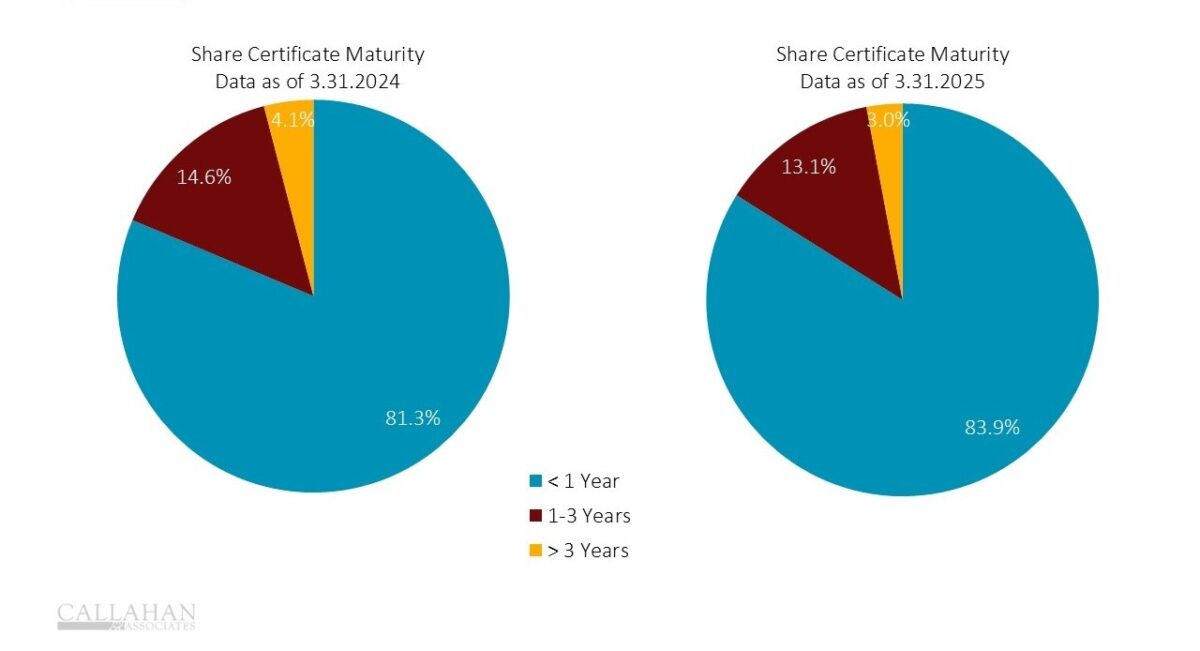

Share Certificate Maturity

For U.S. Credit Unions | Data as of 03.31.2025

With liquidity well in hand, credit unions no longer need to attract rate shoppers for additional funds. Share certificate demand is slowing – particularly in the long term – and certificates with terms of three years or more account for just 3.0% of total certificate dollars. Credit unions are pulling back from borrowing as well, reducing interest expense payments. This frees up funds for cooperatives to support their communities in other ways, whether through community sponsorships, employee compensation, or other avenues.

As for members, many are seeking access to liquidity of their own. The current economic environment, with the potential of a slowdown, has induced a preference for short-term saving tools over those with a longer timeline. Members taking out certificates are drawn to those maturing more quickly, in case they are hit by unexpected job loss, a recession, or simply need to feel more financially secure.

Scales Tip Toward Core Deposits

In short, the balance of risk and flexibility is tipping the scales in favor of core deposits like share draft and regular share accounts over share certificates. Members are prioritizing liquidity and control over slightly higher, locked-in earnings. With uncertainties lingering on the economic front, members are seeking support, and credit unions can offer it. Acting as a trusted advisor, validating member financial concerns, and understanding the reasons behind changing behaviors can help credit unions build long-term relationships and stay relevant when their consumers are in need.